Featured

- Get link

- X

- Other Apps

How To Invest In Volatility

Switch to Plus500 commission-free trading. A long straddle position is costly due to the use of two at-the-money options.

How To Invest For The Long Term In A Volatile Market

How To Invest For The Long Term In A Volatile Market

An investment in an inverse volatility ETF can help to protect a portfolio during these highly turbulent times.

:max_bytes(150000):strip_icc()/ProfitFromVolatility1-4f68837d0ec244df8eb775a9e65bcf40.png)

How to invest in volatility. The What How When To Invest Posted on May 17 2020 by Seth Levine - 2 Comments - Updated July 23 2020. Despite the volatility understanding that a mutual fund is a balanced investment will help ease your worry and keep you on top of your investment goals in the long-term. How to Invest in Low Volatility Markets - Trading with the VIX under 15.

If you dont like concentrated bets then err towards minimum variance. Choose Between Passive Active Management. How do I invest in low volatility stocks.

Find the square root of the variance. This tells you how spread-out the data is. Compare the trend with price action on popular index futures contracts including the.

Divide the sum by the number of values minus one in the data set to find the variance. Long-term earnings will go up and that is actually what you are investing in - you are owning a. Simple solution is to invest 50 in XIV and 50 in this strategy every quarter leading to the following.

In a straddle strategy a trader purchases a call option and a put option on the same underlying with. CFD Service - 72of retail lose money. Collateral Leverage Volatility.

Advertentie Be your own Broker. One such index is the Volatility Index VIX created by. This represented by PowerShares PHDG The other fund Barclays XVZ is a straight volatility play.

Keep a real-time VIX on your screens when considering entries into volatility funds. Some practitioners and portfolio managers seem to completely ignore or dismiss volatility forecasting models. How to Profit from Volatility Straddle Strategy.

There are various possible explanations for this. Let Volatility Lead to Opportunity. The cost of the.

After completing these steps the final number is the standard deviation. Determine whether an active or passive fund is best for you. There are two basic volatility strategy categories one grouping is funds intended as portfolio solutions that combine equities SP500 and a volatility hedge.

Stocks with low volatility tend to yield an excess return compared to the risk taken. When volatility is high stock market performance usually goes down. While the research concludes that there is little to choose between the various strategies you should know what matters to you as an investor.

If return is all that counts then naive low volatility may be the way to go. How to Invest in Mutual Funds Step 1. Find the sum of the squared deviations.

If playback doesnt begin shortly try restarting your device. Trading on Volatility Investors who seek profits from market volatility can trade ETFs or ETNs that track a volatility index. Using Volatility Index VIX.

CFD Service - 72of retail lose money. Volatility and Market Fluctuation Volatility can benefit investors of any stripe. How to Invest in VIX ETFs.

You cant turn on the business news these days without hearing about the Volatility Index or VIX. 2011-217 CAGR 54 Max DD 28 No year. Stop wasting money on commissions.

The stock market will always be volatile dont forget that. Stop wasting money on commissions. This research-based observation is referred to as the low-volatility factor.

Many more conservative traders favor a long-term strategy called. Switch to Plus500 commission-free trading. Advertentie Be your own Broker.

How To Buy The Vix 6 Steps With Pictures Wikihow

How To Buy The Vix 6 Steps With Pictures Wikihow

How To Invest In The Vix Volatility Index And The Risks Of Investing In Vix Youtube

How To Invest In The Vix Volatility Index And The Risks Of Investing In Vix Youtube

Low Volatility Investing A Strategy For All Market Environments By Nt Asset Management Medium

Low Volatility Investing A Strategy For All Market Environments By Nt Asset Management Medium

