Featured

Roll Ira Into 401k

The IRS regulations say that Roth IRAs may not be rolled over into a Qualified Plan. Although most kinds of IRAs may be rolled over into a Solo 401 k there is one exception to the rule.

What Is A Rollover Ira And Should I Do It

What Is A Rollover Ira And Should I Do It

You can legally roll over SIMPLE IRA assets into a 401k plan.

Roll ira into 401k. However the tax treatment of the rollover will be dictated by the rollover date. Even if your annual income is above the thresholds for Roth IRA contributions youre still allowed to. Additionally if you are withdrawing money prior to the age of 59½ then the IRS levies an additional 10 percent penalty tax.

You can choose to do a direct or indirect rollover. They may also be subject to an. IRA 401K withdrawal Non Resident Alien 401K IRA retirement reduce tax International Tax.

Often individuals who leave companies where they had 401 k plans will roll the funds from them into IRAs. As a result the average 401 k plan participant who rolls a balance into an IRA will often end up investing in one of the most expensive retail share classes. Dont let confusion about annual limits make you fall short of your retirement goals.

Once youre 100 positive that your employer 401k accepts a. Alternatively move the assets into another SIMPLE IRA at any time. Rolling over a 401kfrom a previous.

When a solo 401k plans assets reach 250000 the plan administrator will have to file a Form 5500-EZ with the IRS every year. Can you roll your traditional IRA into the new employer plan something called a reverse rollover. Roll the plan to an IRA cash out the 401 k keep the plan as is or consolidate the old 401 k with a 401 k at.

Thus if you have a Roth IRA you are fairly limited as to rollover options. Nearly all 401 k plans use. The IRA-to-401 k maneuver which allows you to roll pretax traditional IRA assets into a 401 k.

If you roll over your 401 k into an IRA youll also want to consider the kind of rollover you need. Annonce Non Resident Alien from the US Retirement Withdrawal 401k US. As long as the 401 k accepts incoming rollovers you.

Individuals with 401 k plans have several options when leaving an employer. So youve got an old 401k lying around and you want to roll it over into an IRA. Advantages of a 401 k-to-Roth IRA rollover include.

Those transfers are treated as a rollover contribution so keep adding to the 401k plan through payroll. How To Do An IRA To 401k Reverse Rollover Step 1 Confirm Eligibility. Rolling your IRA into a 401k does not reduce the amount you or your employer can contribute to your 401k during the year.

How to roll over a 401k to an IRA. Before you begin anything you need to confirm that your employer-sponsored 401k accepts. Tax Consequences of a 401k-to-IRA Rollover.

In the world of retirement account rollovers theres one type that doesnt get much love. As mentioned above you generally wont have to pay any taxes on your 401k-to-IRA rollover. With a Roth 401 k youll likely be more interested in a Roth IRA so that you can maintain.

One other tax consideration. For a direct rollover your old plan sends the money directly into your. Annonce Non Resident Alien from the US Retirement Withdrawal 401k US.

Regardless of whether you own a 401k or an IRA once a distribution is taken it is taxable as ordinary income. Disbursement help free help. Disbursement help free help.

Step 2 Request A Distribution. You can roll over your IRA into a qualified retirement plan for example a 401 k plan assuming the retirement plan has language allowing it to accept this type of rollover. He also said rolling over money in an IRA to a solo 401k will get the solo 401k closer to an IRS reporting threshold.

Avoiding Roth IRA income restrictions. The only time youll have to deal with taxes is if you have a traditional IRA and want to roll over to a Roth IRA. Speaking in general terms IRA and 401 k assets that are distributed and not rolled over to another IRA or eligible retirement plan will be subject to income tax.

If you want to avoid paying taxes wait for two years from the date of plan participation before you carry out the rollover to a 401k. I can avoid the extra paperwork for more years if I dont rollover IRA money into my solo 401k. Roth IRAs can only be rolled over to another Roth IRA.

The answer is yes in many cases you can. IRA 401K withdrawal Non Resident Alien 401K IRA retirement reduce tax International Tax.

