Featured

Insured Money Market Account

You cannot withdraw money or make payments more than six times a month from a money market account. For great rates and easy access to your money check out the CEFCU Insured Money Market Account IMMA.

10 Best Money Market Accounts April 2021

10 Best Money Market Accounts April 2021

A money market account is a savings account that is insured up to the federal maximum.

Insured money market account. For more information on. Banks also may offer what is called a money market deposit account which earns interest at a rate set by the bank and usually limits the customer to a certain number of transactions within a stated time period. Like other deposit accounts money market accounts are insured by the FDIC and NCUA up to 250000 for each account holder.

Most money market funds offer checks and some offer ATM cards to allow those who have funds on deposit to access their funds. Insured Money Market Account Looking for a Savings Account that Earns You a Higher Interest Rate. What Is a Money Market Account.

Eligible money market accounts are FDIC-insured up to 250000 per depositor for each account ownership category so your funds are protected in the event of a bank failure. All of these types of accounts generally are insured by the FDIC up to the legal limit of 250000 and sometimes even more for special kinds of accounts or ownership categories. But unlike a CD account money market accounts.

Money market mutual funds however are not federally insured. Money market mutual funds are an investment. A money market account is also a type of deposit account found at FDIC-insured banks and NCUA-insured credit unions.

Individual FDIC insured deposit accounts backed by the US. Some may charge monthly maintenance fees especially if you dont keep the minimum balance required. Its a short-term investment savings account that lets you withdraw funds at any time plus your money is insured.

Money market accounts are sometimes called money market deposit accounts or money market savings accounts. Are Money Market Accounts FDIC Insured. Are money market accounts safe.

Watch your funds grow quickly without worrying whether youll be able to use them when you need to. With First Federals Insured Money Market account you can earn a higher interest rate when your accounts average daily balance is 250000 or above. Classified as savings deposit accounts by the Federal Reserve and subject to monthly withdrawal limits see note money market accounts are a popular choice for storing money because they offer higher interest rates than.

However unlike savings accounts nearly all money market funds have minimum deposit amounts. Always make sure that youre looking out for fees. Rest Assured With an Ally Bank Money.

Watch your money grow in an Insured Money Market Account IMMA. Money market accounts are offered at banks credit unions and even some brokerage firms. Contact us to learn more.

Note that this limit applies on a per-depositor per-bank basis. Are money market accounts offered only at banks. With an Insured Money Market Account IMMA you can enjoy the high yields of investing minus the risk.

Your funds are federally insured up to 250000 by the National Credit Union Administration. So with these it is possible to lose some or even all of your principal. In addition a retirement money market account may.

Yes money market accounts are insured by the FDIC Federal Deposit Insurance Corporation up to the legal limit of 250000. There are often restrictions on. Some key features of the GIT Insured Money Market Account include.

By contrast money market funds are not FDIC-insured. Insured Money Market Account. Start an IMMA with as little as 2500 and even use it for Overdraft Protection.

Government High yield money market rates depending on market conditions Monthly account interest that can be reinvested. Investments are not insured by the FDIC and can lose value if the market falls. Open an Account Check Rates.

Money market accounts are FDIC insured. Money market accounts can be a good place to save money because the FDIC insurance protects account owners from the loss of deposited funds if the insured bank fails. Money market accounts at a bank are insured by the Federal Deposit Insurance Corporation FDIC an independent agency of the federal government.

With this tiered IMMA you will enjoy a variable rate structure coupled with the flexibility of a checking account. Like a regular savings account a money market account at a bank is insured by the Federal Deposit Insurance Corporation FDIC while one at a credit union is insured by the National Credit Union Administration NCUA. A critical difference between these two types of savings instruments is that deposits in money market accounts are insured by the FDIC Federal Deposit Insurance Corporation up to the maximum allowed by law at FDIC-insured banks.

Do money market accounts charge fees. Unlike stocks and bonds money market account balances held at a bank are FDIC insured up to 250000 per depositor per institution. These are offered by brokers and other entities that are not banks or credit unions.

