Featured

Irs Tax Amendment

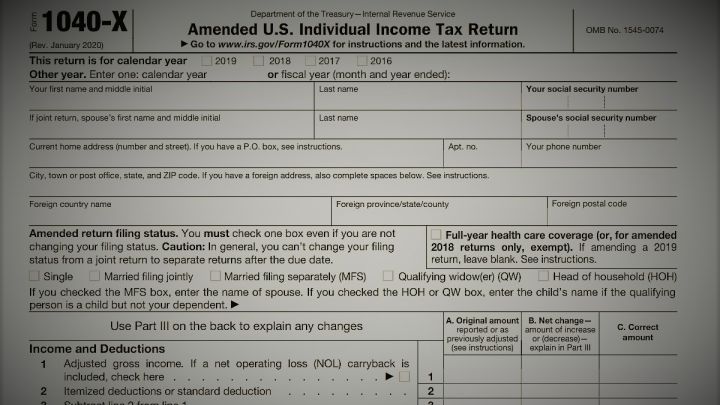

You can file an amended tax return to make the correction. There is no street address.

How To Fix Your Mistakes By Filing An Amended Tax Return

How To Fix Your Mistakes By Filing An Amended Tax Return

Where do I mail my amended return Form 1040X.

Irs tax amendment. All commercial tax-filing software accommodates this the IRS notes. Mail your federal return to the Internal Revenue Service Center listed for the state that you live in. That is a big deal since up to now every amended tax return had to be.

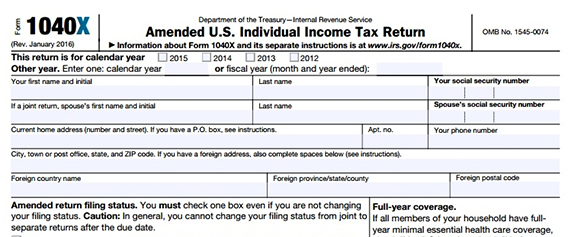

See below when not to file an amendment. File a separate Form 1040-X for each tax year. File Form 1040-X to do the following.

1Any person responsible for paying any income chargeable under the head Salaries shall at the time of payment deduct income-tax on the amount payable at the average rate of income-tax computed on the basis of the rates in force for the financial year in which the payment is made on the estimated income of the assessee under this head for that financial year. When mailing amended returns to the IRS place each tax year in a separate envelope and enter the year of the original return being amended at the top of Form 1040-X. Wait if expecting a refund for the original tax return to.

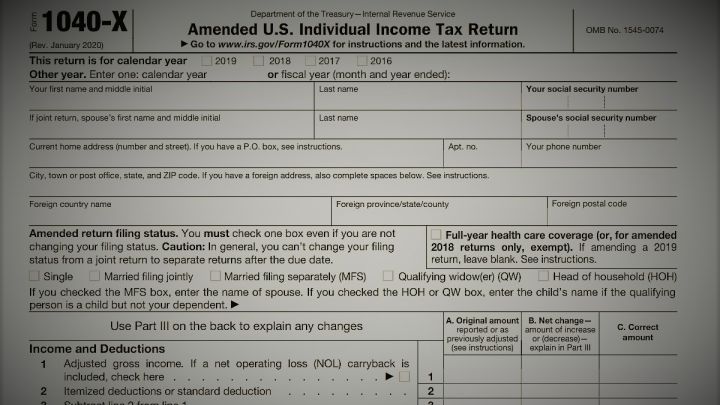

Individual Income Tax Return for this year and up to three prior years. The IRS has announced that this summer for the first time you can amend your tax return file Form 1040-X electronically. The federal tax filing deadline.

The IRS allows you to correct mistakes on a tax return youve already filed by filing an amended tax return. If you file an amended return asking for considerable money. The federal tax filing deadline for individuals has been extended to May 17 2021.

Offer valid for returns filed 512020 - 5312020. Valid for an original 2019 personal income tax return for our Tax Pro Go service only. 91 of 2005 the Amendment including adding new tax rates and tax brackets as well as increasing the annual personal exemption to EGP 9000.

Processing it can take up to 16 weeks. For more details see our August 2020 news release on this topic. You can check the status of your amended return on the IRS Amended Return Status tool by clicking the button below and clicking on What Is Your Federal Tax Return Amendment Status.

If you are amending more than one tax return prepare a separate 1040X for each return. There must be a record of an original electronically filed return for Tax Year 2019 or Tax Year 2020. If the original Tax Year 2019 or Tax Year 2020 return was filed by paper it must be amended by paper.

If the return is not complete by 531 a 99 fee for federal and 45 per state return will be applied. Many taxpayers find the easiest way to figure the entries for Form 1040-X is to make the changes. Generally you must file an IRS Tax Amendment Form andor State Amendment if you need to add more information or make corrections to an income tax return you filed or e-filed and the IRS has accepted this return.

GOVERNMENT SYSTEM IS FOR AUTHORIZED USE ONLY. You can now file Form 1040-X electronically with tax filing software to amend 2019 or 2020 Forms 1040 and 1040-SR. No cash value and void if transferred or where prohibited.

File using paper form. Amended Returns for any other tax years or tax types must be filed by paper. This article includes step-by-step instructions for when and how to amend your tax return using Form 1040-X.

The IRS offers tips on how to amend a tax return. Only Tax Year 2019 and 2020 1040 and 1040-SR returns can be amended electronically at this time. Must provide a copy of a current police firefighter EMT or healthcare worker ID to qualify.

How to find my. 26 of 2020 was issued on 7 May 2020 amending some provisions of the Income Tax Law No. Use of this system constitutes consent to monitoring interception recording reading copying or capturing by authorized personnel of.

