Featured

Why Is Apr Different Than Interest Rate

An annual percentage rate APR is a broader measure of the cost of borrowing money than the interest rate. Thats the interest rate banks charge their most creditworthy clients and its usually 3 percentage points higher than the federal.

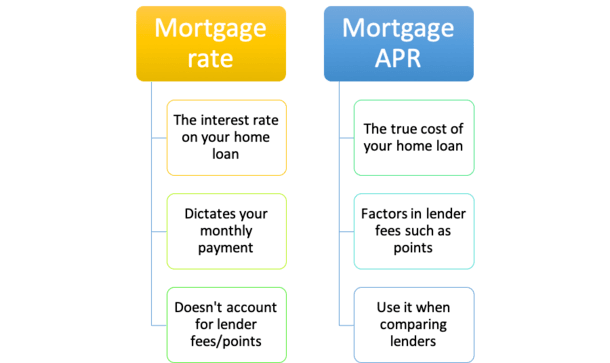

Mortgage Rate Vs Apr What To Watch For The Truth About Mortgage

Mortgage Rate Vs Apr What To Watch For The Truth About Mortgage

The point and other fees turn the interest rate into an APR of 320.

Why is apr different than interest rate. If youre taking out a mortgage the APR may include the interest as well as closing costs insurance fees and more. It shows the total costs and APR over the life of a 200000 mortgage loan. The value of knowing the difference between the APR vs.

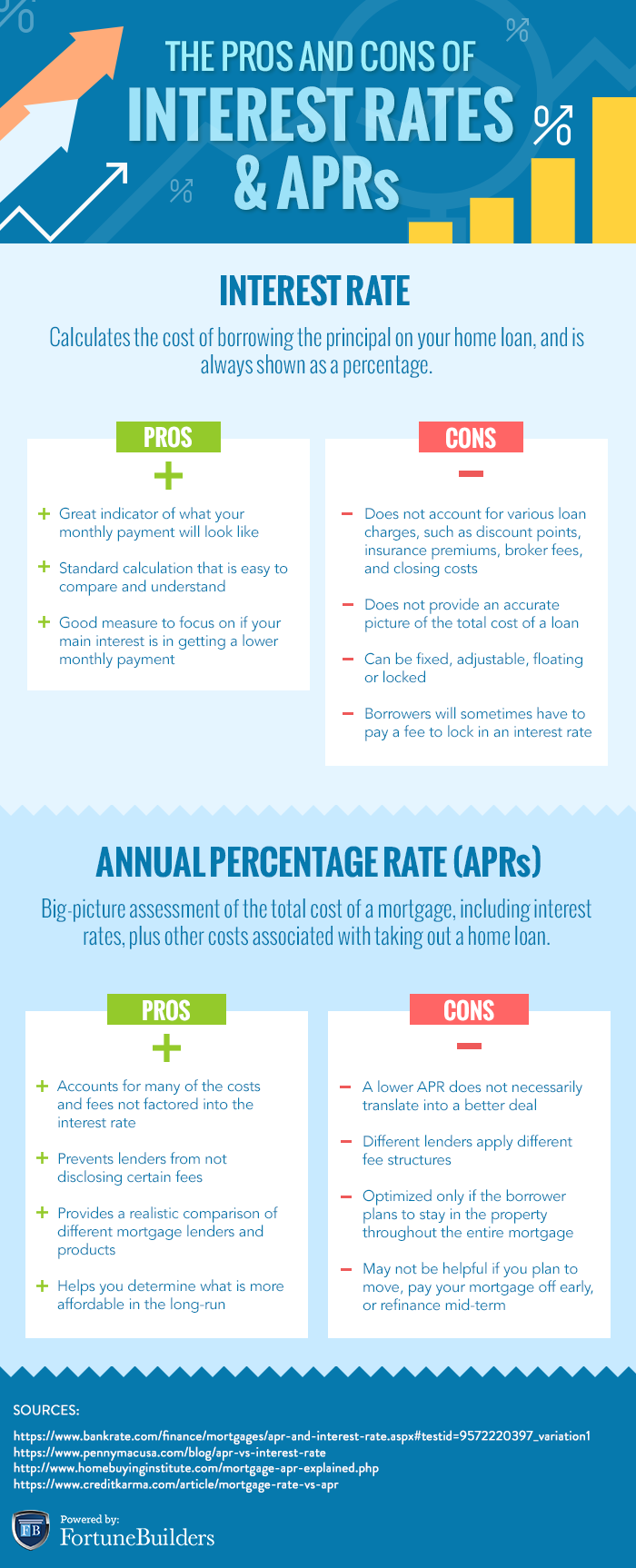

Why is the APR Higher Than the Interest Rate. Interest rate is recognizing the real cost of a loan. The difference Between APR and Interest Rate is simple.