What Is A Money Market Account 2020 Robinhood

What Is A Money Market Account 2020 Robinhood

Savings Account Vs Money Market Account Bushwick Flea

Savings Account Vs Money Market Account Bushwick Flea

What Is A Money Market Account How Does It Compare To High Yield Savings Mintlife Blog

What Is A Money Market Account How Does It Compare To High Yield Savings Mintlife Blog

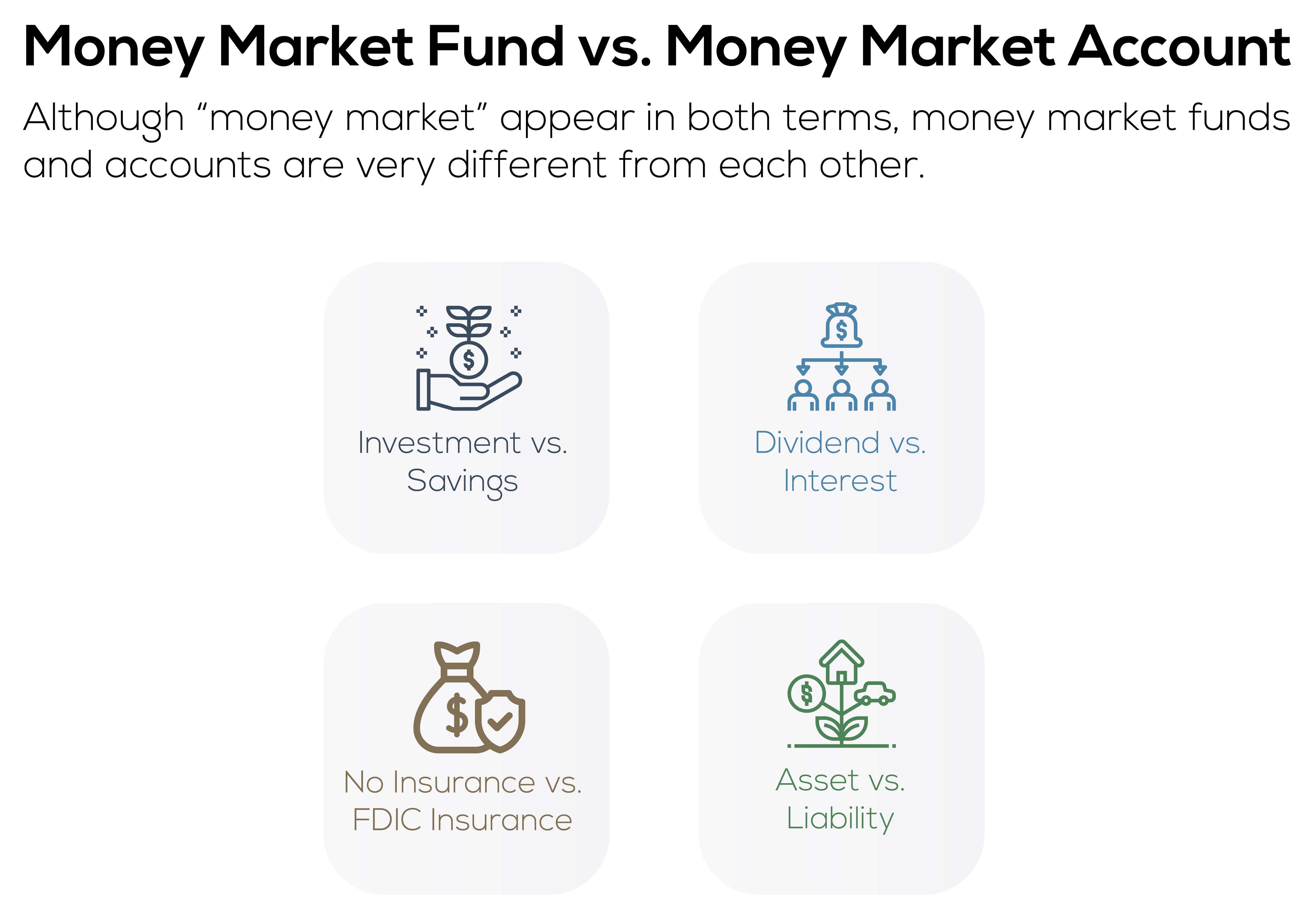

Money Market Fund Definition Examples Investinganswers

Money Market Fund Definition Examples Investinganswers

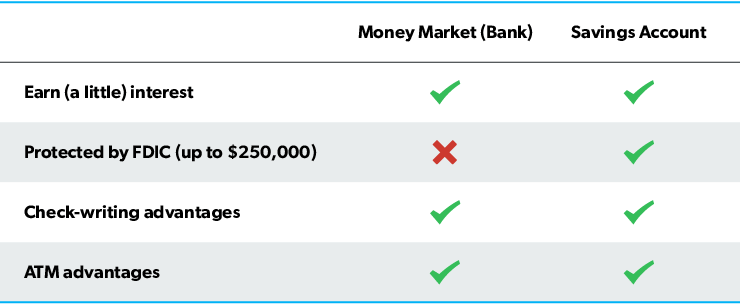

Money Market Vs Savings Which Account Should I Choose Ramseysolutions Com

Money Market Vs Savings Which Account Should I Choose Ramseysolutions Com

Money Market Vs Savings Account Which One Should You Use

Money Market Vs Savings Account Which One Should You Use

Are Money Market Accounts Fdic Insured Watch Your Buck

