Featured

How To Fight Deferred Interest Charges

So even if you pay off that original purchase anything you buy subsequently must also be paid off by the time the deferred interest period ends or youll be hit with interest on the purchase. Heres how it works.

What Is A Deferred Interest Credit Cards How Do They Work Debtwave

What Is A Deferred Interest Credit Cards How Do They Work Debtwave

Prior to that she has to make several LONGGGGG calls just to get a 25 LATE FEE waiver.

How to fight deferred interest charges. Deferred interest credit cards can be helpful since they can allow you to pay off a large purchase interest-free. They claimed this was because the revolving balance has higher interest rates. All of your payment goes to the revolving balance.

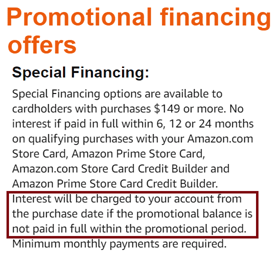

Avoiding deferred interest is straightforward you just have to follow through on the exact terms of the offer including paying off your balance in full before the promotional period expires. If you were charged interest on your deferred interest credit card tell us your complaints. This way your payments will.

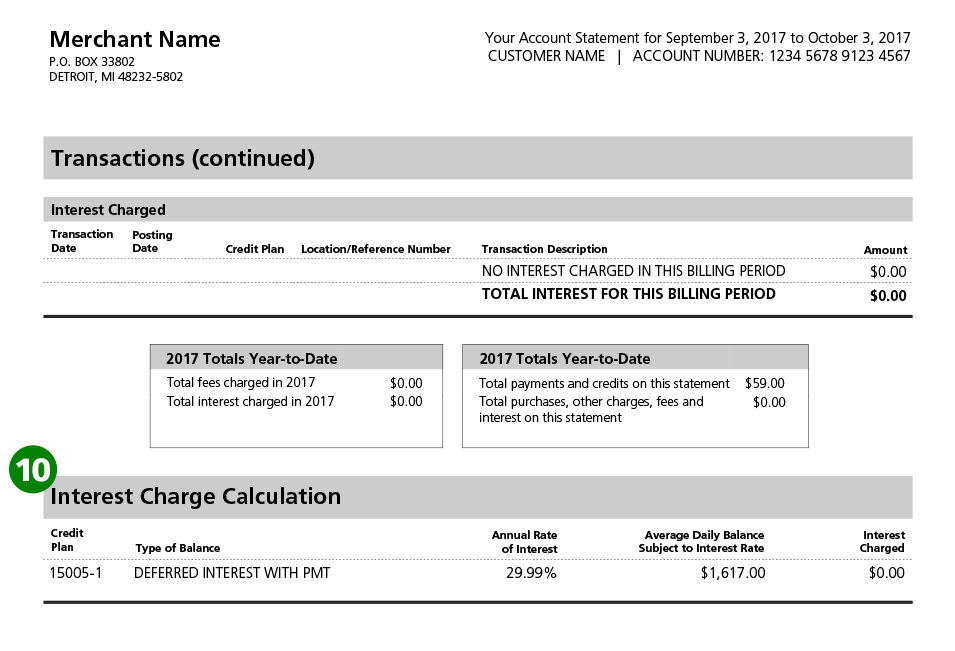

Deferred interest works by holding off on interest during a promotional period typically six to 12 months. One must look for the interest rate mentioned in the contract as well as the amount of time that he or she has for repaying the debt which is taken. Deferred interest is rare among credit cards from major issuers.

I know late fee and interest fees not charges can be negotiated but I was told this charge could not be. Be careful of the deferred interest charges with your The Home Depot Credit card. How this works depends on your contract.

Check your credit card agreement. All of the cards listed on our best balance transfer credit cards roundup have no deferred interest terms. If you dont you will be charged interest on your purchase going back to the date you first made that purchase.

That way you avoid having your payment take too long to arrive or forgetting to make that last payment. When you notice that the interest-free deferral period is about to expire make a large payment to bring the balance to 0 so you dont get slapped with deferred interest charges. If you want to find out whether your credit card charges deferred interest on certain purchases one of the following approaches may help.

