Featured

Does Venmo Charge To Send Money

There are two cases that incur a tranfer fee. For international transfers consider using providers such as Wise.

Here S Why You Should Stop Using Venmo And Start Using Facebook Messenger For Paying Back Your Friends

Here S Why You Should Stop Using Venmo And Start Using Facebook Messenger For Paying Back Your Friends

Venmo Is Convenient but Use It Safely.

/how-safe-venmo-and-why-it-free_FINAL-5c7d732a46e0fb00018bd86c.png)

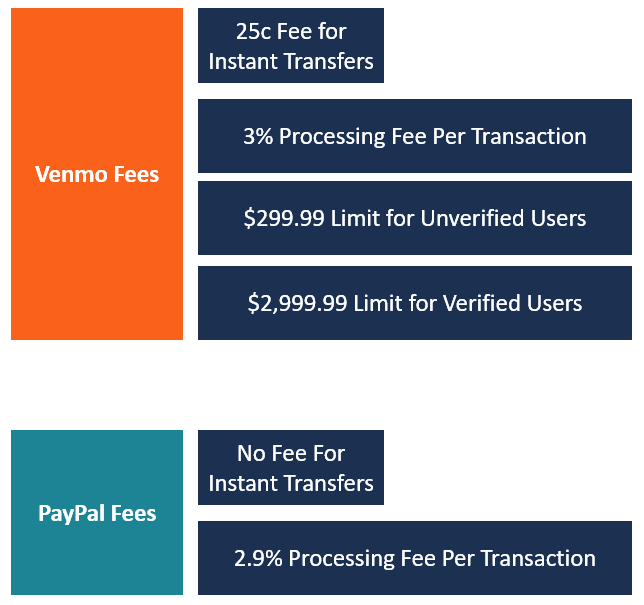

Does venmo charge to send money. Venmo launched a platform with an integrated social network in 2012. Dont pay more than you have to - check the exchange rate being used before you commit. Theres no charge for setting up a Venmo account and sending or receiving money from it.

If you link your Venmo account to a credit card purchases are free but theres a 3 fee if you use the card to send money to an individual. When transferring money from Venmo to your linked back unverified accounts have a limit of 99999. Receiving money into your Venmo account or using Venmos standard transfer to your bank account.

Once youve received money youll need to send a request to transfer the funds directly to your bank account. Instant transfers allow you to send money from Venmo to an eligible US. Venmo also takes safety seriously.

