Featured

What Line Is Agi On 1040

On a Form 1040A your AGI will be on Line 21. Your adjusted gross income is unique to you and can be found on your Form 1040.

1040 Form Agi Line Page 3 Line 17qq Com

1040 Form Agi Line Page 3 Line 17qq Com

Youll need to look at your tax return from last year to find your prior year AGI.

What line is agi on 1040. It will show your AGI from last year. On a Form 1040 your AGI will be on Line 37. Line 8b is only the AGI.

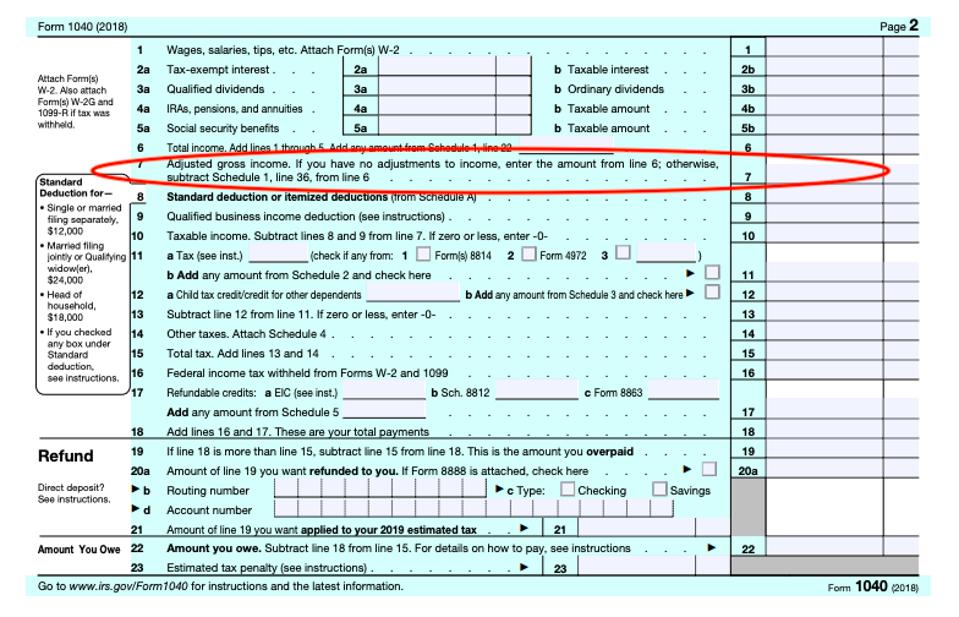

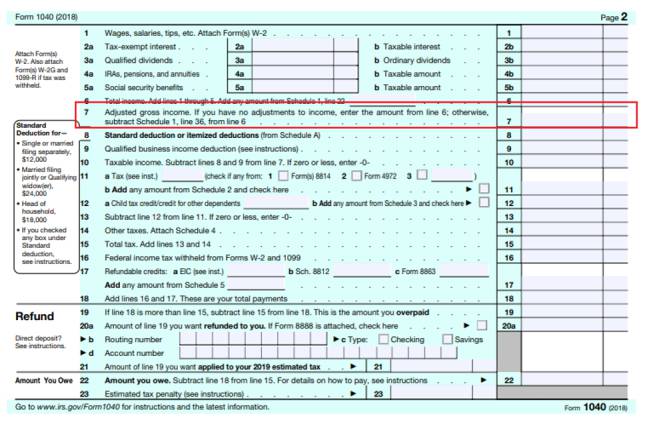

If you file Form 1040 your MAGI is the AGI on line 8b line 7 in Drake18 line 38 in Drake17 and prior of that form modified by adding back any. The 2018 AGI is on the 2018 Federal tax return you filed Form 1040 Line 7. Need to know more about adjusted gross income.

For the tax year 2020 check the line 8b on form 1040-SR. On a Form 1040EZ your AGI will be on Line 4. IRS utilizes AGI for determining the income you owe for tax-paying this year.

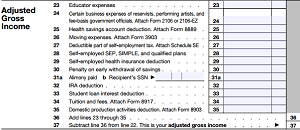

Gross income includes your wages dividends capital gains business income retirement distributions as well as other income. For AGI you will need both the 1040 Form and Schedule 1. Depending on the form you filed last year your AGI shows up on the following lines.

Your AGI will never be more than. If you filed with TaxSlayer last year we will have your prior year return available for you to access. MAGI when using Form 1040.

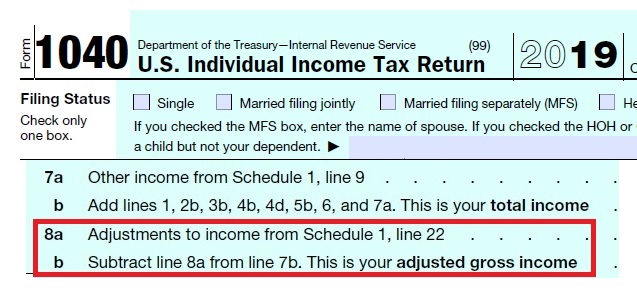

What is my adjusted gross income. As of 2019 your AGI is now listed on line 7 on the back of the Form 1040. For most taxpayers MAGI is adjusted gross income AGI as figured on their federal income tax return.

