Featured

Income Qualification For Mortgage

Pre-qualification is a casual estimate that determines how much money you can borrow for a mortgage. When underwriting mortgage loans most lenders follow the guidelines of.

How Much House Can You Afford Money Under 30

How Much House Can You Afford Money Under 30

Some kinds of income are not subject to taxes for example child support and disability.

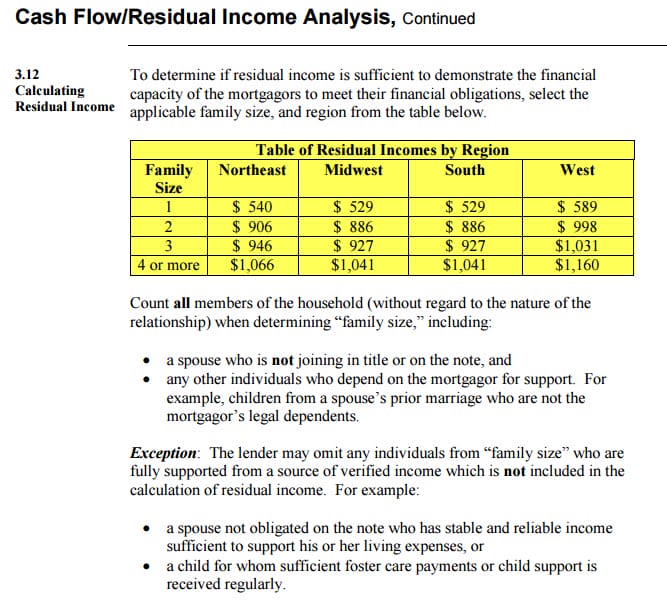

Income qualification for mortgage. The USDA counts the income of all adult household members to ensure the household income doesnt exceed the program limits in your area. This is a general estimate not an actual amount. A lender reviews your income assets and debts based on self-reported information.

In the next section we will display a table of widely used loan programs along with the limits. Usually non-taxable income is. 1 the income you can demonstrate and 2 the amount of debt you are carrying.

Fannie Mae lists 26 non-employment income types as. Salary is often the largest income source but lenders can also include RSU income investment income self-employmentbusiness income bonuses and other sources when adding up your total qualifying income. Financial institutions use two different ratios to measure your borrowing ability.

For example self-employment income commissions bonuses tips investments rental income spousal and child. Mortgage pre-qualification is an informal estimate of how much money you can borrow for a home loan. Having income from a long-term salaried position is the easiest way to qualify for a mortgage.

