Featured

Fixed Vs Variable Student Loan

This is the trade-off one must consider when choosing to pursue a variable vs. Variable Interest Rate Student Loans to Study in the USA Fixed-rate loans are just what they say they arefixed which means that your rate never goes up.

What Is The Difference Between A Fixed Vs Variable Interest Rate When I Refinance My Dental Student Loan New Dentist Blog

What Is The Difference Between A Fixed Vs Variable Interest Rate When I Refinance My Dental Student Loan New Dentist Blog

Rates are typically lower.

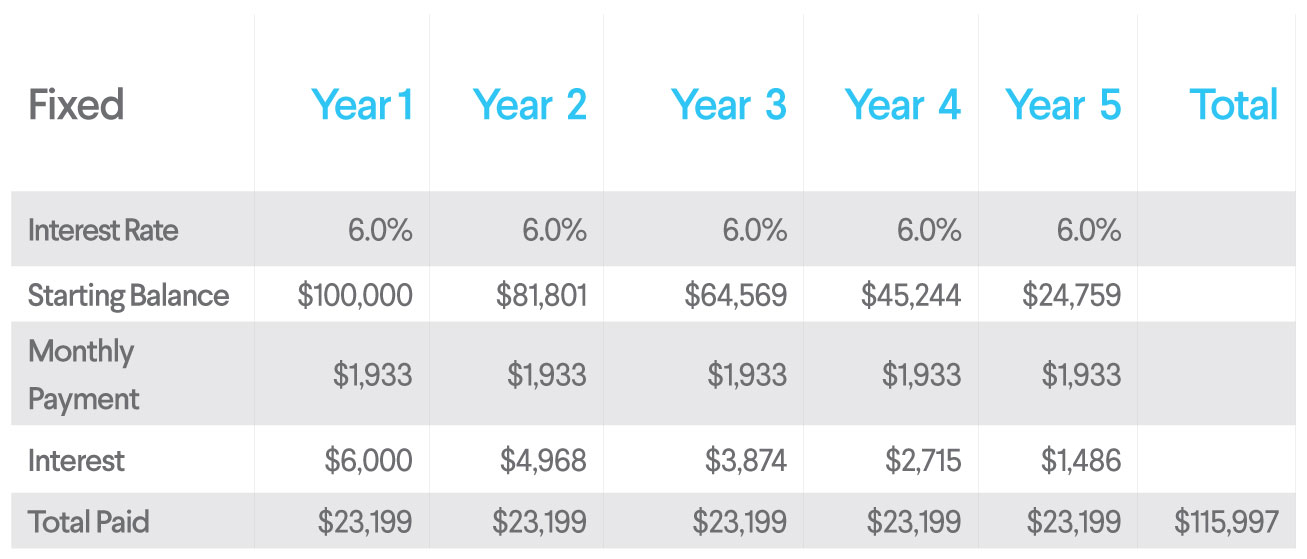

Fixed vs variable student loan. A variable interest rate loan is a loan where the interest charged on the outstanding balance fluctuates based on an underlying benchmark or index that periodically changes. Fixed student loan interest rates are generally a better option than variable rates. Fixed interest rate student loans A variable interest rate fluctuates over time while a fixed interest rate remains the same over the life of a loan.

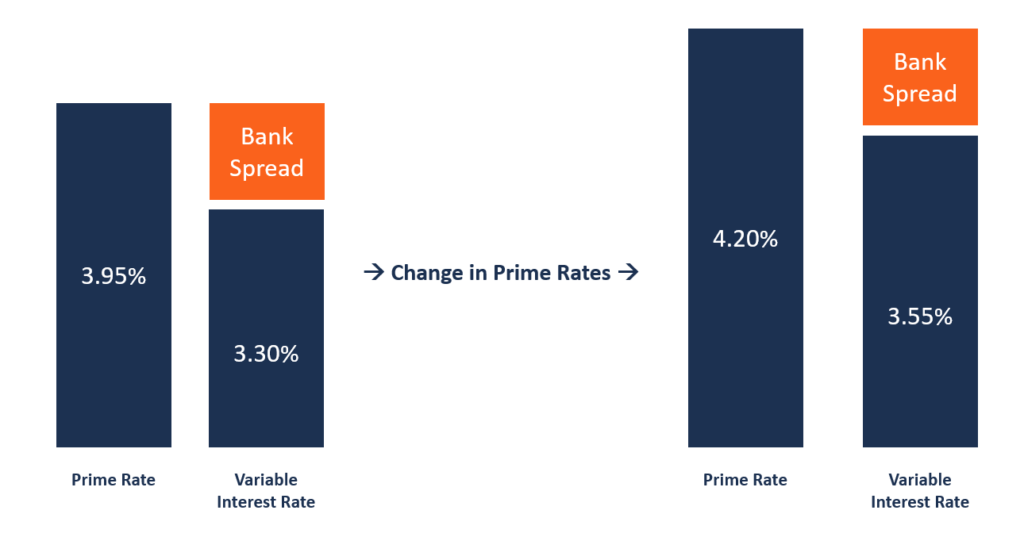

This means your minimum payment will change as. Variable interest rates are determined by two components. If you borrow private student loans you can choose between variable or fixed.