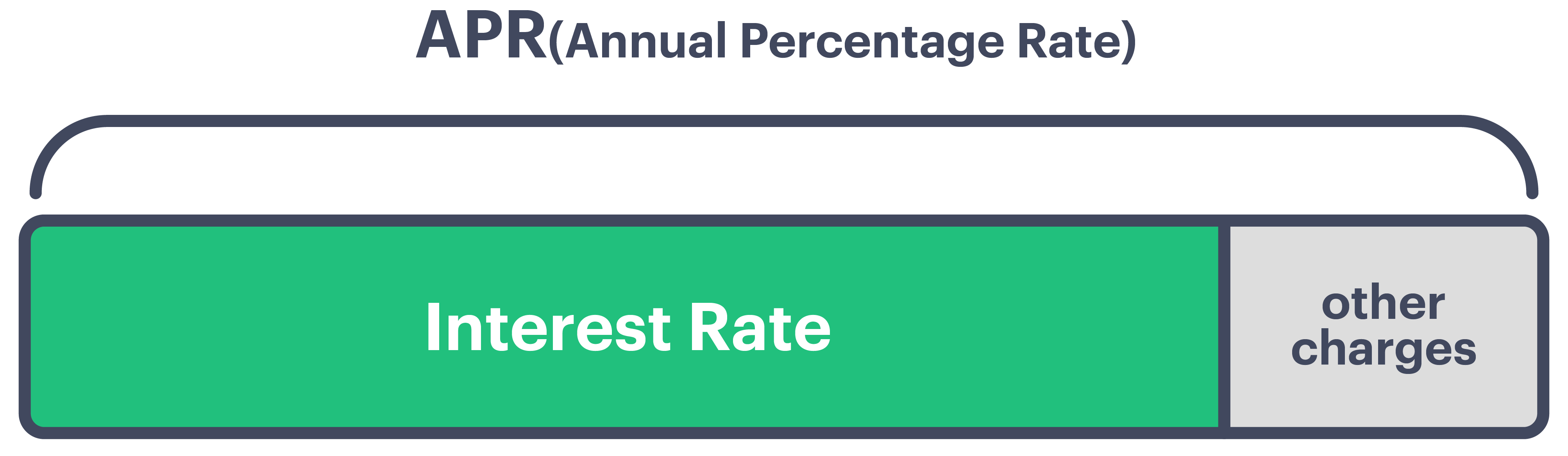

For that reason your APR is usually higher than your interest rate. The APR or annual percentage rate is the interest rate of the loan factoring in specified closing costs like the loan origination fee processing fees mortgage insurance and so forth. APR is the loans true cost while the interest rate is just the amount of interest youll pay.