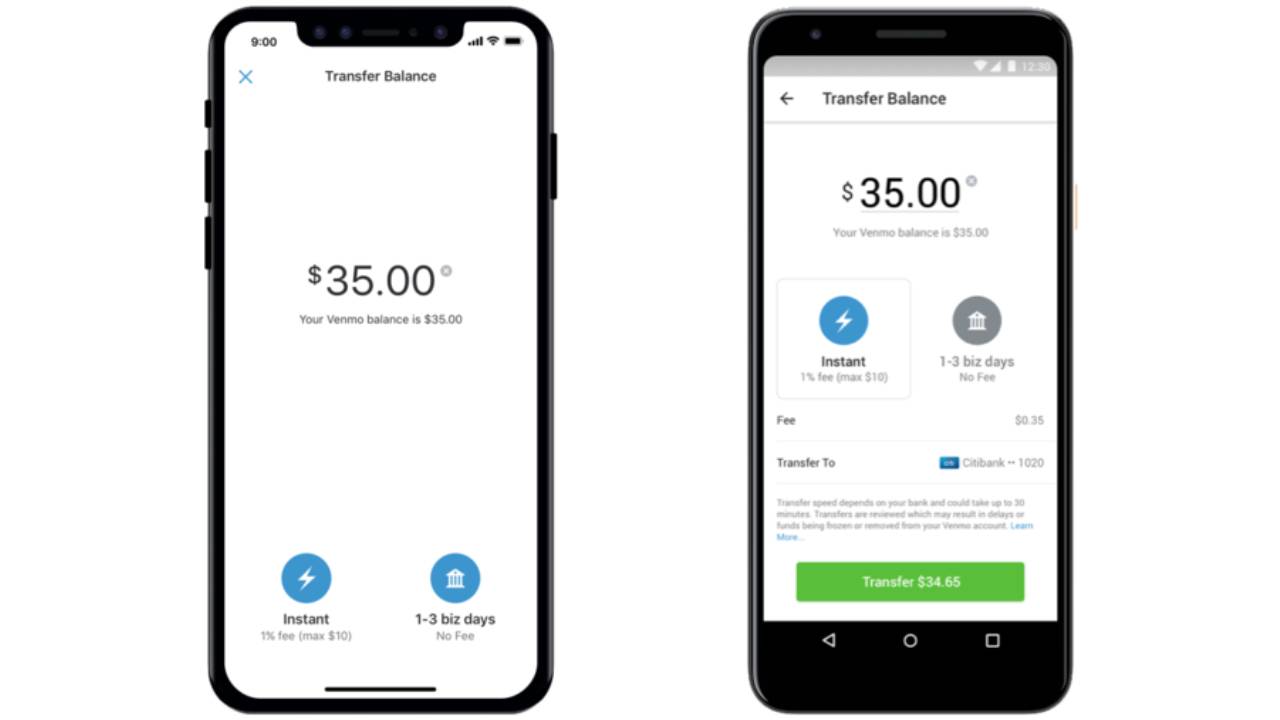

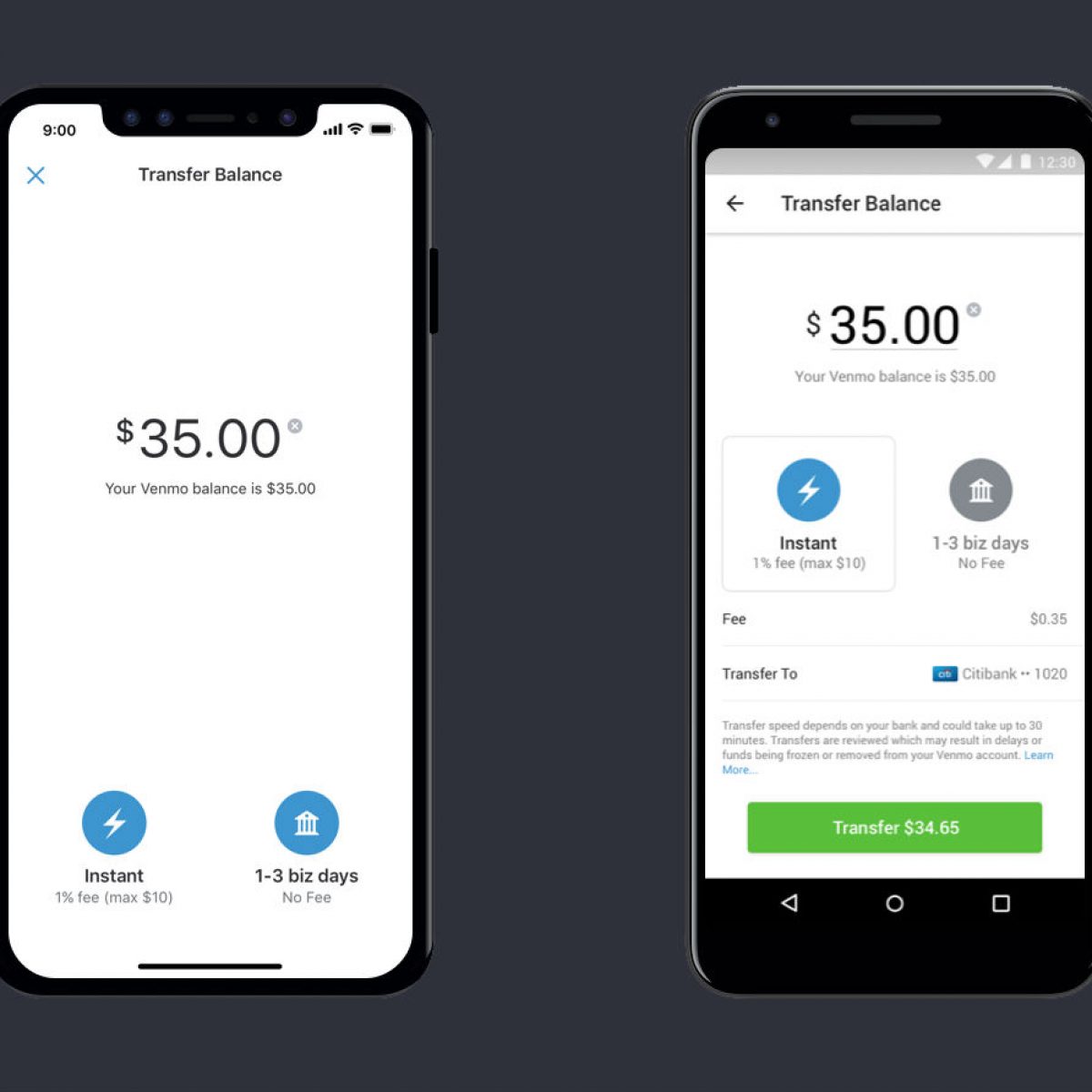

If you use your credit card for transfer there will be a 3 charge. A 1 fee with a minimum fee of 025 and a maximum fee of 10 is deducted from the transfer amount for each transfer. PayPal requires all users to be verified and allows users to send up to 60000 but may limit the amount to 10000 in a single transaction.