Your amended return will take up to 3 weeks after you mailed it to show up on our system. Use Form 1040-X Amended US. To do so you must have e-filed your original 2019 or 2020 return.

Check the status of your Form 1040-X Amended US. The IRS announced that you can now amend your tax return by filing Form 1040-X electronically. The zip code indicated in the chart below is exclusive to the corresponding IRS processing center.

Once you have mailed in your federal tax amendment Form 1040X it will take up to 16 weeks from the IRS receipt date until the form is processed. Filing an amended tax return with the IRS is a straightforward process. Individual Income Tax Return to correct errors to an original tax.

Quarterly estimated tax payments are still due on April 15 2021.

Wondering How To Amend Your Tax Return Picnic S Blog

Wondering How To Amend Your Tax Return Picnic S Blog

Prepare And File 1040 X Income Tax Return Amendment

Prepare And File 1040 X Income Tax Return Amendment

Irs Adds E Filing For Form 1040 X Amended Tax Returns Cpa Practice Advisor

Irs Adds E Filing For Form 1040 X Amended Tax Returns Cpa Practice Advisor

Irs Adds E Filing For Form 1040 X Amended Tax Returns Cpa Practice Advisor

Irs Adds E Filing For Form 1040 X Amended Tax Returns Cpa Practice Advisor

How To Go About Filing An Amended Tax Return E File Com

How To Go About Filing An Amended Tax Return E File Com

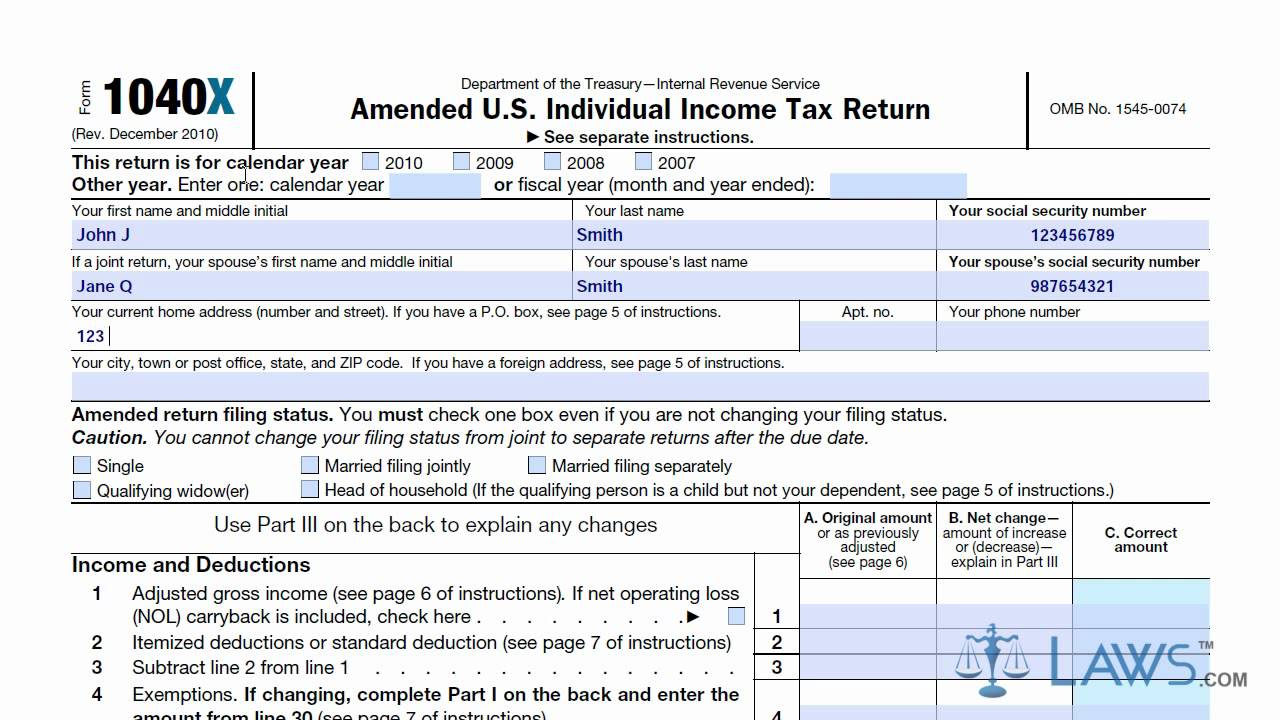

Learn How To Fill The Form 1040x Amended U S Individual Income Tax Return Youtube

Learn How To Fill The Form 1040x Amended U S Individual Income Tax Return Youtube

Tax Filing 2021 How To File An Amended Tax Return As Com

Tax Filing 2021 How To File An Amended Tax Return As Com

Irs Letter 4364c Amended Return Notification H R Block

Irs Letter 4364c Amended Return Notification H R Block

How Filing Tax Amendments Works Howstuffworks

How Filing Tax Amendments Works Howstuffworks

Irs To Start Accepting Some E Filed Amended Returns Don T Mess With Taxes

2020 Form Irs 1040 X Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 1040 X Fill Online Printable Fillable Blank Pdffiller

You Made A Mistake On Your Tax Return Should You Amend It Wsj

You Made A Mistake On Your Tax Return Should You Amend It Wsj

Irs Letter 89c Amended Return Required To Correct Account H R Block

Irs Letter 89c Amended Return Required To Correct Account H R Block

:max_bytes(150000):strip_icc()/Screenshot23-9b7ca8ec7adf4e11b37a6eb53f751745.png)

Comments

Post a Comment