Featured

Irs Quarterly Payment Online

July 15 for the 2nd quarter. Employers engaged in a trade or business who pay compensation Form 9465.

Irs Payment Options How To Make Your Payments

Irs Payment Options How To Make Your Payments

17 days ago Irs Quarterly Payments 2020 Coupons - Best Coupon Codes.

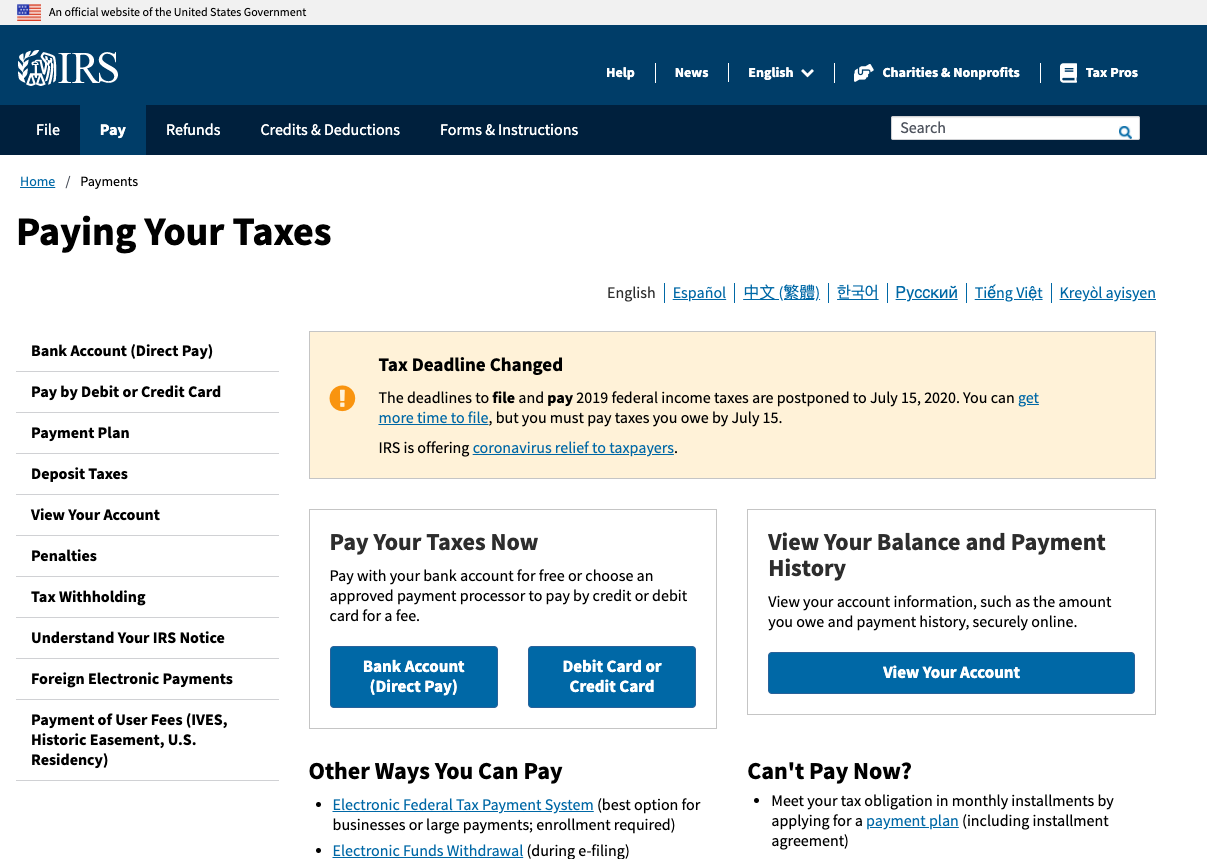

Irs quarterly payment online. Registering with EFTPS isnt complicated. Online Payment Agreements are available Monday Friday 6 am. When you file your annual tax return you will pay the balance of taxes.

AmendFix Return Form 2848. The fastest and easiest ways to make an estimated tax payment is by using IRS Direct Pay the IRS2Go app or the Treasury Departments Electronic Federal Tax Payment System. Rules Governing Practice before IRS Search.

How Can I Pay Quarterly Estimated Taxes Online. April 15 for the 1st quarter. Thats why we recommend using tax software see below.

View the amount you owe pay online or set up an online payment agreement. My CPA gives me one each year so if you dont have one you might want to ask your CPA. You can also pay your taxes with a check or money order.

Taxpayers should not re-submit these payments. You just need a bank account Social Security Number or Employer Identification Number and a mailing address. You can make quarterly payments through the EFTPS over the phone at 1-800-555-4477 or online.

Apply for an ITIN Circular 230. The IRS urged taxpayers not to submit the payments a second time if they were worried the payments didnt go through. October 15 for the 3rd quarter.

For additional information refer to Publication 505 Tax Withholding and Estimated Tax. You can use the Electronic Federal Tax Payment System EFTPS for paying your taxes online. Go to IRSgovSecureAccess to review the required.

If you pay from your. For information on other payment options visit IRSgovpayments. To do that sign up online or call the above phone number to have a signup form mailed to you.