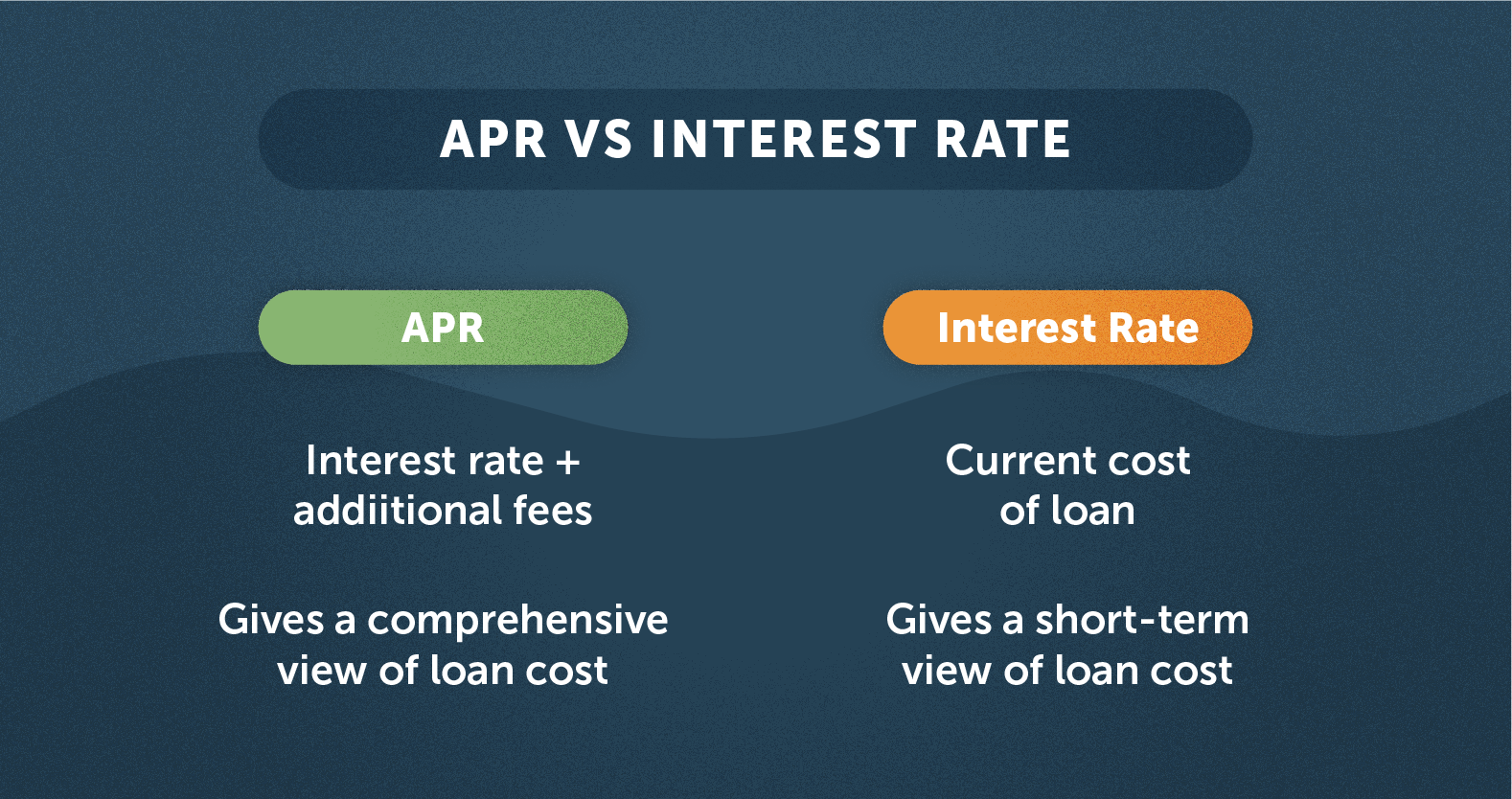

The interest rate on credit cards is based on the prime rate. An APR is defined as the sum of the interest rate plus extra fees and expressed as a percentage. The APR is almost always higher than the interest rate including other costs associated with borrowing the money.

Interest rate refers to the annual cost of a loan to a borrower and is expressed as a percentage. The fees turn the interest rate into an APR of 337. Loan B which has an interest rate of 3 1 discount point costing 2000 and 3000 in other lender fees.

The APR reflects the interest rate any points mortgage broker fees and other charges that you pay to get the loan. Why These Numbers Matter in a Mortgage Since APR includes both the interest rate and certain fees associated with a home loan APR can help you understand the. Since SoFi does not charge any fees your APR will normally equal the interest rate but there will be instances where your APR is different because of your first payment due date which is determined from the time of disbursement.

Your APR annual percentage rate attempts to combine all the costs of your mortgage interest rate lender fees discount points closing costs etc and represent this total cost as a percentage. So the APR is almost always higher than the interest rate. 15 discount points are used cut the rate by 025 and added another 15 points would cut the rate by 050.

