Featured

- Get link

- X

- Other Apps

Roth Ira Withdrawal Rules Irs

Keep in mind that you can only withdraw up to the amount you. Before making a Roth IRA withdrawal keep in mind the following guidelines to avoid a potential 10 early withdrawal penalty.

Roth Ira Withdrawal Rules Oblivious Investor

Roth Ira Withdrawal Rules Oblivious Investor

In general you can withdraw your Roth IRA contributions at any time.

Roth ira withdrawal rules irs. Same trustee transfer If your traditional and Roth IRAs are maintained at the same financial institution you can tell the trustee to transfer an amount from your traditional IRA to your Roth IRA. The Roth IRA Withdrawal Rules Since your own contributions can always be taken out tax free all the rules discussed below apply only to the investment or interest earnings in your Roth. Roth IRAs have different withdrawal rules if they are inherited.

With a traditional IRA youll pay a penalty if you take withdrawals before you hit age 595. 4 lignes As far as the IRS is concerned a Roth IRA distribution is considered qualified if your. However the IRA must first meet the five-year period to avoid a Roth IRA early withdrawal penalty.

Your withdrawal from a Roth IRA wont be taxable under three circumstances. If you satisfy the requirements qualified distributions are tax-free. With a Roth IRA though you can withdraw your contributions at any time without paying a penalty.

The beneficiary is allowed but not required to take distributions prior to. Withdrawals must be taken after a five-year holding period. Over the years weve likely talked about the benefit of Roth IRAs and how they can help in your overall financial plan.

A conversion to a Roth IRA results in taxation of any untaxed amounts in the traditional IRA. A Roth IRA is a hit among investors who expect to be in a higher tax bracket during retirement. Youre age 59½ or older and youve had your Roth for five years or longer measured from the first day of the year in which you established and contributed to it.

If you inherit the Roth from your spouse you can treat it as your own. Qualified Distribution withdrawal is totally tax free. You cannot deduct contributions to a Roth IRA.

There are 3 types of distribution rules which will determine taxability of earnings. But you can only pull the earnings out of a Roth IRA after age 59 12 and after owning the account for at least five years. A participant must begin taking annual distributions from the account by the later of age 72 70 ½ if they reach 70 ½ before January 1 2020 or retirement except certain owners must begin distributions at age 72 70 ½ if they reach 70 ½ before January 1 2020.

Instead of a 401k hardship withdrawal tap your Roth IRA first. If you withdraw your Roth IRA earnings before you reach age 59½ and before you meet the 5-year rule its considered an early withdrawal. The 5-year rule requires the IRA beneficiaries who are not taking life expectancy payments to withdraw 100 of the IRA by December 31 of the year containing the fifth anniversary of the owners death.

Withdrawals must be taken after age 59½. You withdraw no more than the amount of your original contributions regardless of your age. The 10 tax on early withdrawals may apply to the part of the distribution that is includible in gross income.

You can make contributions to. Their tax-free nature makes them excellent accumulation vehicles and withdrawals from them are tax-freein most cases. There are rules that must be satisfied in order for withdrawals to be tax and penalty-free.

Designated Roth accounts are subject to the required minimum distribution rules. Roth IRA withdrawal and penalty rules vary depending on your age and how long youve had the account and other factors. Lets say you add funds to your Roth IRA now while your income is.

Roth IRA Withdrawal Rules and Penalties - SmartAsset Contributions to a Roth IRA go in post-tax which means you wont pay taxes on distributions. Accessing a Roth IRA provides an advantage over a hardship withdrawal and you wont even need to prove hardship to do so. With a Roth IRA contributions are not tax-deductible but earnings can grow tax-free and qualified withdrawals are tax- and penalty-free.

For example if the owner died in 2019 the beneficiary would have to fully distribute the plan by December 31 2024. If you inherit a Roth IRA you can withdraw the money tax-free. A Roth IRA is an IRA that except as explained below is subject to the rules that apply to a traditional IRA.

/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg) Roth Ira Withdrawals Read This First

Roth Ira Withdrawals Read This First

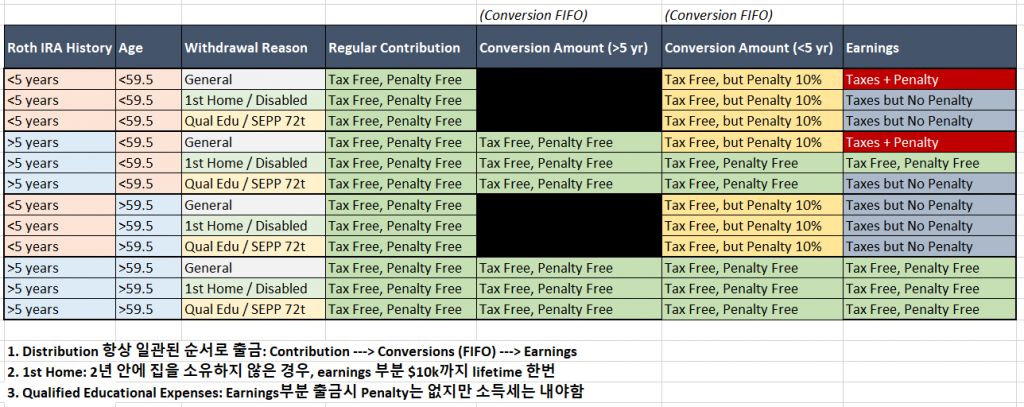

Roth Ira Distribution Rules 은준위 Eunjourney Com

Roth Ira Distribution Rules 은준위 Eunjourney Com

/required-minimum-distributions-9019da5770284fc0ace6a56792363045.png) All About Required Minimum Distribution Rules Rmds