Sending money over Venmo triggers a standard 3 fee but the company waives that expense when the transaction is. You cant withdraw money to a credit card. Otherwise use Venmo to send payments to your friends family or other trustworthy sources.

For verified accounts you will be allowed to transfer up to 1999999 per week. Do I need to add money to Venmo to pay someone. It uses encryption for all your transactions to keep your money safe.

Venmos initial person-to-person sending limit is 29999. Sign up for free. You might not know that Venmo is a mobile payment service owned by PayPal.

Venmo became successful very quickly because they did not charge individual users transaction fees opting instead to charge vendors. Venmo charges a three percent fee to send money from your credit card though if you only use your Venmo balance or bank account to send money there are no fees. Venmo doesnt charge for basic services like.

With Venmo you can pull funds from your account balance debit. Through peer-to-peer marketing strategies Venmo has become one of the most popular apps for sending money to friends and family. Venmo does not have a monthly or annual fee.

For credit cards there is a standard 3 fee per transaction. Bank account or VisaMastercard debit card typically within 30 minutes. The company launched an aggressive marketing strategy in 2015 encouraging retailers to accept Venmo as a form of payment.

Also Venmo charges you a 1 minimum 025 fee maximum 10 fee when transferring money from your Venmo account to your eligible linked debit card or bank account when you use the Instant Transfer option. Venmo allows you to send your dollars to your friends in the US. If you make a payment for an amount that is equal to or less than the amount in your Venmo balance itll be fully funded by your Venmo balance.

The good news is Venmo doesnt charge you for most of its services. Finally dont use Venmo for online sales or business operations. Sending money from a linked bank account debit card or your Venmo balance.

If you have access to a Venmo balance any payments you receive from friends will be added to your Venmo balance and you can use those funds to make payments. You wont pay any fees for registering and holding an account No monthly or annual fees There are no charges for receiving payments in your Venmo account. It allows users to send and receive money and make online purchases from approved vendors.

Venmo charges a three percent fee to send money from your credit card though if you only use your Venmo balance or bank account to send money there are no fees. Through these two methods Venmo will not charge a fee when transferring your balance to your bank account if you opt to wait 1-3 Business Days. Once a user is verified that increases to a weekly rolling limit of 499999.

However there are no charges for sending people money using the Venmo balance debit card or bank account. Receivingwithdrawing money into your Venmo account or using our standard transfer to your bank account. You dont need to add money to Venmo to make payments.

Theres also no charge if you link your Venmo account to a bank account or debit card. The only scenario where its safe to pay an online merchant is if Venmo authorizes it.

Venmo Overview How It Works Fees And Transaction Limits

Venmo Overview How It Works Fees And Transaction Limits

How To Send Money On Venmo And Set A Privacy Setting

How To Send Money On Venmo And Set A Privacy Setting

How To Instantly Transfer Money From Venmo To Bank Account

How To Instantly Transfer Money From Venmo To Bank Account

/cdn.vox-cdn.com/uploads/chorus_asset/file/10103319/venmo_instant_transfer.png) Venmo Can Now Instantly Transfer Money To Your Debit Card For 25 Cents The Verge

Venmo Can Now Instantly Transfer Money To Your Debit Card For 25 Cents The Verge

Does Venmo Charge A Fee A Guide To Venmo Fees And How To Avoid Them

Does Venmo Charge A Fee A Guide To Venmo Fees And How To Avoid Them

How Venmo Works And What To Know Before You Use It Marketwatch

How Venmo Works And What To Know Before You Use It Marketwatch

Does Venmo Charge A Fee A Guide To Venmo Fees And How To Avoid Them

Does Venmo Charge A Fee A Guide To Venmo Fees And How To Avoid Them

:max_bytes(150000):strip_icc()/001-venmo-instant-transfer-not-working-4583914-1d165def59854046804bffc86c03c45e.jpg) Venmo Instant Transfer Not Working Here S What To Do

Venmo Instant Transfer Not Working Here S What To Do

/how-safe-venmo-and-why-it-free_FINAL-5c7d732a46e0fb00018bd86c.png) How Safe Is Venmo And Is It Free

How Safe Is Venmo And Is It Free

Venmo Finally Offers Instant Money Transfers To Bank Accounts Slashgear

Venmo Finally Offers Instant Money Transfers To Bank Accounts Slashgear

Venmo Instant Transfer Suddenly Stops Working Slashgear

Venmo Instant Transfer Suddenly Stops Working Slashgear

Venmo Can Now Instantly Transfer Funds To Linked Bank Accounts Not Just Debit Cards

Venmo Can Now Instantly Transfer Funds To Linked Bank Accounts Not Just Debit Cards

Comments

Post a Comment