Featured

Can You Borrow Money For A Down Payment

You can still obtain a conventional loan with less than a 20 down payment but PMI will be required. If you dont have enough savings on hand or if youre worried about cash flow you may want to borrow money for a down payment.

/how-much-do-we-need-as-a-down-payment-to-buy-a-home-1798252_FINAL-d436ccb9c27f4ced9c60c70eb01a4fdb.png) How Much Do We Need As A Down Payment To Buy A Home

How Much Do We Need As A Down Payment To Buy A Home

But just like wood borrowed money seasons and changes its properties.

/choosing-a-down-payment-315602-Final-21f6f43a49084466afd65a24f1d288b9.png)

Can you borrow money for a down payment. Providing a down payment on a small business loan gives a lender confidence. However like borrowing money from. Choosing either route has major drawbacks such as.

Typically loans require repayment over five years but when you use the proceeds for your down payment on your. The rules about where your down payment can come from are straightforward. The short answer is no.

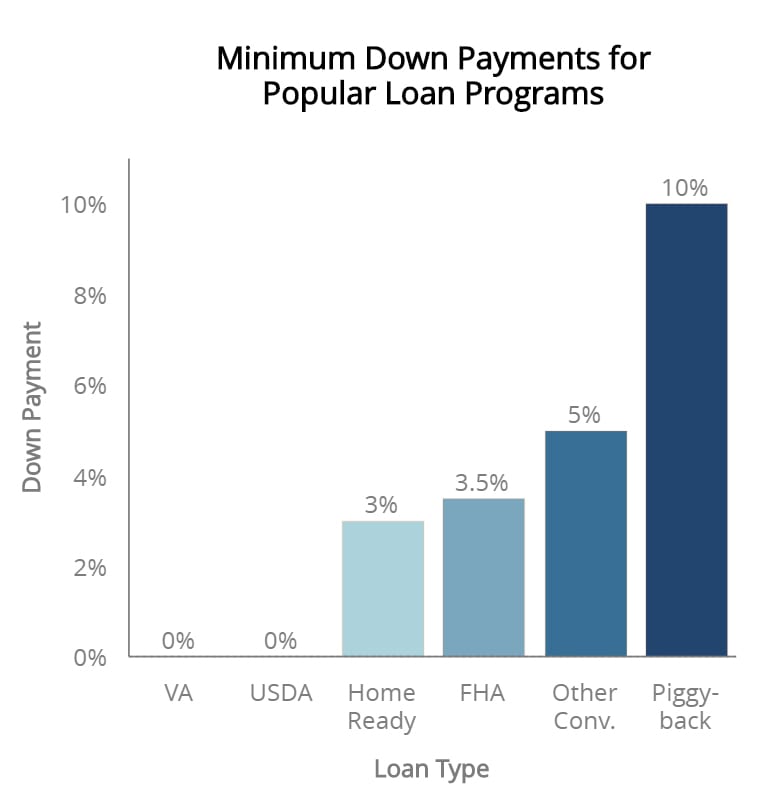

Your lender will assume its for your down payment. Lenders want the down payment funds to come directly from the borrower and not have to be repaid. For example if you borrow a home loan backed by the Federal Housing Administration to buy a two- to four-unit property youd only need a 35 down payment.

If youre getting a loan or seller financing to acquire the property then the lender is lending you some of the money for it but chances are youll need to provide a down payment upfront first. When a bigger down payment on a house can put you at risk. A smaller loan amount usually means smaller monthly mortgage payments.

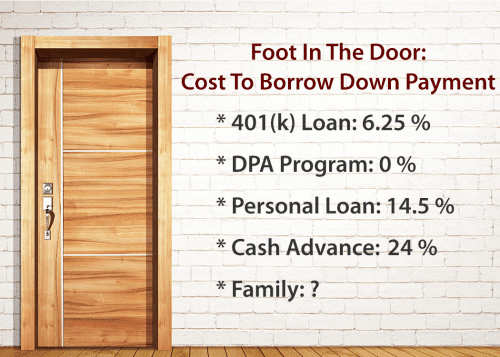

Get Approved for a Home Loan Can I use a Personal Loan for a Down Payment. The rate charged on a 401 k loan is usually the prime rate plus 1 or 2 but your actual rate will be set by your plan provider. Making a 75000 down payment on a 300000 home you only save 500 per month compared to a zero-down loan.

