Featured

Income Tax Refund Delay

The new special provision was. We used to be able to start filing right around the middle of January said AC.

Why Your 2021 Early Tax Return Will Be Delayed This Year

Why Your 2021 Early Tax Return Will Be Delayed This Year

Mistakes on Your Return.

Income tax refund delay. But others who filed electronically are still waiting for their refunds. So how long a delay will my tax return have. Generally tax refunds are issued in a period of 2-4 months he added.

Part of this law includes a section that requires the IRS to. The IRS cant release these refunds before Feb. The IRS is still estimating that 90 of people should receive their refunds within 21 days.

15 but the IRS is saying to expect your refund by the first week of March. The IRS is holding 29 million tax returns for manual processing delaying tax refunds for many Americans according to the. How Long Do I Have To Wait For My Refund.

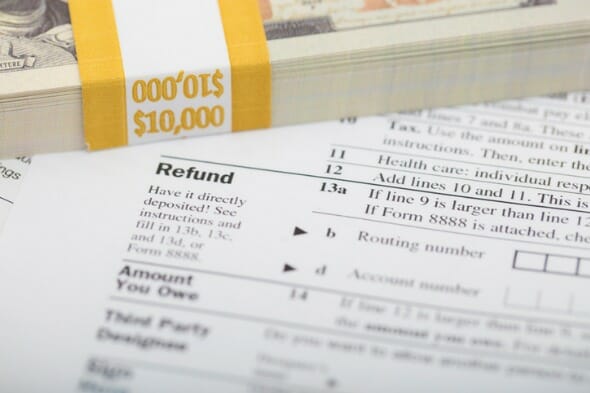

A 1040 income tax form. The IRS is already behind last years pace processing returns. This tax season the earned income tax credit can be claimed on a 2020 tax return based on someones 2019 or 2020 income this year.

There are several factors that can cause a delay in your tax return. In fact those who filed their ITRs in June-July are yet to receive refunds. This year it h taken 6-8 weeks for some.

Who is Affected by the Tax Refund Delays. Tax refund delays hit e-filers too The IRS has told people who filed a paper return to expect delays. Iowans should not expect a delay in refunds on state income taxes.

Nearly 7 million tax filers who await their tax refunds face significant delays this tax season as the IRS rushes to send out stimulus checks. If you file early the IRS will hold your refund until February 15 and then begin processing your refund. The Internal Revenue Service which encouraged taxpayers to file early for a speedier return maintains that most refunds will be issued within 21 days for taxpayers with direct deposit who file.

This will slow down any potential refund. Tax return and youre wondering where your refund is you are not alone. This year the Internal Revenue Service is pushing back its processing of federal income tax returns by two weeks.

The irs usually sends most refunds within three weeks or less. Mistakes could include mathematical errors or. A 2015 tax law called the Protecting Americans from Tax Hikes PATH Act created built-in certain rules to help protect against tax fraud and identity theft.

The IRS is holding more than 29 million tax returns for manual processing delaying refunds for many low-income Americans as the agency struggles to adopt a slew of coronavirus pandemic-related. The delays taxpayers have experienced this year have been largely unavoidable Collins said. Many taxpayers who filed their income tax return for the year FY2019-20 around three-four months back are yet to receive refunds.

Typically you can expect to receive your tax refund less than 21 days after filing electronically. However if you file a paper tax return expect delays. There seems to be a delay in issuance of refunds.

If you file an incomplete return or if you have any mistakes on your tax return the IRS will spend longer processing your return. Claiming Earned Income Tax Credit or Additional Child Tax Credit. Millions of tax refunds delayed 0711.

The new provision was. IRS data shows 76. So you could see a delay until the middle to end of February.

Reason for Tax Refund Delay. This tax season the Earned Income Tax Credit can be claimed on a 2020 tax return based on someones 2019 or 2020 income this year. Some tax refund payments could be delayed as the IRS manually processes millions of returns due to a 2019 backlog and abrupt changes to the tax code made in December.

Delayed refunds containing the earned income tax credit EITC andor the additional child tax credit ACTC. The delays have already cost the agency billions in interest on late refunds.