This works the same way a deferred interest loan does. You can transfer debt before the promo period ends. But once that period ends interest starts to add up.

For late fee interest charge waivers on a Chase credit card my sister always gets them via e-mail request without breaking a sweat ever since Indian service reps started answering the e-mails in 2011. Any deal with interest free for X time obviously comes with some fine print and its everyones responsibility to know what that is. Also make sure you make your minimum payments on.

Keep your deferred interest card just for paying down your initial purchase to avoid the complexities of overlapping balances. How to avoid getting hit with deferred interest. A deferred charge is an expenditure that is paid for in one accounting period but for which the underlying asset will not be entirely consumed until one or more future periods have been completed.

Even carrying a balance of just 001 can send your bill soaring with interest fees. If you arent able to pay it off in time however youll owe all of the interest that accrued up until that point. Imaging you make a purchase of 1000 on a 0 deferred interest.

There are no interest charges on the cards balance for a set period as long as you pay off your balance by the end of the predetermined time. Instead deferred interest offers are more common with retail store credit cards and co-branded credit cards. If you pay off the loan during that period you wont pay any interest at all.

What is a Deferred Charge. This is supposed to benefit consumers but it has an unintended consequence on store cards with deferred rate offers. How to avoid deferred interest charges.

Say you make an initial purchase of 1000 on a credit card that comes with a 25 percent interest rate after the initial deferred-interest promotional period of. Try to pay off your deferred interest balance well before the deferred interest period ends. They dont put anything on your bill for you to be able to allocate your payment to the deferred interest charges.

In the next step simply multiply the amount that is owed with the rate of interest and the. Consequently a deferred charge is carried on the balance sheet as an asset until it is consumed. One of the attorneys looking into these lawsuits may then call or e-mail you directly to explain more about their investigation and how you could take part.

Usually deferred-interest loans come with higher rates than youd find on most personal loans. From my perspective my activity would be worth more if I stayed as a customer than to let such a. Once consumed a deferred charge is reclassified as an expense in.

But if you arent able to pay off the balance within the promotional period you risk incurring extremely high deferred interest charges which defeats the purpose of the special financing. Are credit card interest charges negotiable to be waived. Your credit card works the same way on a month to month basis - if you dont pay IN FULL by the end of a payment period you are charged interest on the FULL AMOUNT not just the part you didnt cover.

What Is Deferred Interest How Does It Work Credit Card Insider

What Is Deferred Interest How Does It Work Credit Card Insider

What Is Deferred Interest How Does It Work 2021

What Is Deferred Interest How Does It Work 2021

Entering A Loan With Deferred Interest Palo Alto Software

Entering A Loan With Deferred Interest Palo Alto Software

Deferred Interest Explained Youtube

Deferred Interest Explained Youtube

What Is Deferred Interest How Does It Work 2021

What Is Deferred Interest How Does It Work 2021

A Simple Trick For Getting Credit Card Interest Charges Waived Len Penzo Dot Com

A Simple Trick For Getting Credit Card Interest Charges Waived Len Penzo Dot Com

Deferred Interest Handling A Tricky Credit Card Feature Credit Karma

Deferred Interest Handling A Tricky Credit Card Feature Credit Karma

Deferred Vs 0 Interest How No Interest Credit Cards Can Be Costly Nerdwallet

Deferred Vs 0 Interest How No Interest Credit Cards Can Be Costly Nerdwallet

Form 8404 Interest Charge On Disc Related Deferred Tax Liability Stock Photo Image Of Deferred 8404 205323792

Form 8404 Interest Charge On Disc Related Deferred Tax Liability Stock Photo Image Of Deferred 8404 205323792

Deferred Interest Charges La Gi định Nghĩa Vi Dụ Giải Thich

Deferred Interest Charges La Gi định Nghĩa Vi Dụ Giải Thich

Https Www Nclc Org Issues Deceptive Bargain Html Print Pdf

How Do 0 Apr Credit Cards Work Everything You Should Know Valuepenguin

What S A Deferred Interest Credit Card Credit Karma

What S A Deferred Interest Credit Card Credit Karma

Comments

Post a Comment