Featured

Short China Etf

Der ETF setzt eins zu eins den Hang-Seng-Index umgekehrt um. ETF issuers are ranked based on their estimated revenue from their ETFs with exposure to China.

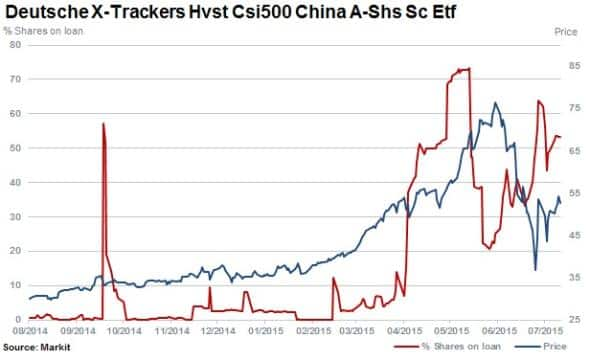

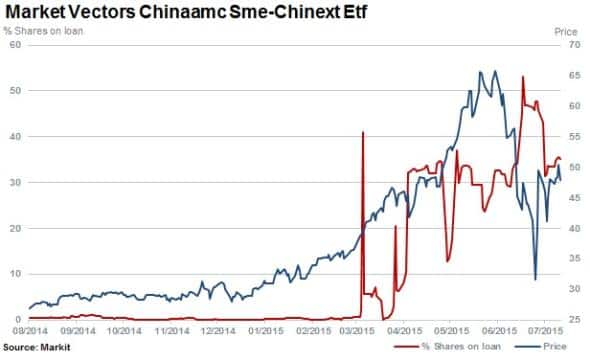

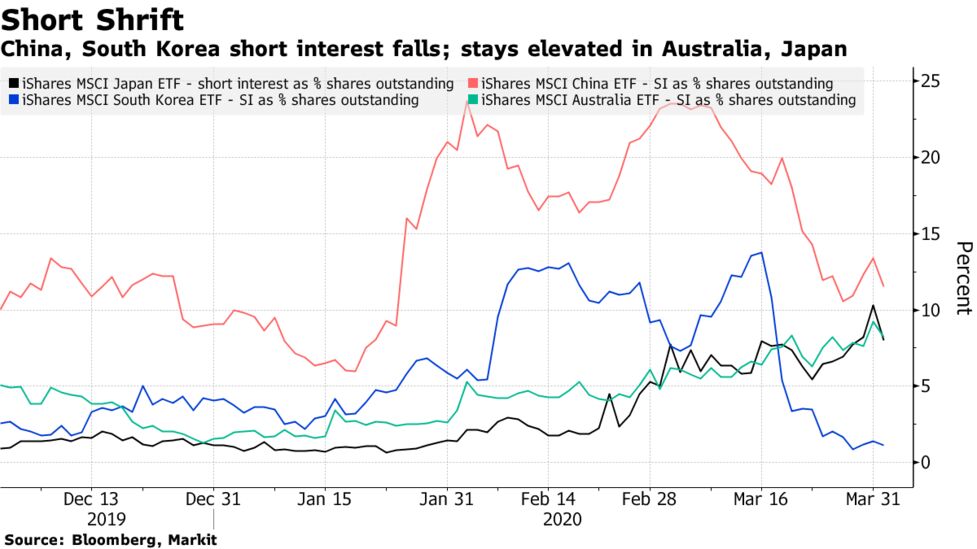

Shorts Gain On Chinese A Share Etfs

Shorts Gain On Chinese A Share Etfs

Deka MSCI China ex A Shares ETF.

Short china etf. Die Nachbildung erfolgt mittels der Unfunded Swap Methode und die Dividenden sowie Ausschüttungen werden nicht an die Anleger ausgezahlt sondern in den Fonds investiert. Launched in 2009 the Direxion Daily FTSE China Bear 3X ETF YANG seeks to return three times the inverse daily performance of the FTSE China 50. To get the estimated issuer revenue from a single China ETF the AUM is multiplied by the ETFs expense ratio.

Direxion Daily China Bear 3x Shares NYSEARCAYANG. Auch hier ist ein ETF zu finden und zwar der Amundi ETF MSCI China UCITS ETF EUR. The Deutsche X-trackers Harvest CSI 500 China-A Shares Small Cap ETF ASHS D-73 is the worst-performing China exchange-traded fund.

Die Besonderheit bei einem Investment in China sind die unterschiedlichen Aktienklassen. InverseShort China ETFs seek to provide the opposite daily or monthly return of various broad indexes tied to Chinese stocks. This essentially creates a short position in Chinese stocks.