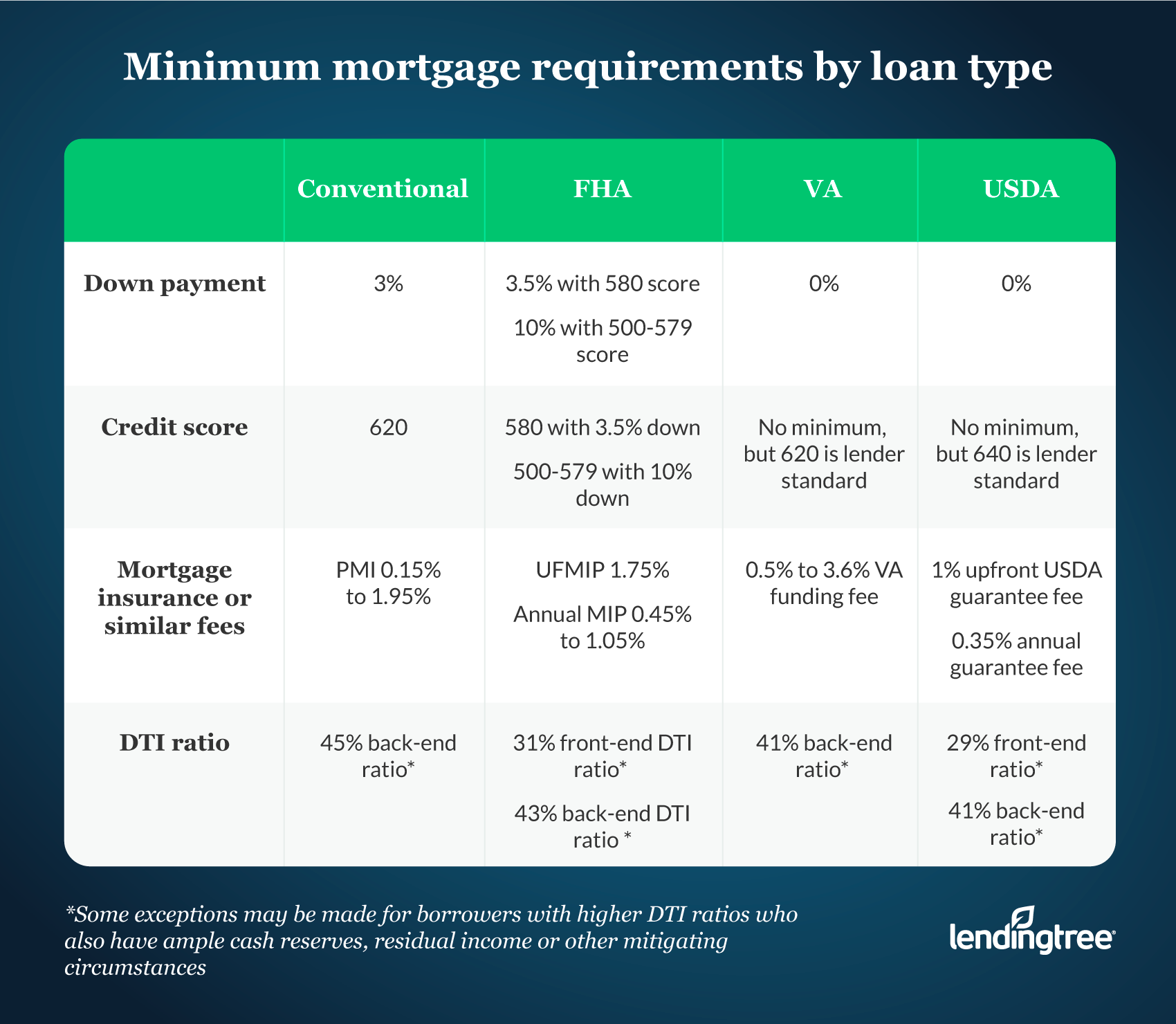

Lenders examine your debt-to-income ratio credit score and current income to see if you qualify for a home loan. At 45 your required annual income is 54946 Maximum monthly payment PITI 119837. For conventional loans the debt to income ratios are much lower However the maximum debt to income ratios can be as high as 50 DTI.

Use the income eligibility search tool to check on the limits in your state. Many lenders used to offer whats known as stated income mortgages where all a borrower had to do was state their income and the mortgage would be based on that number without any verification process. Your income can be proved easily through an employment letter and recent pay stubs.

A 20 down payment is ideal to lower your monthly payment avoid private mortgage insurance and increase your affordability. The first is your Gross Debt Service Ratio GDSR. In that case lenders are allowed to count that income as worth more.

Calculations are made using the current interest rate monthly debt payments and other important variables. Some loan programs place more emphasis on the back-end ratio than the front-end ratio. Mortgage Qualifying Income The income sources that a mortgage lender considers when calculating the loan size you qualify for.

It is conservative to use only about 28 of your monthly income for a mortgage although lenders may allow you up until about 35 of your monthly income. Pre-Approval These two terms may sound interchangeable but theyre not. As long as your total documentable income is at or above the higher of the two figures you should be able to handle the monthly housing payment and the rest of your obligations and a lender will likely qualify you for the mortgage amount derived from the calculation.

The second is your Total Debt Service Ratio TDSR. Under traditional debt-to-income DTI ratios the income figure generated by the calculator should be sufficient to cover these monthly costs. Total household income for a USDA loan must be at or below 115 of the median household in the area youre buying.