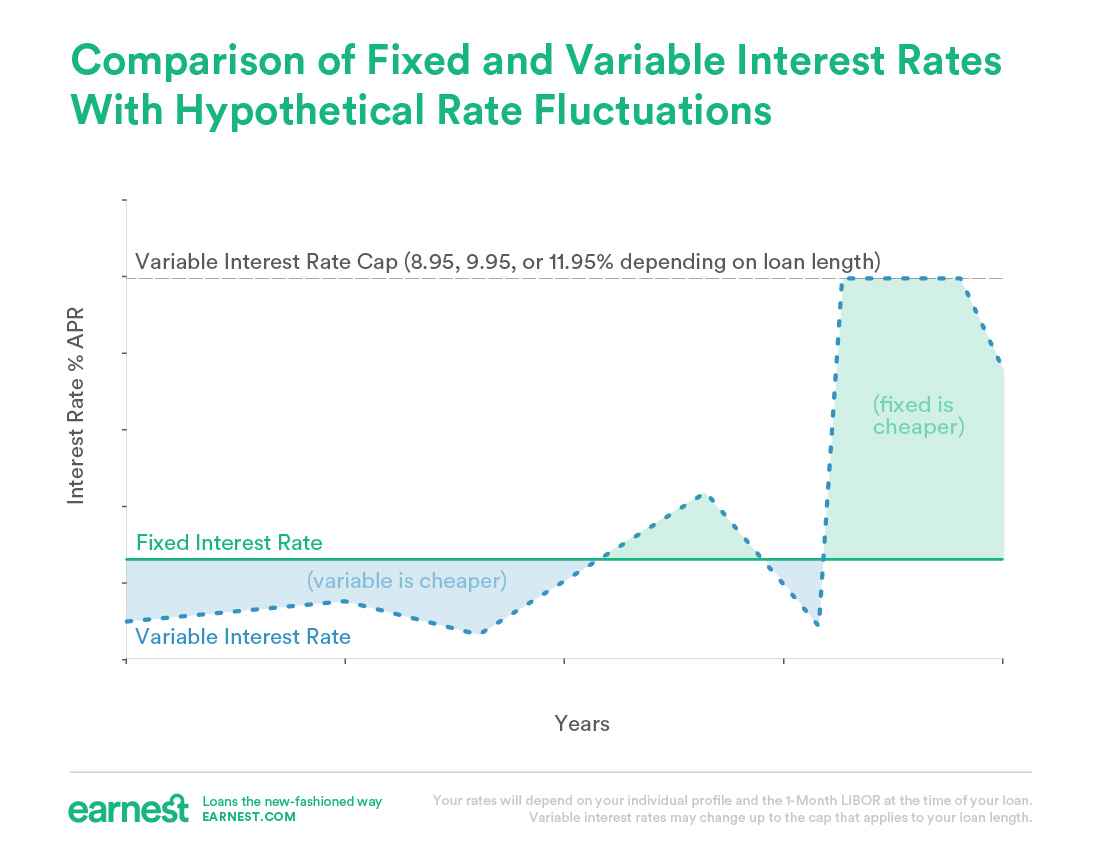

Thats because fixed rates always stay the same while variable rates can change monthly or quarterly in. Choosing between a fixed and variable rate when refinancing your student loans depends on a few factors. A fixed-rate student loan offers a predictable monthly payment with an interest rate that doesnt change over the life of the loan.