Why Income Tax Refund May Delay In Assessment Year 2020 21

Why Income Tax Refund May Delay In Assessment Year 2020 21

Income Tax Refund Itr Payments Become Fast Modi Govt Shares This Interesting Data The Financial Express

Income Tax Refund Itr Payments Become Fast Modi Govt Shares This Interesting Data The Financial Express

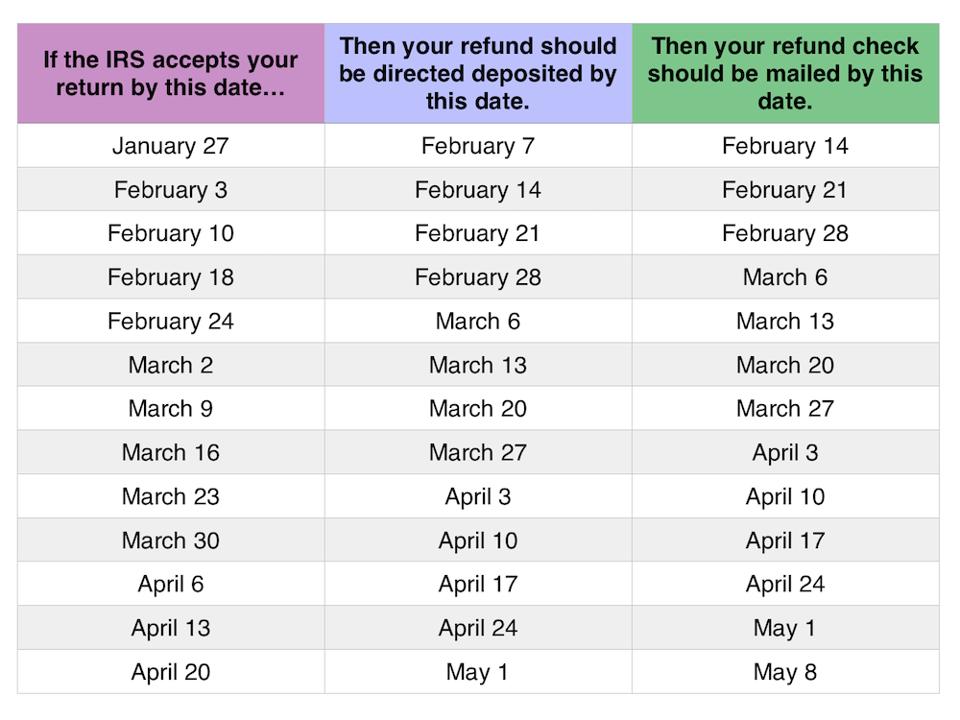

2020 Tax Refund Chart Can Help You Guess When You Ll Receive Your Money

2020 Tax Refund Chart Can Help You Guess When You Ll Receive Your Money

Income Tax Refund Getting Delayed These Could Be The Reasons

Income Tax Refund Getting Delayed These Could Be The Reasons

Haven T Received Income Tax Refund Yet Here S How You Can Raise A Re Issue Request Business News

Haven T Received Income Tax Refund Yet Here S How You Can Raise A Re Issue Request Business News

Tax Refund Delay What To Do And Who To Contact 2020 Smartasset

Tax Refund Delay What To Do And Who To Contact 2020 Smartasset

2018 Income Tax Refunds Delayed For Child Tax Credit And Eitc Returns

2018 Income Tax Refunds Delayed For Child Tax Credit And Eitc Returns

Stimulus Check 2021 Millions Face Tax Refund Delay As Relief Arrives

Stimulus Check 2021 Millions Face Tax Refund Delay As Relief Arrives

Why Your 2021 Early Tax Return Will Be Delayed This Year

Why Your 2021 Early Tax Return Will Be Delayed This Year

2021 Tax Refund Delays 2020 Tax Year Late Tax Refunds

2021 Tax Refund Delays 2020 Tax Year Late Tax Refunds

Income Tax Refund Stuck Steps To Take Reasons For Delay

Income Tax Refund Stuck Steps To Take Reasons For Delay

Tax Return Irs Tax Refund 2021 Dates Reason For Delay How To Check And Avoid Errors Marca

Tax Return Irs Tax Refund 2021 Dates Reason For Delay How To Check And Avoid Errors Marca

When Will You Get Your 2021 Income Tax Refund Cpa Practice Advisor

When Will You Get Your 2021 Income Tax Refund Cpa Practice Advisor

Waiting For Your Tax Refund Know The Reasons For Delay And Check The Status

Waiting For Your Tax Refund Know The Reasons For Delay And Check The Status

Comments

Post a Comment