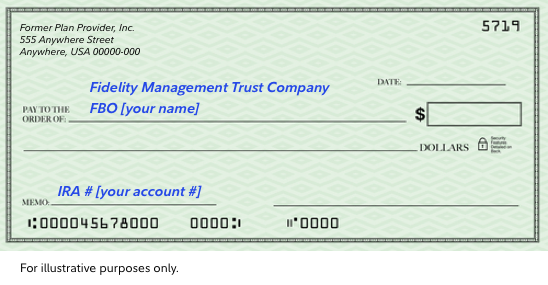

401k To Rollover Ira New Account Steps Fidelity

401k To Rollover Ira New Account Steps Fidelity

What Is A Rollover Ira Retirement Rollovers Explained Youtube

What Is A Rollover Ira Retirement Rollovers Explained Youtube

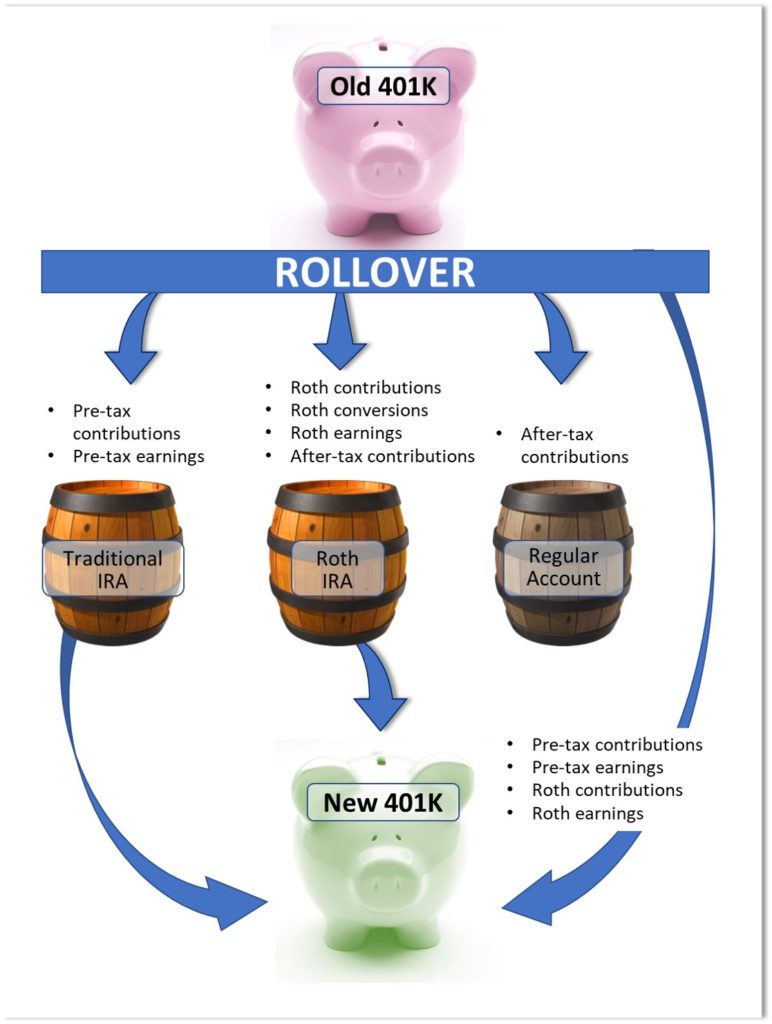

The Complete 401k Rollover Guide Retire

The Complete 401k Rollover Guide Retire

Understanding The Ira To 401k Reverse Rollover

Understanding The Ira To 401k Reverse Rollover

The Right Way To Roll Over Your 401 K And Ira Money Marketwatch

The Right Way To Roll Over Your 401 K And Ira Money Marketwatch

The Difference Between A Rollover Ira And A Traditional Ira Saverocity Finance

The Difference Between A Rollover Ira And A Traditional Ira Saverocity Finance

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png) How To Take Money Out Of A 401 K Plan