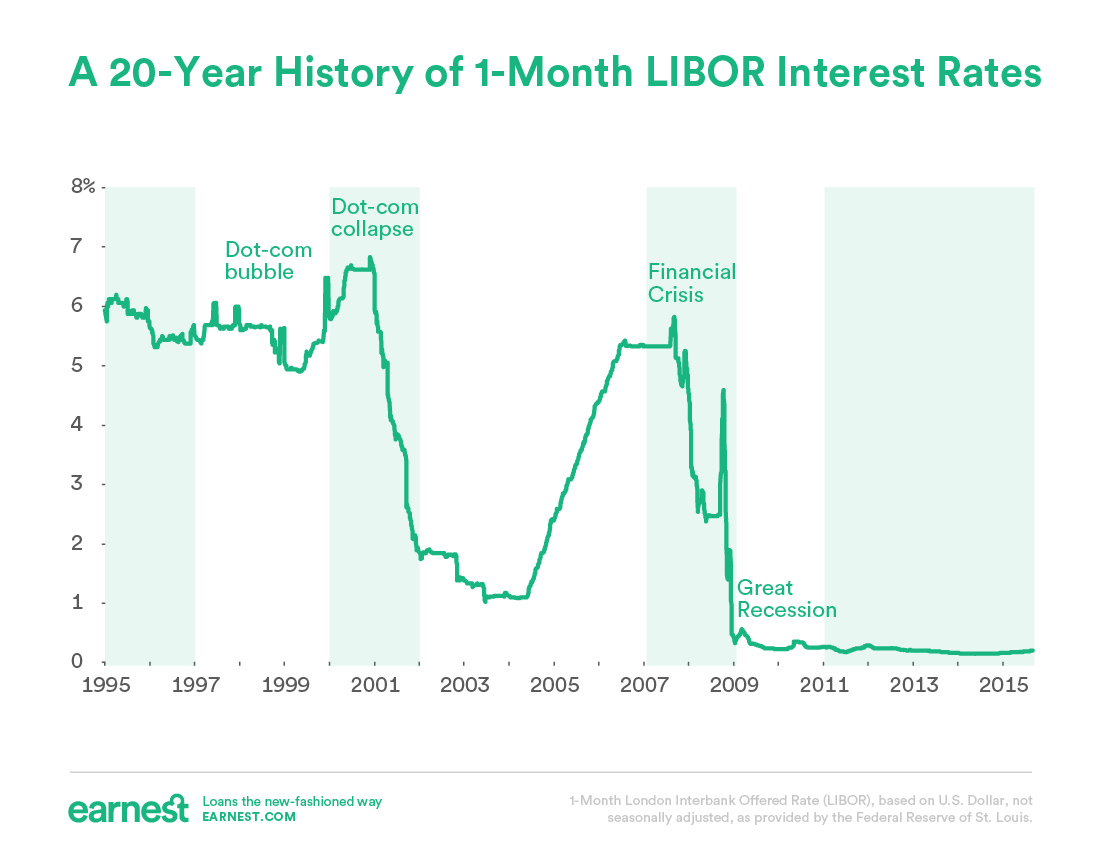

When rates are low you can save money on your student loans. Unlike fixed interest rate student loans however variable rates are only offered by private lenders and generally start at significantly percentages than fixed rates. Annons MPOWER provides financing for international students studying in the US.

However refinancing rates are typically lower than private student loan. And like with private student loans these rates are based on your personal finances rather than set by an institution. Variable rates change based on market conditions and that means your payment can change as well.

Annons MPOWER provides financing for international students studying in the US. A private student loan with a fixed rate will always have a higher interest rate than a variable rate loan from the same lender. Like private student loans loans for refinancing student debt tend to come with a choice of fixed or variable interest rates.

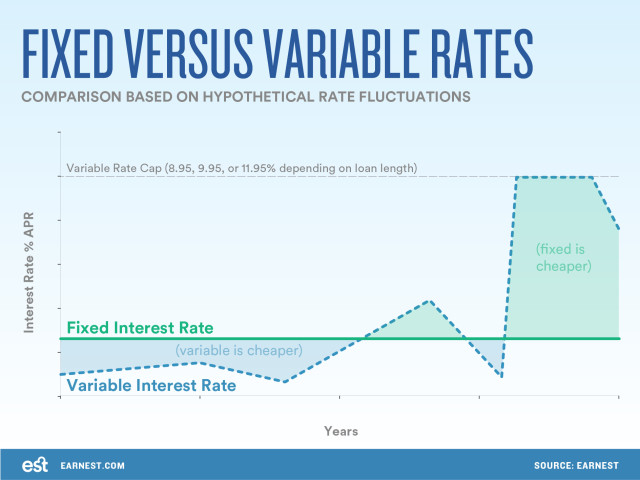

Your tolerance for risk -- A fixed-rate loan is clearly the safer option whereas a. However variable rates are often lower at least initially than fixed rates. Since student loans are repaid over a relatively long period of time lenders set rates such that if they do increase in the future they arent losing out on the margin they could earn had the loan been variable.