Please specify your yearly or monthly gross income. With FHA insured mortgage loans the maximum front end debt to income ratios allowed is 469 and the maximum back end debt to income ratios allowed is 569. For a 250000 home a down payment of 3 is 7500 and a down payment of 20 is 50000.

While one is surface level the other is an essential part of the homebuying process. It usually takes just one to three days and can be done online or over the phone. Types of investment income that can be used for mortgage qualification Typically there are only two forms of investment income that can be used for mortgage qualification dividends and interest.

Income requirements to qualify for a conventional mortgage explained Fannie and Freddie minimum income guidelines. Expect a lender to ask you about your income assets credit score and existing debts. The amount of money you spend upfront to purchase a home.

A back ratio also known as a debt-to-income ratio is another income-related figure that influences mortgage qualification. Use this mortgage income qualification calculator to determine the required income for the amount you want to borrow. The amount of mortgage you may qualify for depends on two things.

Most home loans require a down payment of at least 3. If you have sources of income other than a salary ask your lender if they will include these sources for mortgage qualification. A back ratio is similar to a front ratio except that it takes monthly.

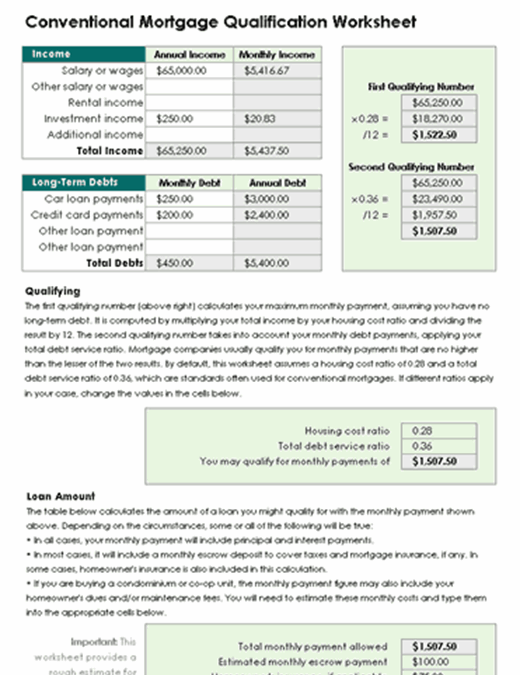

To determine your front-end ratio multiply your annual income by 028 then divide that total by 12 for your maximum monthly mortgage payment. Mortgage Pre-Qualification vs. Typically lenders cap the mortgage at 28 percent of your monthly income.

How to qualify for a home loan. They do not perform hard inquiries on your credit report which means it does not affect your credit score. This value should be the total of the household income if you are buying the property with a partner.

:max_bytes(150000):strip_icc()/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg) 5 Things You Need To Be Pre Approved For A Mortgage

5 Things You Need To Be Pre Approved For A Mortgage

Qualify For Mortgage The Basics

Qualify For Mortgage The Basics

Mortgage Qualification Chart Learn How Much You Can Borrow

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

New Mortgage Qualification Rules May Necessitate Lowering Your Home Expectations

Mortgage Qualification Calculator Spreadsheet

Affordability Calculator How Much House Can I Afford Zillow

Affordability Calculator How Much House Can I Afford Zillow

2021 Minimum Mortgage Requirements Lendingtree

2021 Minimum Mortgage Requirements Lendingtree

Mortgage Qualification Worksheet

Mortgage Qualification Worksheet

New Mortgage Qualification Rules May Necessitate Lowering Your Home Expectations

Buy A House In 2021 With These Low Income Home Loans

Buy A House In 2021 With These Low Income Home Loans

Here S The Income Requirements For Reverse Mortgage

Here S The Income Requirements For Reverse Mortgage

Here S How To Figure Out How Much Home You Can Afford

Here S How To Figure Out How Much Home You Can Afford

Mortgage Qualification Worksheet Mortgage Qualification Spreadsheet

Comments

Post a Comment