As many other fees are also added in APR so it is higher than Rate. This is calculated by the lender based on how risky a borrower they think you might be. Your interest rate is simply the cost of borrowing the principal amount of your loan.

Its typically the opposite as a result of closing costs so its certainly strange at first glance. Rate is simple the monthly interest rate in round figure where as APR is more complicated as it includes many other fees as well. The most significant difference between an APR and the interest rate is that the APR offers a complete picture of how much a loan will cost while the interest rate provides a shorter-term view.

The real APR is the interest rate you will actually have to pay - rather than just the advertised or representative rate. APR is the annual cost of a loan to a borrower including fees. Interest rates between the two loans differ by a quarter point 025.

A home loans annual percentage rate APR is also displayed as a percentage but is higher than the accompanying interest rate. Unlike an interest rate however it includes other charges or fees such as mortgage insurance most closing costs discount. Like an interest rate the APR is expressed as a percentage.

Thats because an APR not only takes your interest rate into account but also factors in other costs such as most closing costs and lender fees. The chart below is from BankRate. A loans annual percentage rate APR includes all.

The federal Truth in Lending. They make this decision based on a range of information including the following. Rate is easy to calculate on the other hand APR is complicated as different companies charge different fees for their services.

Because the APR is a more comprehensive view of what youll pay for that loan.

Annual Percentage Rate Wikipedia

Annual Percentage Rate Wikipedia

/how-your-credit-score-influences-your-interest-rate-960278_fin2-6e9a6586481946a4a418afa6d7e2522e.png) How A Credit Score Influences Your Interest Rate

