Featured

What Is A 10 1 Arm Loan

Given how the interest rate can potentially change after the initial 10 years are up that means that the. After that it has an adjustable rate that usually changes once each year for the remaining life of the loan.

Should I Consider An Adjustable Rate Mortgage Better Mortgage

Should I Consider An Adjustable Rate Mortgage Better Mortgage

Its a hybrid home loan program with a 30-year term.

What is a 10 1 arm loan. The 1 means that after the 10. For instance a 51 ARM has a fixed rate and payment during its first five years and then it resets annually according to its terms. There is a cap on the rate adjustment per year and a limit to how much the rate can go up total.

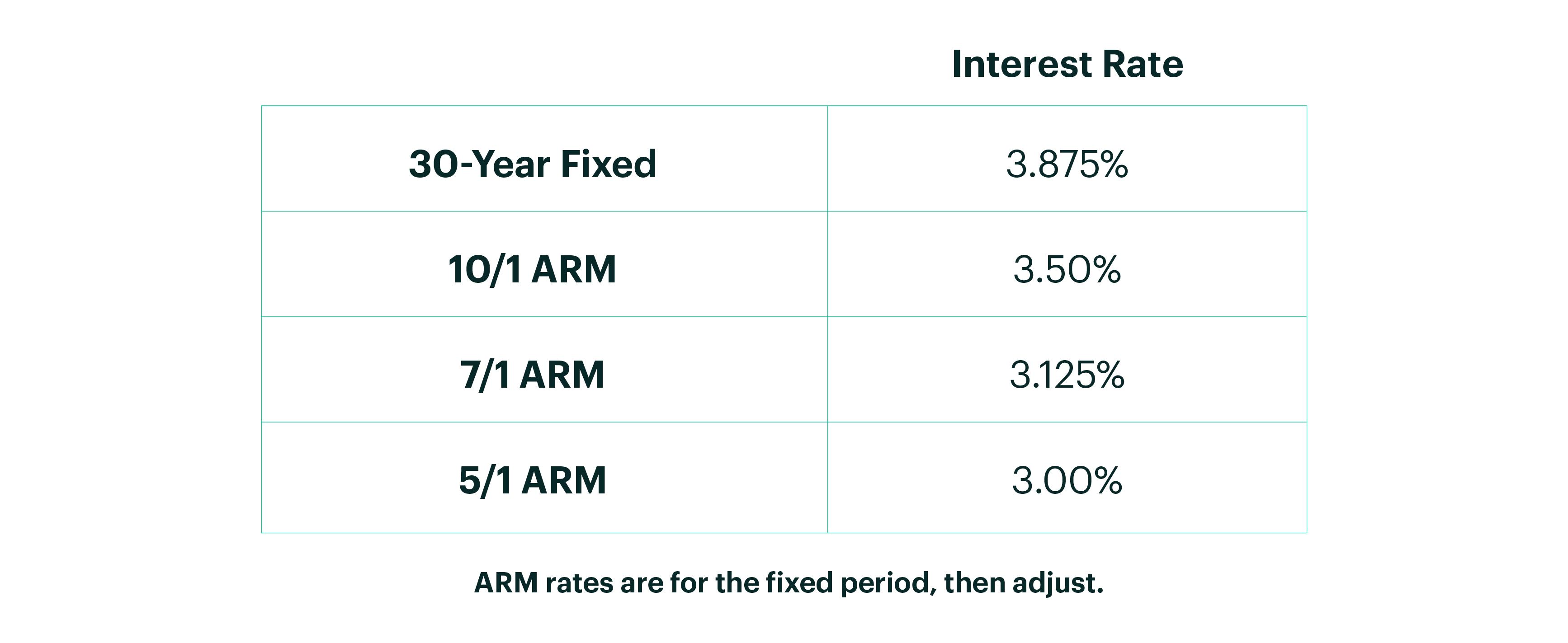

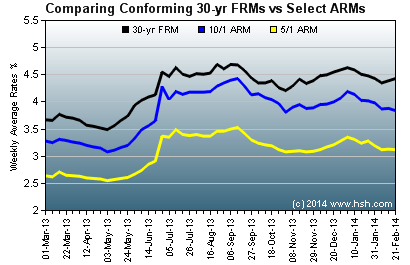

Borrowers turn to ARMs because the initial interest rates that come with these loans are generally lower than. If your interest rate. A 101 ARM adjustable-rate mortgage is often one of the best alternatives to choosing a 30-year fixed-rate mortgage.

Meaning its fixed before becoming adjustable. The 10-year ARM also know as a 101 Arm mortgage loan is one that has a fixed rate through the first decade but then the rate will change annually for the rest of the loan. 101 ARM the biggest difference is how long your initial fixed interest rate will last.

A 101 ARM is an adjustable rate mortgage loan with a fixed rate for the first 10 years. Here are the basics of the 101 ARM and what it can provide to you as a consumer. This index rate fluctuates with market conditions.

After an initial 10-year period the fixed rate converts to a variable rate. With a 101 ARM your initial interest rate will remain. It remains variable for the remaining life of the loan adjusting every year in line with an index rate.

Any ARM loan offers potential savings during the initial fixed-rate period. The 10 means that you will have 10 years of a fixed interest rate. To better understand if a 71 ARM is right for you here are the pros and cons you should consider.

The number before the slash is the period that your interest rate is fixed and the. There are several advantages of choosing a 71 ARM which include. A 101 ARM is another type of hybrid adjustable-rate mortgage.