The FTSE China 25 Index ETF FXI is. The main downside to MCHI US is that the total expense ratio is on the higher side at 059 and the withholding tax implications that you brought up. Gezieltes Engagement in den führenden 50 chinesischen an der Hong Kong Stock Exchange notierten Aktien in einem einzigen Handelsgeschäft.

Dieser Fonds hat ein Volumen von 83 Millionen Euro und die jahreskosten betragen 055 Prozent. With a loss of 52 percent in less than a month. YXI is one of the few unleveraged ETFs to go short China.

This short ProShares ETF seeks a return that is -2x the return of its underlying benchmark target for a single day as measured from one NAV calculation to the next. The total expense ratio TER of ETFs on these indices is between 019 pa. Securities in the Index are weighted based on the total market value of their shares so that securities with higher total market values will generally have a higher representation in the Index.

An effective though risky way to short the China market is to take short positions in ETFs that are long on Chinese stocks. For an investment in the Chinese stock market there are 12 indices available which are tracked by 21 ETFs. ProShares Short FTSE China 50 seeks daily investment results before fees and expenses that correspond to the inverse -1x of the daily performance of the FTSE China 50 Index.

The following five China ETFs offer a variety of ways for you to get the China exposure you want in your portfolio. Direkter Zugang zu chinesischen Unternehmen mit hoher Marktkapitalisierung. LU0429790313 WKN DBX0C4 seiner Investmentstrategie nachgehen.

Wer Zweifel an der Nachhaltigkeit der Erholung in Fernost hat kann mit dem db x-trackers HSI Short Daily Index ETF der Deutschen Bank ISIN. Engagement in einem einzelnen Land und in Unternehmen mit hoher Marktkapitalisierung. Estimated revenue for an ETF issuer is calculated by aggregating the estimated revenue of the respective issuer ETFs with exposure to China.

The level of magnification is included in their descriptions and are generally -1x -2x or -3x. The speciality of investing in China are the different categories of Chinese stocks. The funds use futures and can also be leveraged.

Due to the compounding of daily returns holding periods of greater than one day can result in returns that are significantly different than the target return and ProShares returns. For short-term trades I would prefer MCHI US iShares MSCI China ETF because the trading liquidity is ample US275m daily average volume so the bidask spread is only 001. Die Gesamtkostenquote TER der ETFs auf diese Indizes liegt zwischen 019 pa.

ProShares Short FTSE China 25. Für ein Investment in den chinesischen Aktienmarkt stehen 12 Indizes mit 21 ETFs zur Auswahl. China-Bären sollten sich mit entsprechenden ETFs positionieren und Short per Indexfond auf den chinesischen Markt gehen.

The FTSE China 50 Index TXIN0UNU consists of the 50 largest and most liquid public Chinese companies currently trading on the Hong Kong Stock Exchange SEHK.

How To Short China Etf Or Etfs Dr Stojsic

ملف التركيز سوف تقرر Short China Etf Cabuildingbridges Org

ملف التركيز سوف تقرر Short China Etf Cabuildingbridges Org

Tide Indicators Analysis 1 February 2020 Tideinvestor

Tide Indicators Analysis 1 February 2020 Tideinvestor

Inverse China Etfs At Support Amid Slowdown Fears

Shorts Gain On Chinese A Share Etfs

Shorts Gain On Chinese A Share Etfs

How To Short China S Stock Market With Etfs Etf Com

How To Short China S Stock Market With Etfs Etf Com

China Bear Etf Breakout Provides Trading Opportunity

ملف التركيز سوف تقرر Short China Etf Cabuildingbridges Org

ملف التركيز سوف تقرر Short China Etf Cabuildingbridges Org

Shorts Gain On Chinese A Share Etfs

Shorts Gain On Chinese A Share Etfs

Proshares Short Ftse China 50 Etf Us74347x6581

ملف التركيز سوف تقرر Short China Etf Cabuildingbridges Org

ملف التركيز سوف تقرر Short China Etf Cabuildingbridges Org

ملف التركيز سوف تقرر Short China Etf Cabuildingbridges Org

ملف التركيز سوف تقرر Short China Etf Cabuildingbridges Org

China Etfs Best Ones To Watch And How To Invest Ig Uk

China Etfs Best Ones To Watch And How To Invest Ig Uk

What S The Best Way For A Us Investor To Short Chinese Tech Stocks Quora

Comments

Post a Comment