Borrowing money to make a down payment is allowed as long as you provide some of the down payment using the money you already have. But as with any loan youll have to pay yourself back with interest. You can either borrow from your family from your retirement funds or get a.

However theres a point at which funds borrowed. You can withdraw funds or borrow from your 401 k to use as a down payment on a home. Simply put the more you can put down the better.

If youre planning on acquiring an investment property you need the money. Ask any lender if youre allowed to borrow your downpayment with a personal loan or cash advance and they will probably say no. Heres What You Can Do If You Need Down Payment Money To Purchase.

If you have excellent credit with a 20 down payment a conventional loan may be a great option as it usually offers lower interest rates without private mortgage insurance PMI. Conventional and government-backed home loans do not allow for the down payment to come from a loan of any kind. Borrowing some cash might just be the best way to get funding for your down payment.

Learn how to get a home equity loan for a down payment a 401k loan and other types of loans. You must live in one of those units full time but you can rent out the other units and earn extra income. Putting down more money upfront not only reduces the amount you have to pay back over time it typically results in lower rates and fees from your lender.

Considering borrowing money for a down payment. You can borrow up to 50000 or half your vested account balance whichever is less. Saving for a down payment can be difficult but putting money down on a home purchase is a good idea for multiple reasons.

Many people prefer to ask their loved ones for a loan rather than an outright gift. Buying a house is an important thing after all and when you think of the importance of the down payment you cant overlook it. Borrowing Down Payment Money From a Relative or Friend Another way to raise money for a down payment is to borrow it from friends and family.

If you do not want to get a 401k loan for your down payment then withdrawing money is another option. If your 401 k plan provider allows loans you could borrow up to 50000 or half your vested account balance whichever is lower. Lower monthly payments The more money you put down the less youll have to borrow to buy your home.

Home Equity Loans Requirements And Borrowing Limits Nerdwallet

Home Equity Loans Requirements And Borrowing Limits Nerdwallet

7 Reasons Why You Should Never Borrow Money For A Down Payment Money After Graduation

7 Reasons Why You Should Never Borrow Money For A Down Payment Money After Graduation

How Do Lenders Know If You Borrow Your Down Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How Do Lenders Know If You Borrow Your Down Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Down Payment Overview Key Terms Pros And Cons

Down Payment Overview Key Terms Pros And Cons

Can You Borrow Money For The Down Payment Deb And Chris Thomas Mortgages

Can You Borrow Money For The Down Payment Deb And Chris Thomas Mortgages

How To Buy A House With 0 Down In 2021 First Time Buyer

How To Buy A House With 0 Down In 2021 First Time Buyer

How To Buy A House With 0 Down In 2021 First Time Buyer

How To Buy A House With 0 Down In 2021 First Time Buyer

/choosing-a-down-payment-315602-Final-21f6f43a49084466afd65a24f1d288b9.png) Down Payments How They Work How Much To Pay

Down Payments How They Work How Much To Pay

Can You Borrow Your Down Payment

Can You Borrow Your Down Payment

/how-loans-work-315449-color-V22-4dcd4f3587dd412ba418600a644fed80.png) Learn How Loans Work Before You Borrow

Learn How Loans Work Before You Borrow

Pros And Cons Of A Large Down Payment On A House

Pros And Cons Of A Large Down Payment On A House

Can You Borrow Money For A Down Payment Dpa Search

Can You Borrow Money For A Down Payment Dpa Search

/how-to-save-for-a-down-payment-on-a-house-1289847-ADD-FINAL-V2-19727618c0644a6d868a54644efc5c02.png) Tips On How To Save For A House Down Payment

Tips On How To Save For A House Down Payment

Can You Borrow Money From Family For A Down Payment Dpa Search

Comments

Post a Comment