All About Required Minimum Distribution Rules Rmds

Which Is Better Traditional Or Roth Iras 1080 Financial Blog

2019 Roth Ira Withdrawal Rules Infographic Inside Your Ira

2019 Roth Ira Withdrawal Rules Infographic Inside Your Ira

/exceptions-ira-early-withdrawal-penalty-2388980-Final-38a20015611944799acc47f83bba47af.png) Exceptions To The Ira Early Withdrawal Penalty

Exceptions To The Ira Early Withdrawal Penalty

Traditional Roth Iras Withdrawal Rules Penalties H R Block

Traditional Roth Iras Withdrawal Rules Penalties H R Block

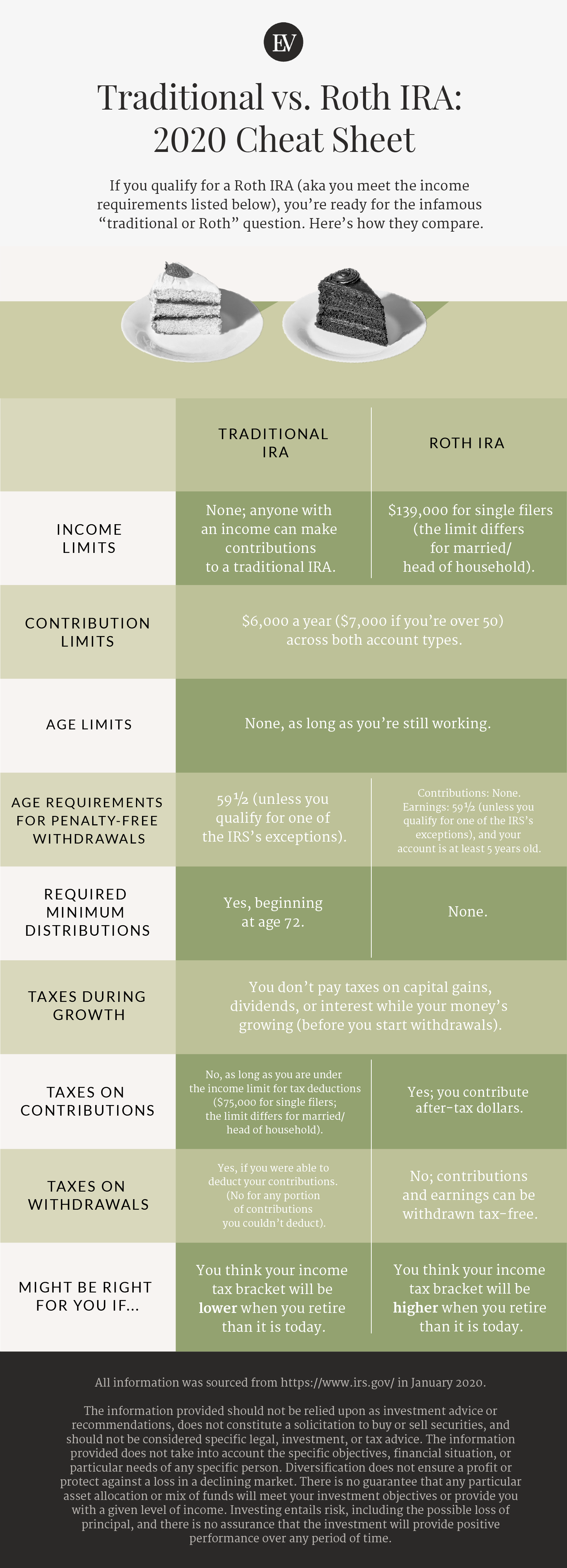

Roth Vs Traditional Ira What You Need To Know Ellevest

Roth Vs Traditional Ira What You Need To Know Ellevest

Publication 590 B 2020 Distributions From Individual Retirement Arrangements Iras Internal Revenue Service

Publication 590 B 2020 Distributions From Individual Retirement Arrangements Iras Internal Revenue Service

:max_bytes(150000):strip_icc()/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg) Roth Ira Withdrawals Read This First

Roth Ira Withdrawals Read This First

Form 5329 Instructions Exception Information For Irs Form 5329

Form 5329 Instructions Exception Information For Irs Form 5329

Retirement Portfolio Withdrawal Requirements Library Insights Manning Napier

Retirement Portfolio Withdrawal Requirements Library Insights Manning Napier

Https Retirementlc Com Wp Content Uploads 2017 07 2017 07 06 Roth Ira Distribution Ordering Rules Pdf

/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg) Roth Ira Withdrawals Read This First

Roth Ira Withdrawals Read This First

Comments

Post a Comment