You must use the mailing address the IRS. You can handle most of your tax transactions on the IRS website. For online enrollment you need your name Social Security number and bank account details.

Access your online account Individual taxpayers only Go to IRSgovAccount to securely access information about your federal tax account. A much easier method is to use IRS Direct Pay. All times are Eastern time.

Visit IRSgovpayments to view all the options. You may send estimated tax payments with Form 1040-ES by mail or you can pay online by phone or from your mobile device using the IRS2Go app. Make checks and money orders payable to.

As TuiCoupons tracking online shoppers can recently get a save of 50 on average by using our. You also have an option to pay online via the IRS payment portal. You would mail that along with a check to the IRS.

Besides mailing your payment you can pay online by debit or credit card which incurs a convenience fee or by using the EFTPS system which has no fee but you have to enroll. Before making a payment you need to sign up for the service. Same as any other kind of tax payment if the tax paid during the course of the tax year is more than the tax liability the IRS will issue you a refund.

If you make your payments by check you can do so using IRS Form 1040-ES. If paying by check taxpayers should be sure to make the check payable to the. After youve enrolled and received your credentials you can pay any tax due to the Internal Revenue Service IRS using this system.

Certain fees may apply. Installment Agreement Request POPULAR FOR TAX PROS. The Electronic Federal Tax Payment System tax payment service is provided free by the US.

Access your tax records online. How To Pay Your Quarterly Taxes Online The IRS makes it easy to pay taxes online. COUPON 3 days ago The quarterly federal estimated tax payments are due in.

They can also visit IRSgovpayments to pay electronically. Employers Quarterly Federal Tax Return Form W-2. Complete the Form 1040-ES Estimated Tax for Individuals and mail it to the IRS with a check.

You can pay by ACH transfer from your checking account using free IRS Direct Pay or pay by phone using the EFTPS system. Once youve calculated your quarterly payments You can submit them online through the Electronic Federal Tax Payment System. It has everything you need to pay your taxes including installment options digital payments estimated tax payment forms and more.

If a taxpayer re-submitted any of these payment requests due to the delay in processing they may cancel them by calling 1-888-353-4537 said the IRS. VOUCHER 5 days ago 26 days ago CODES 5 days ago Irs Quarterly Payment Coupons results have been found in the last 90 days which means that every 9 a new 2020 irs quarterly payment coupons result is figured out. As you can see through the IRS form figuring out your own quarterly payments is incredibly difficult.

To pay quarterly estimated taxes traditionally you would have a little paper voucher called the Form 1040-ES. Once youre registered you are also able to pay by phone by calling 888-555-4477. This is an online payment method provided by the IRS.

Apply for Power of Attorney Form W-7. Department of the Treasury. You can also pay using paper forms supplied by the IRS.

Most taxpayers qualify for this option and an Online Payment Agreement can usually be set up in a matter of minutes on IRSgovopa. Review the past 5 years of your payment history. January 15 for the 4th quarter.

Freelancer S Guide To Quarterly Estimated Taxes The Wherever Writer

Freelancer S Guide To Quarterly Estimated Taxes The Wherever Writer

How To File Quarterly Taxes In An Instant

How To File Quarterly Taxes In An Instant

Easiest Way To Pay Self Employment Estimated Taxes Accounting For Jewelers

Easiest Way To Pay Self Employment Estimated Taxes Accounting For Jewelers

The Procrastinator S Guide To Filing Quarterly Taxes Cashville Skyline

The Procrastinator S Guide To Filing Quarterly Taxes Cashville Skyline

Irs 1040es Estimated Tax Payment Online Using Direct Pay

Irs 1040es Estimated Tax Payment Online Using Direct Pay

How To Pay Federal Estimated Taxes Online To The Irs In 2021

How To Pay Federal Estimated Taxes Online To The Irs In 2021

Some Irs Online Services Including Ways To Pay Estimated Taxes Are Working Despite Shutdown Don T Mess With Taxes

The Procrastinator S Guide To Filing Quarterly Taxes Cashville Skyline

The Procrastinator S Guide To Filing Quarterly Taxes Cashville Skyline

How To Pay Quarterly Taxes Online Irs Il Dor The Dancing Accountant

How To Pay Quarterly Taxes Online Irs Il Dor The Dancing Accountant

Bergners Credit Card Payment Irs Quarterly Tax Payment Online

Bergners Credit Card Payment Irs Quarterly Tax Payment Online

Quarterly Taxes 5 Quick Steps To Pay Estimated Tax Payments Online Careful Cents

Quarterly Taxes 5 Quick Steps To Pay Estimated Tax Payments Online Careful Cents

Quarterly Taxes 5 Quick Steps To Pay Estimated Tax Payments Online Careful Cents

Quarterly Taxes 5 Quick Steps To Pay Estimated Tax Payments Online Careful Cents

Irs Direct Pay One Of Many Ways To Pay Estimated Taxes Don T Mess With Taxes

How To Make The 2 Estimated Tax Payments Also Due July 15 Don T Mess With Taxes

Comments

Post a Comment