On Line 8b of IRS Form 1040 or. If you filed Form 1040 your AGI will be listed on Line 8b. Line 11 on Form 1040 and 1040-SR for tax year 2020 Line 8b on Form 1040 and 1040-SR for tax year 2019 Line 7 on Form 1040 for tax year 2018 Line 21 on Form 1040A for tax years before 2018 Line 4 on Form 1040EZ for tax years before 2018.

Foreign earned income exclusion 2. Find your prior-year AGI on Line 8b of your 2019 Form 1040. Beside above what line is AGI on 1040 for 2018.

For 2019 you can find the amount listed on the following lines based on the form you used. On a Form 1040EZ your AGI will be on Line 4. Tips for Calculating Adjusted Gross Income.

If you used a paid preparer last year you might obtain a copy of last years tax return from that preparer. If you filed Form 1040-NR your AGI will be listed on Line 35. To find your prior-year Adjusted Gross Income AGI look on a copy of the tax return you filed last year.

On a Form 1040A your AGI will be on Line 21. If you filed a joint return last year and this year with the same spouse you and your spouse will have the. For tax year 2020 yo can find your AGI on page 1 line 11 of the IRS Form 1040.

For the tax year 2020 check the line 8b on the form 1040. Adjusted Gross Income AGI is defined as gross income minus adjustments to income. What if I dont have my prior year return.

In respect to this what is AGI on 1040. To find your prior-year Adjusted Gross Income AGI look on a copy of the tax return you filed last year. Finding this number is easy if you already filed your 2020 return and printed a copy for your records.

Adjustments to Income include such items as Educator expenses Student loan interest Alimony payments or contributions to a retirement account. Various versions of Form 1040 reflect the AGI amount on different lines. Individual Income Tax Return and on your 2020 taxes your.

In fact your lender will probably want to see a copy of your return so they can verify your AGI. 2 If you filed elsewhere and you do have a copy of your 2019 Tax Return identify the exact form and line number for your AGI. Foreign housing exclusion 3.

On your 2019 tax return your AGI is on line 8b of the Form 1040. On Line 35 of IRS Form 1040NR. 1040 look on line 11.

This form is the US. 1040NR look on line 11. In other words AGI is the sum of your yearly earnings including dividends wages rental income royalties and more.

Have all your income information at the ready as you begin filling out Form 1040. On a Form 1040 your AGI will be on Line 37. The exact location of your 2020 AGI adjusted gross income depends on which 1040 form you filed.

Adjusted Gross Income aka AGI is nothing but your totalgross income achieved after required deductions. As you take care of your taxes make sure you have an adequate financial plan in place. Covered California participants will need to reference line 7 of the 2019 1040 tax form instead of the line 37 of the old forms to get their Adjusted Gross Income AGI.

You can determine the value of your adjusted gross income from different lines on various forms.

Form 7 Agi Line You Will Never Believe These Bizarre Truths Behind Form 7 Agi Line Power Of Attorney Form Tax Return Student Loan Interest

Form 7 Agi Line You Will Never Believe These Bizarre Truths Behind Form 7 Agi Line Power Of Attorney Form Tax Return Student Loan Interest

Taxes From A To Z 2019 M Is For Medical Expenses

Taxes From A To Z 2019 M Is For Medical Expenses

Tax Return 1 Windsor Clark Check Figures Form Chegg Com

Tax Return 1 Windsor Clark Check Figures Form Chegg Com

How To Find Your Modified Adjusted Gross Income Novel Investor

How To Find Your Modified Adjusted Gross Income Novel Investor

What Is Adjusted Gross Income Agi Gusto

What Is Adjusted Gross Income Agi Gusto

Second Stimulus Check What Is My Agi And Where Can I Find It As Com

Second Stimulus Check What Is My Agi And Where Can I Find It As Com

Archives Business Bookkeeping Services

Archives Business Bookkeeping Services

Schedule A Form 1040 Itemized Deductions Omb No 1845 0074 Go To Www Gov Scheduled For Instructions And The Latest Information If You Are Course Hero

What Should My Adjusted Gross Income Be

What Should My Adjusted Gross Income Be

What Is Adjusted Gross Income Agi Gusto

What Is Adjusted Gross Income Agi Gusto

New Adjusted Gross Income Federal Income Tax Line For Covered California Income Estimates

New Adjusted Gross Income Federal Income Tax Line For Covered California Income Estimates

22 Tax Deductions No Itemizing Required On Schedule 1 Don T Mess With Taxes

What Was Your Adjusted Gross Income For 2019 Federal Student Aid

Comments

Post a Comment