How To Take Money Out Of A 401 K Plan

401k Rollover To Ira Td Ameritrade

401k Rollover To Ira Td Ameritrade

Rollover Revisited Why Sticking With A 401k May Be Better

Rollover Revisited Why Sticking With A 401k May Be Better

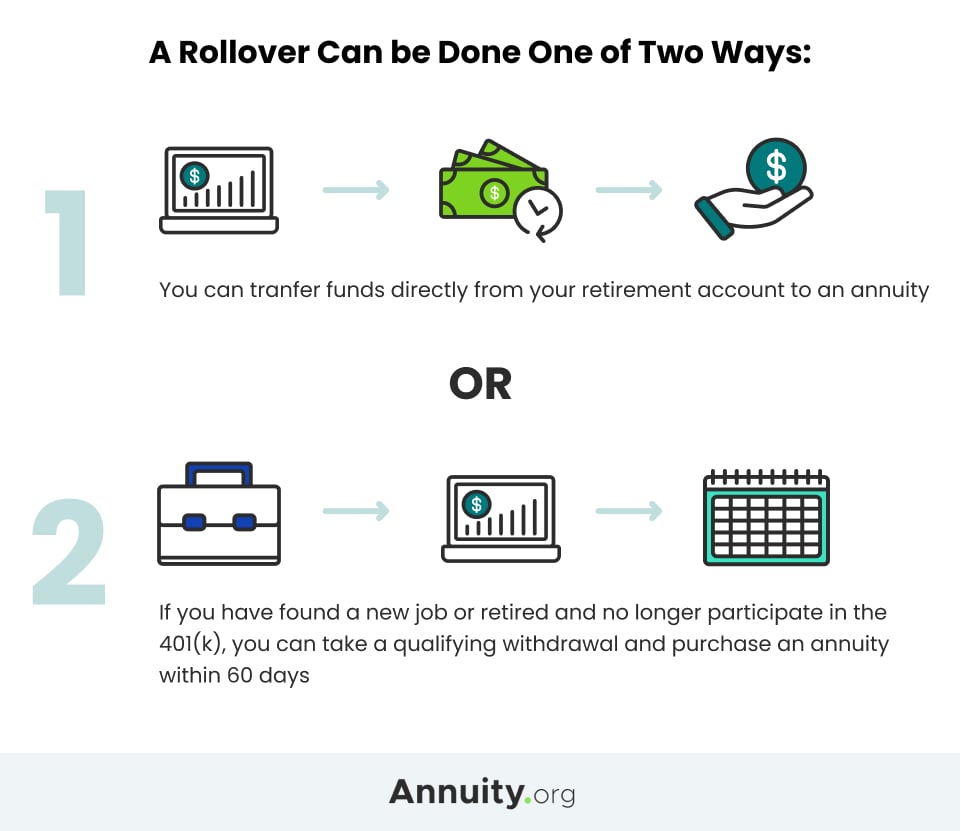

Roll Over Ira Or 401 K Into An Annuity Rollover Strategies

Roll Over Ira Or 401 K Into An Annuity Rollover Strategies

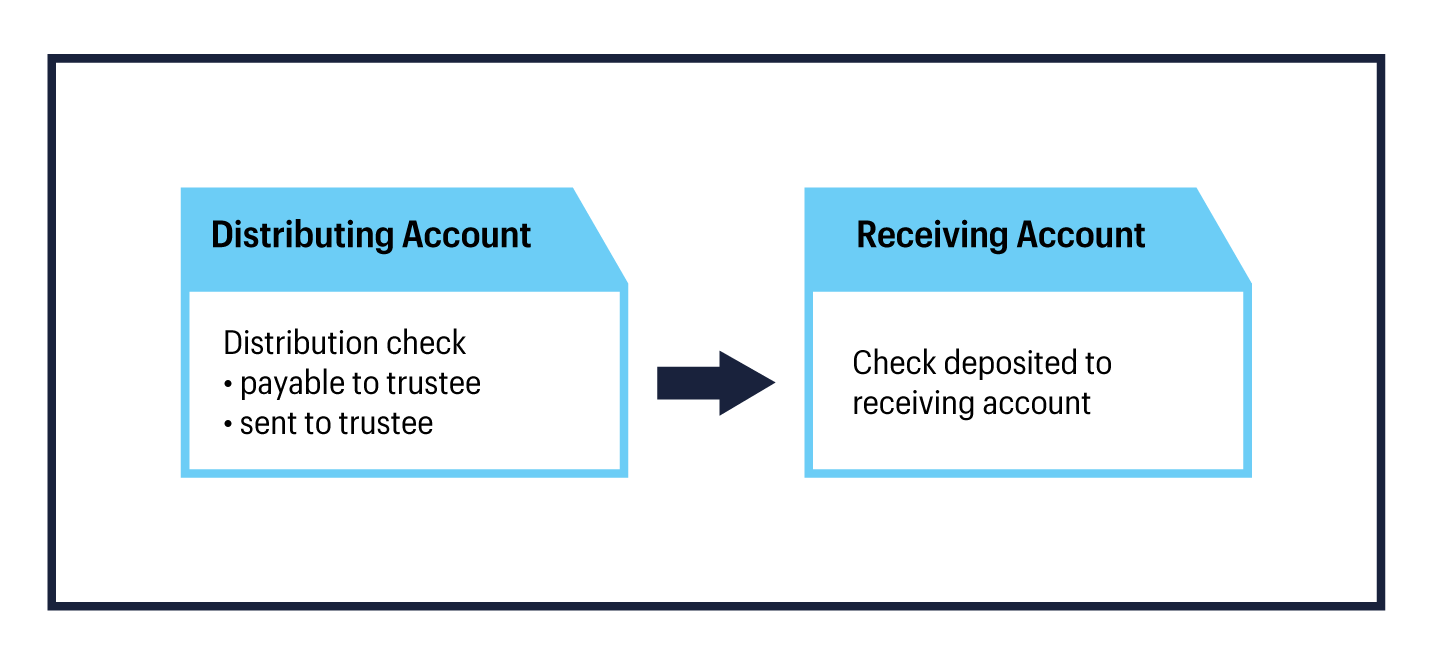

Understanding Ira Rollovers Learn More

Understanding Ira Rollovers Learn More

The Complete 401k Rollover Guide Retire

The Complete 401k Rollover Guide Retire

Rolling Over A 401k To An Ira The Reformed Broker

Comments

Post a Comment