Are Money Market Accounts Fdic Insured Watch Your Buck

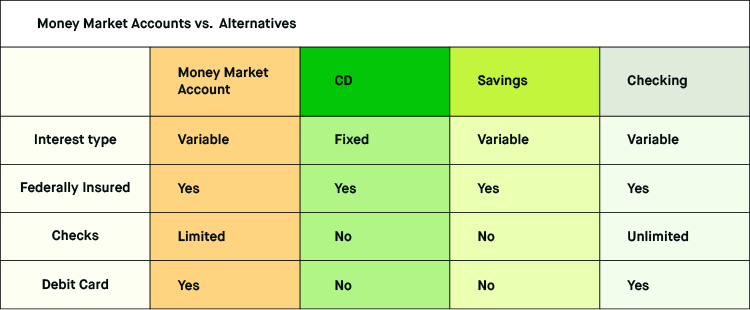

Compare Checking Savings And Money Market Accounts Ally

Compare Checking Savings And Money Market Accounts Ally

Money Market Account Mma Turbocharge Your Savings With This Insured Account Plain Finances In 2020 Money Market Account Money Market Finance

Money Market Account Mma Turbocharge Your Savings With This Insured Account Plain Finances In 2020 Money Market Account Money Market Finance

Money Market Account Benefits Discover

Money Market Account Benefits Discover

![]() Fdiconnect Insured Bank Deposit Money Market Saving Account

Fdiconnect Insured Bank Deposit Money Market Saving Account

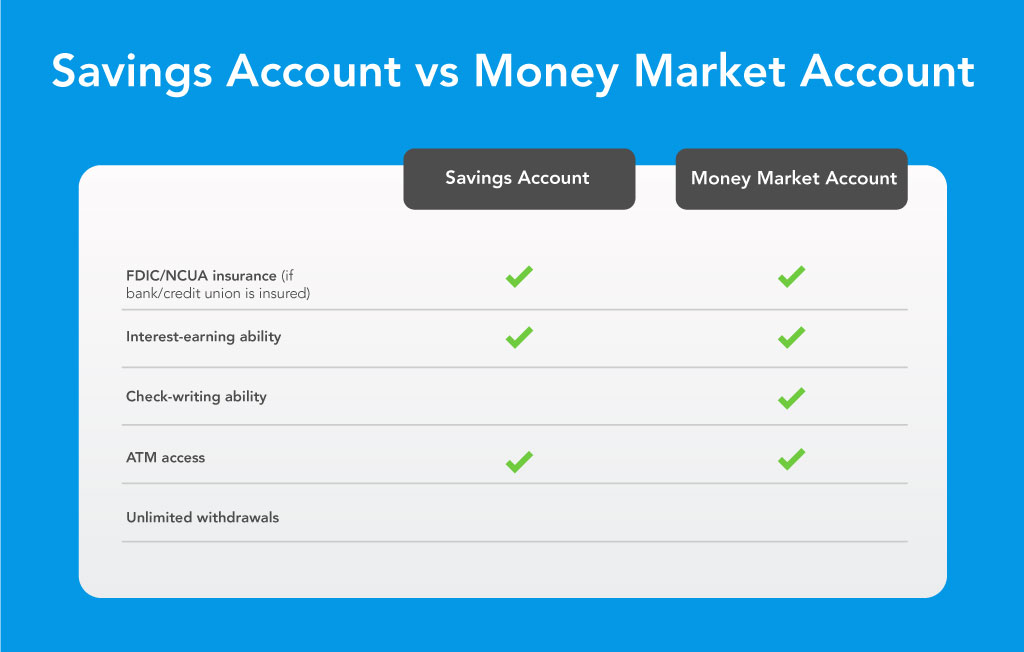

Money Market Accounts Vs Savings Accounts Ally

Money Market Accounts Vs Savings Accounts Ally

Comments

Post a Comment