Featured

Low Index Funds

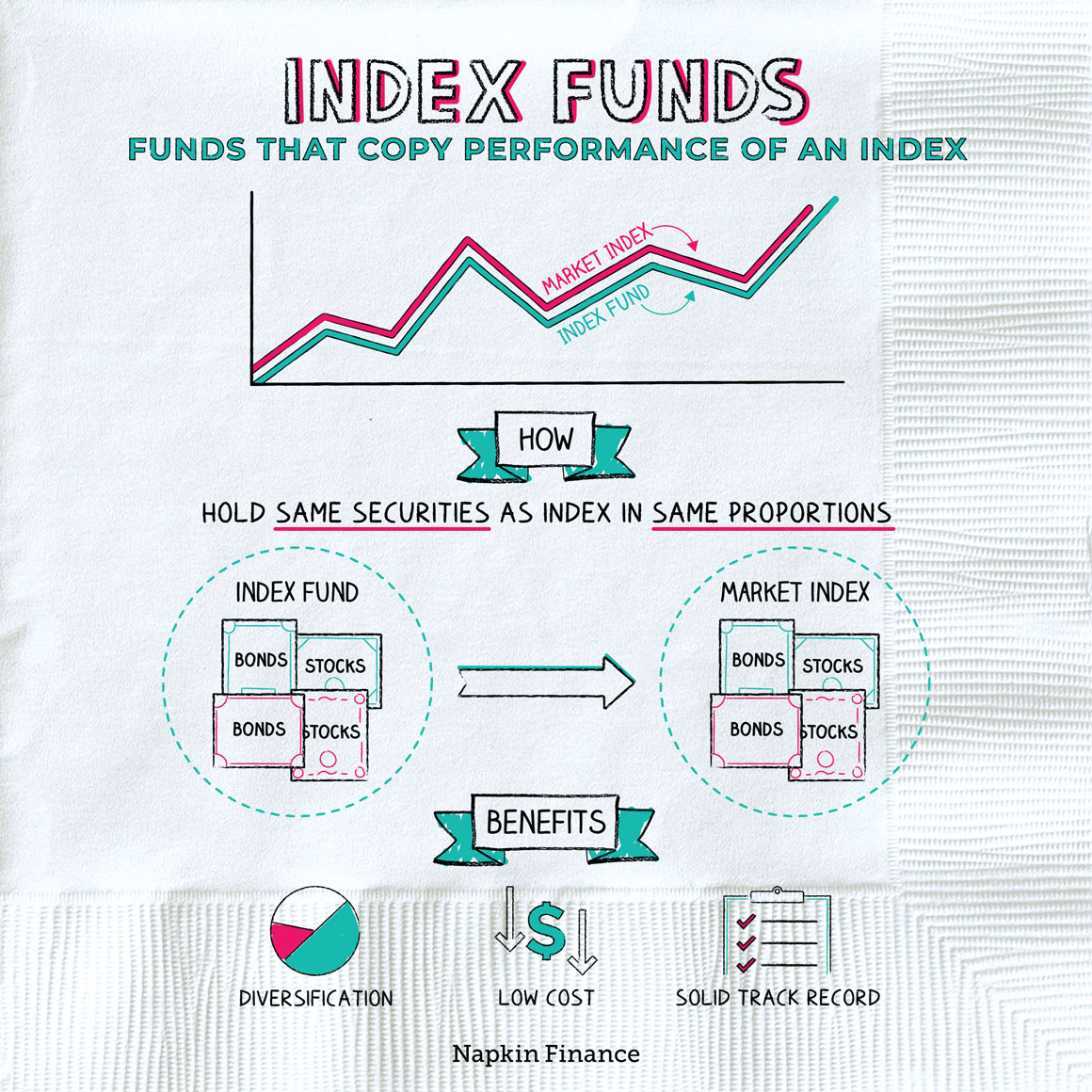

Index funds are passively managedthe fund manager picks an index to track and simply replicates the holdings. Index funds can be taken as a long-term less risky form of investment The success of these funds predominantly depends on the choice of index and their low volatility Since these funds create a portfolio that almost replicates the chosen index the returns offered by these funds are also similar to that of the index.

Best 8 Low Cost Index Funds 2020 2021 Money Flicker

In the early days of the stock market it was just thata market for stocks.

Low index funds. Pension investment in index funds. Mutual funds were the first low-cost index funds and remain the lowest-cost index funds but ETF index funds are increasingly popular for their transparency and liquidity. Index funds capture asset classes in a low-cost and tax-efficient manner and are used to design balanced portfolios.

If your 401 k plan. Financial experts recommend index funds as the best investing vehicle for most people because theyre. Here are two of the cheapest mutual funds tracking small-cap stock indices.

Index tracker funds have become increasingly popular in recent years. Top mid-cap picks include the Vanguard Mid-Cap ETF. Its only fitting that a broadly diversified index fund with super low fees in this case Vanguard Total Stock Market ETF NYSEARCA.

Since index funds do not require a large investment team they are very low cost. Here are seven of the top low-cost index funds. Its easy to see why they provide instant diversification in one simple low-cost investment.

The expense ratio is 015 or 15 for every 10000 invested and the minimum initial investment is 2500. Vanguard has an Index Mutual Fund the Total Stock Market Index VTI is a great example of a low-cost index fund with an expense ratio of 004. Vanguard Total Stock Market ETF ticker.