Lowest Market Volatility In Over 20 Years My Asset Class

Lowest Market Volatility In Over 20 Years My Asset Class

How To Invest In Volatile Markets Daytrading Com

How To Invest In Volatile Markets Daytrading Com

How To Go Long On The Vix Index Six Figure Investing

How To Go Long On The Vix Index Six Figure Investing

Low Volatility Investing Wikipedia

Low Volatility Investing Wikipedia

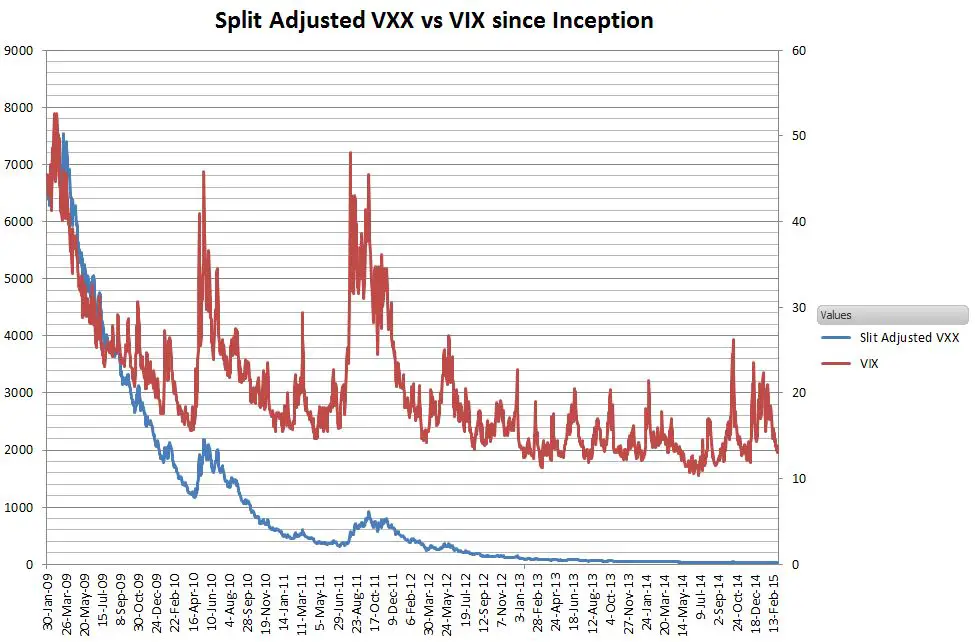

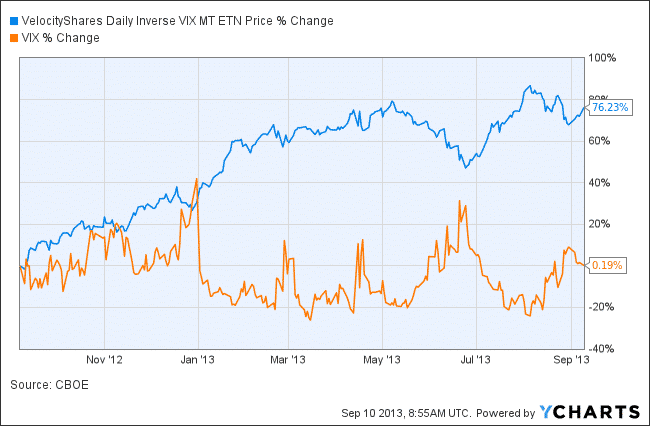

Invest In Volatility Comparison Of Vix Volatility And Ziv Return

Invest In Volatility Comparison Of Vix Volatility And Ziv Return

:max_bytes(150000):strip_icc()/dotdash_v3_Moving_Average_Strategies_for_Forex_Trading_Oct_2020-01-db0c08b0ae3a42bb80e9bf892ed94906.jpg) Cboe Volatility Index Vix Definition

Cboe Volatility Index Vix Definition

:max_bytes(150000):strip_icc()/dotdash_Final_What_Is_the_Best_Measure_of_Stock_Price_Volatility_Nov_2020-01-a8e356925bcb472194445af0b566336b.jpg) What Is The Best Measure Of Stock Price Volatility

What Is The Best Measure Of Stock Price Volatility

What Is The Vix Volatility Index And How Do You Trade It

What Is The Vix Volatility Index And How Do You Trade It

How To Invest In High Volatility Market Review On Followebinar With Ken Kraken From Followme Support Followme Trading Community

How To Invest In High Volatility Market Review On Followebinar With Ken Kraken From Followme Support Followme Trading Community

:max_bytes(150000):strip_icc()/dotdash_Final_The_Volatility_Index_Reading_Market_Sentiment_Jun_2020-02-289fe05ed33d4ddebe4cbe9b6d098d6b.jpg) The Volatility Index Reading Market Sentiment

The Volatility Index Reading Market Sentiment

Comments

Post a Comment