This changes the formula for deciding between fixed and variable interest rates because with more time for LIBOR to possibly increase you are taking on more. The cheaper rate can be appealing in its own right but you will need to remain more careful and vigilant with paying variable rate loans than you would with fixed-rate loans. If you borrow federal student loans you can only have a fixed interest rate.

You could potentially miss out on savings if variable rates drop lower than your rate. A variable rate may start out lower than a fixed rate but it will fluctuate over the life of the loan as its underlying reference rate changes. A ten-year max for federal loans.

Cons of Fixed-Rate Federal Loans. Private student loans can range from five to 15 to even 20 years in length vs. Generally have a higher interest rate than variable rate student loans.

Education you deserve check your eligibility today. If playback doesnt begin shortly try restarting your device. Private student loans tend to offer variable interest rates along with fixed-interest options.

Here are some of the benefits of a variable-rate student loan. Theres no way to know if interest rates for a variable rate loan will increase. Education you deserve check your eligibility today.

A fixed interest rate for example will simply be quoted as 12 or 105. Variable interest rate loans also known as floating rate loans are loans in which interest rates change based on market fluctuations.

Fixed Or Variable Rate Student Loans How To Choose

Fixed Or Variable Rate Student Loans How To Choose

Should I Choose A Fixed Or Variable Rate International Student Loan Edupass

Should I Choose A Fixed Or Variable Rate International Student Loan Edupass

Fixed Vs Variable Student Loan Rates Rating Walls

Fixed Vs Variable Student Loan Which Is Best For You Mpower Financing

Fixed Vs Variable Student Loan Which Is Best For You Mpower Financing

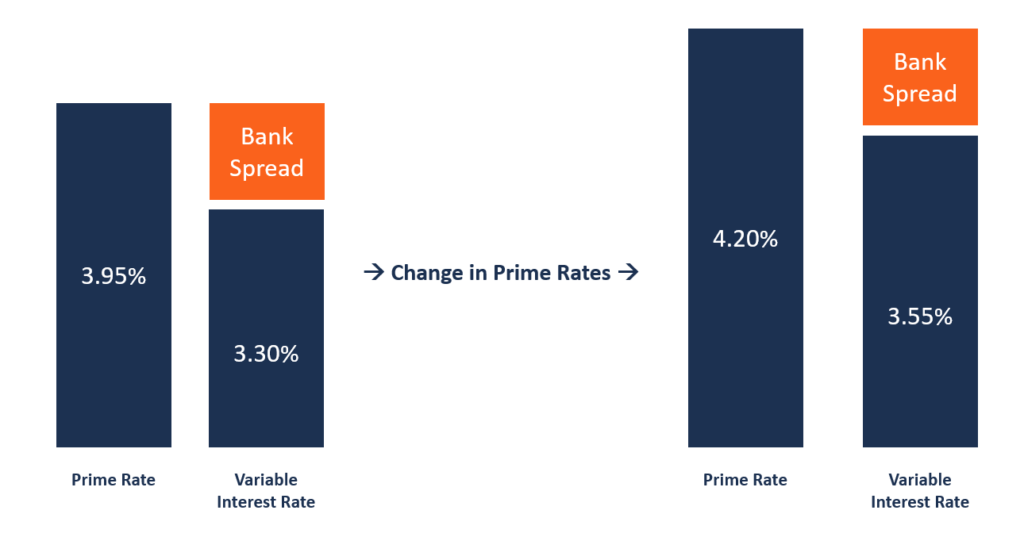

How Does An Interest Rate Change Affect My Student Loan Earnest

How Does An Interest Rate Change Affect My Student Loan Earnest

Fixed Or Variable Rate Loan Which One Should You Choose

Fixed Or Variable Rate Loan Which One Should You Choose

Refinance Student Loan What To Do When Variable Rates Rise

Refinance Student Loan What To Do When Variable Rates Rise

Fixed Vs Variable Student Loan Rates Bankrate

Fixed Vs Variable Student Loan Rates Bankrate

Fixed Or Variable Rate Loan Which One Should You Choose

Fixed Or Variable Rate Loan Which One Should You Choose

Fixed Rate Or Variable Rate Student Loan Rating Walls

Fixed Rate Or Variable Rate Student Loan Rating Walls

How Does An Interest Rate Change Affect My Student Loan Earnest

How Does An Interest Rate Change Affect My Student Loan Earnest

Variable Rate Loans Overview How It Works How To Structure

Variable Rate Loans Overview How It Works How To Structure

Variable Vs Fixed Interest Rates For Student Loans College Ave

Variable Vs Fixed Interest Rates For Student Loans College Ave

Difference Between Variable And Fixed Rate Student Loans Difference Between

Comments

Post a Comment