Northern Small Cap Index NSIDX. Low costs are one of the biggest selling points of index funds. These index funds will track small-cap indices like the Russell 2000 Index or the SP SmallCap 600 index.

Saving on fees over the course of years can add up to thousands of dollars in your pocket. Anzeige Fonds-Depot mit Maximal-Rabatt-Garantie. Low Cost Index Funds.

Low turnover refers to the number of. A combination of various index mutual funds or ETFs could be used to implement a full range of investment policies from low to high risk. SP 500 funds offer a good return over time theyre diversified and about as low risk as stock investing gets.

People that work for large corporations often have the opportunity to invest in low-cost index funds offered in 401 k plans that offer institutional shares of certain funds. Jetzt beim Ausgabeaufschlag sparen. An index fund is a mutual fund or exchange-traded fund ETF designed to mirror the performance of a major index like the Dow Jones Industrial Average SP 500 or Nasdaq.

And while you can still buy individual stocks today there are many different investment products vying for your attention including mutual funds index funds and exchange-traded funds ETFs. The SP 500 index fund continues to be among the most popular index funds. Index funds are a type of mutual fund that aim to track the performance of a market index.

Some of the best low-cost large-cap index funds include the Vanguard Large Cap ETF NYSEMKTVV and the Schwab Large Cap ETF NYSEMKTSCHX. Index funds pay fewer dividends than actively managed mutual funds and they also have a low turnover rate. Jetzt beim Ausgabeaufschlag sparen.

Theyre cheap to run because. Anzeige Fonds-Depot mit Maximal-Rabatt-Garantie. VTI Don Bennyhoff investment committee chairman and director of investor education at.

Index Funds Meaning Benefits Types Complete Guide

Index Funds Meaning Benefits Types Complete Guide

High Cost Index Funds And Low Cost Actively Managed Funds My Money Blog

High Cost Index Funds And Low Cost Actively Managed Funds My Money Blog

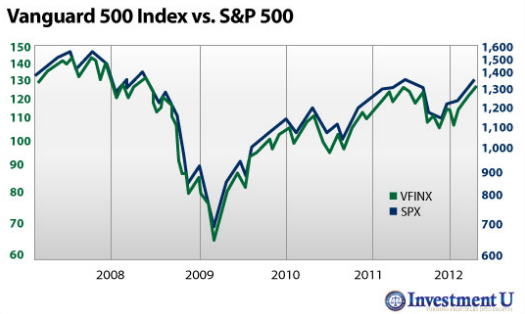

Vanguard 500 Index Fund Low Cost But Are There Better Alternatives Nasdaq

Vanguard 500 Index Fund Low Cost But Are There Better Alternatives Nasdaq

How To Choose Between Investing Money In Low Cost Index Fund Or Fixed Deposit Savings Account For Long Term Investment Quora

Low Cost Index Trackers That Will Save You Money Monevator

Low Cost Index Trackers That Will Save You Money Monevator

/investing-in-index-funds-for-beginners-0f50f5cc29f84124b1a16c799b70df46.png) Investing In Index Funds For Beginners

Investing In Index Funds For Beginners

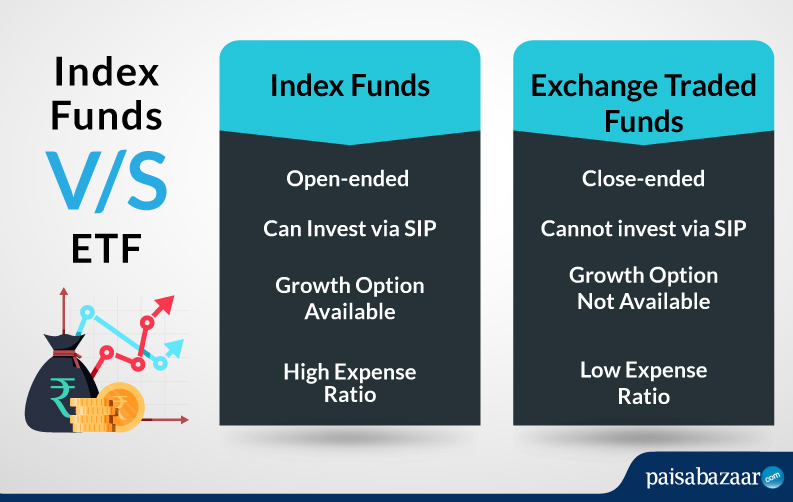

Etf Vs Index Funds 6 Factors To Know Which Is Better To Invest

Etf Vs Index Funds 6 Factors To Know Which Is Better To Invest

What Is An Index Fund Index Funds Definition Napkin Finance Has Your Answers

What Is An Index Fund Index Funds Definition Napkin Finance Has Your Answers

What Is An Index Fund And Why Should I Invest In One Clark Howard

What Is An Index Fund And Why Should I Invest In One Clark Howard

An Infographic That Details The 3 Steps To Index Fund Investing Investing Index Fund

An Infographic That Details The 3 Steps To Index Fund Investing Investing Index Fund

How To Pick Low Cost Index Funds Learn How The Pros Keep Fees Low

How To Pick Low Cost Index Funds Learn How The Pros Keep Fees Low

Save More Money With Indexed Funds Invest It Wisely

Why Index Funds Are The Best Seeking Alpha

Why Index Funds Are The Best Seeking Alpha

Comments

Post a Comment