How A Credit Score Influences Your Interest Rate

What Is Apr And What Exactly Do You Need To Know Lexington Law

What Is Apr And What Exactly Do You Need To Know Lexington Law

Apr Vs Interest Rate Surprising Differences Between The Two Numbers

Apr Vs Interest Rate Surprising Differences Between The Two Numbers

Pros And Cons Of Apr Versus Interest Rate Fortunebuilders

Pros And Cons Of Apr Versus Interest Rate Fortunebuilders

Apr Vs Interest Rate Why It S So Important The Lenders Network

Apr Vs Interest Rate Why It S So Important The Lenders Network

Apr Vs Interest Rate Know The Difference When Choosing A Personal Loan Upgrade

Apr Vs Interest Rate Know The Difference When Choosing A Personal Loan Upgrade

Apr Vs Interest Rate Difference And Comparison Diffen

Apr Vs Interest Rate Difference And Comparison Diffen

What S The Difference Between Interest Rate And Apr

What S The Difference Between Interest Rate And Apr

Apr Vs Interest Rate For Car Loans Tresl Auto Finance

Apr Vs Interest Rate For Car Loans Tresl Auto Finance

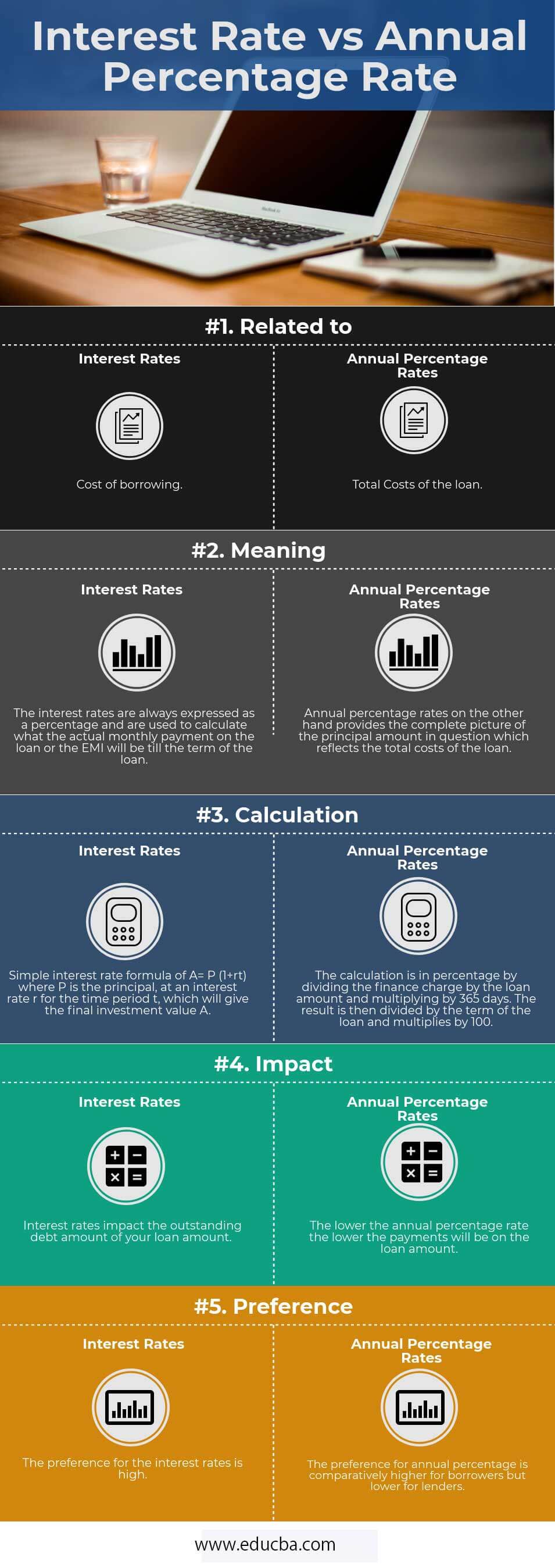

Interest Rate Vs Annual Percentage Rate Top 5 Differences

Interest Rate Vs Annual Percentage Rate Top 5 Differences

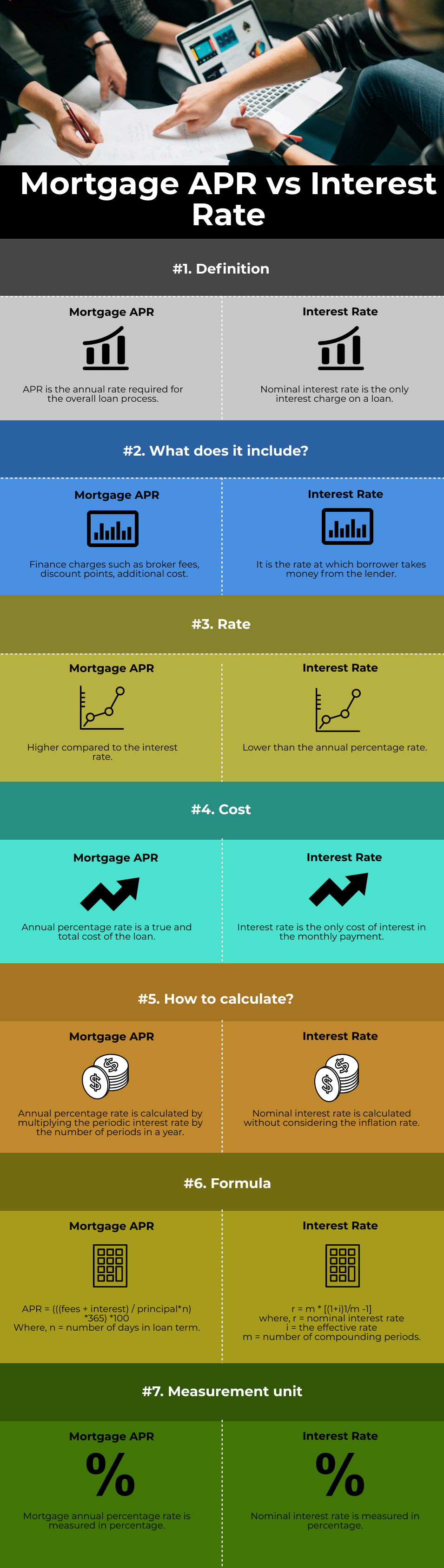

Mortgage Apr Vs Interest Rate Top 7 Useful Differences To Learn

Mortgage Apr Vs Interest Rate Top 7 Useful Differences To Learn

The Difference Between Apr And Interest Rate On A Mortgage Mortgagehippo

The Difference Between Apr And Interest Rate On A Mortgage Mortgagehippo

Apr Vs Interest Rate What You Need To Know Youtube

Apr Vs Interest Rate What You Need To Know Youtube

Comments

Post a Comment