It commonly refers to an adjustable rate mortgage with an interest rate that is fixed for 1 year and that adjusts annually after that. The name tells you basically everything you need to know and heres how to read it. For example a 106 ARM indicates that the interest rate is fixed for 10 years and then the interest rate will be adjusted every six months after that for the duration of your loan.

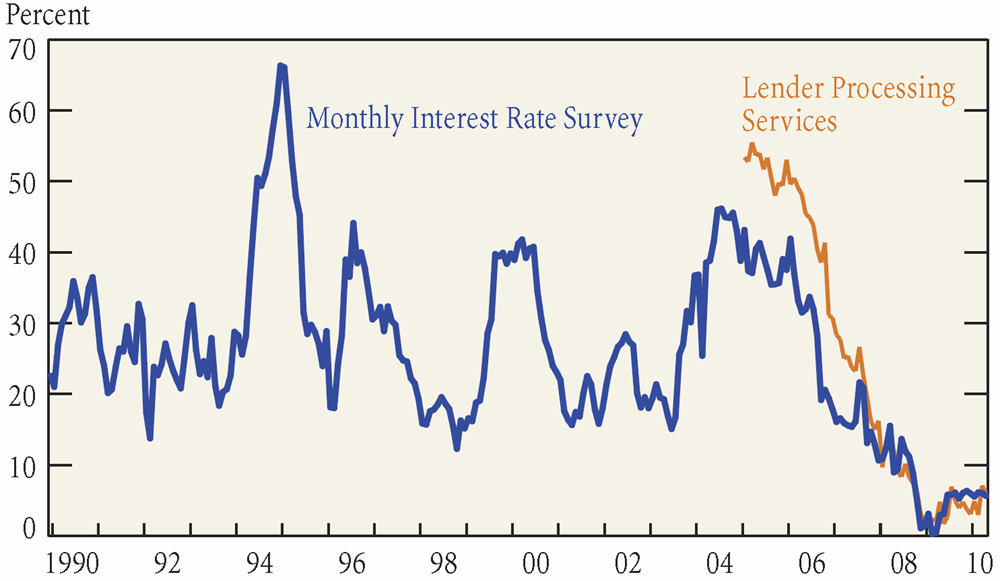

What is a 101 ARM loan. A 101 ARM loan is a cross between a fixed-rate loan and a variable-rate loan. Hearing that your interest rate could change after 10 years can sometimes make consumers feel uneasy perhaps triggering memories of the 2008 housing crisis.

By Beth Buczynski When considering a 51 vs. Though its important to remember that ARM mortgages. With a 71 ARM your introductory period is locked in for 7 years before any adjustments are.

Five years with a 51 ARM and 10 years with a 101 ARM. The right choice depends on what you expect for the future and whether or not you can afford higher mortgage payments. During that period you will have the same monthly mortgage payment as well.

For example 101 ARM has a set rate for 10 years after which the rate adjusts annually based on a benchmark interest rate chosen by the lender such. 6 lignes The most common ARM loans are 51 71 loans with the 31 101 being relatively less. A 11 ARM is often called a 1 year ARM.

One of the shorter of the hybrid-ARMs which are home loans that are fixed initially before becoming adjustable is the 31 ARM Lets learn more about how it works. When your interest rate adjusts your monthly mortgage payment will change too. Similarly 101 ARM rates remain fixed for the first ten years.

In this example we look at a 1 year ARM for 270000 with a starting interest rate of 6875. When buying a home or refinancing you need to choose between a fixed-rate loan and an adjustable-rate mortgage ARM like a 101 ARM. What Does 101 Mean.

101 ARM Basics Rates. Rates may be fixed for 7 or 10 years although the 5-year ARM is a very common option. Lower payments during the fixed-rate period.

You get a fixed interest rate for the first 3 years. What is a 101 ARM mortgage. It has a 2 cap on each adjustment.

An ARM has a fixed rate for the first several years of the loan term thats often called the teaser rate because its lower than any comparable rate you can get for a fixed-rate mortgage.

10 1 Arm Definition Today S Rates Quicken Loans

10 1 Arm Definition Today S Rates Quicken Loans

Freddie Mac Says Hybrid Arms Most Popular Of An Unpopular Product

Adjustable Rate Vs Fixed Rate Mortgage Calculator

Adjustable Rate Vs Fixed Rate Mortgage Calculator

10 1 Arm Loan With Disclosures Sample Disclosure Advertise Your Loans

What Is A 10 1 Arm And How Does It Work Financial Samurai

What Is A 10 1 Arm And How Does It Work Financial Samurai

10 1 Arm Mortgage Calculator Definition Rates The Texas Mortgage Pros

10 1 Arm Mortgage Calculator Definition Rates The Texas Mortgage Pros

10 1 Arm Vs 30 Year Fixed Bankrate Com

10 1 Arm Vs 30 Year Fixed Bankrate Com

10 1 Arm Loan With Disclosures Sample Disclosure Advertise Your Loans

Current Mortgage Interest Rates April 2021

Current Mortgage Interest Rates April 2021

10 Year Home Loan Calculator Page 1 Line 17qq Com

10 Year Home Loan Calculator Page 1 Line 17qq Com

10 1 Arm Calculator 10 Year Hybrid Adjustable Rate Mortgage Calculator

10 1 Arm Calculator 10 Year Hybrid Adjustable Rate Mortgage Calculator

What Is A 10 1 Arm And How Does It Work Financial Samurai

What Is A 10 1 Arm And How Does It Work Financial Samurai

Why Home Buyers Should Consider Adjustable Rate Mortgages Wsj

Why Home Buyers Should Consider Adjustable Rate Mortgages Wsj

Comments

Post a Comment