Featured

Do You Have To Pay For Turbotax

If you have taxes owing to the CRA or are interested in setting up tax instalments because you are self-employed the CRA allows you to pay your taxes online simply and efficiently. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return.

Millions Of Americans Might Not Get Stimulus Checks Some Might Be Tricked Into Paying Turbotax To Get Theirs Propublica

Millions Of Americans Might Not Get Stimulus Checks Some Might Be Tricked Into Paying Turbotax To Get Theirs Propublica

First even though they say its free only people with simple taxes such as 1040EZ can file without paying.

Do you have to pay for turbotax. If you are considering using TurboTax to do your taxes this year you should know what its going to cost. Satisfaction Guaranteed or you dont pay. Satisfaction Guaranteed or you dont pay.

If you use TurboTax Online or Mobile. Now with that open you want to go to the IRS website and use one of their. How you pay your Turbotax fee has nothing to do with that.

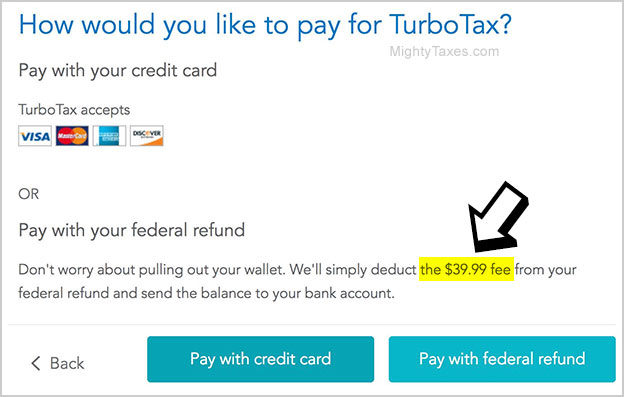

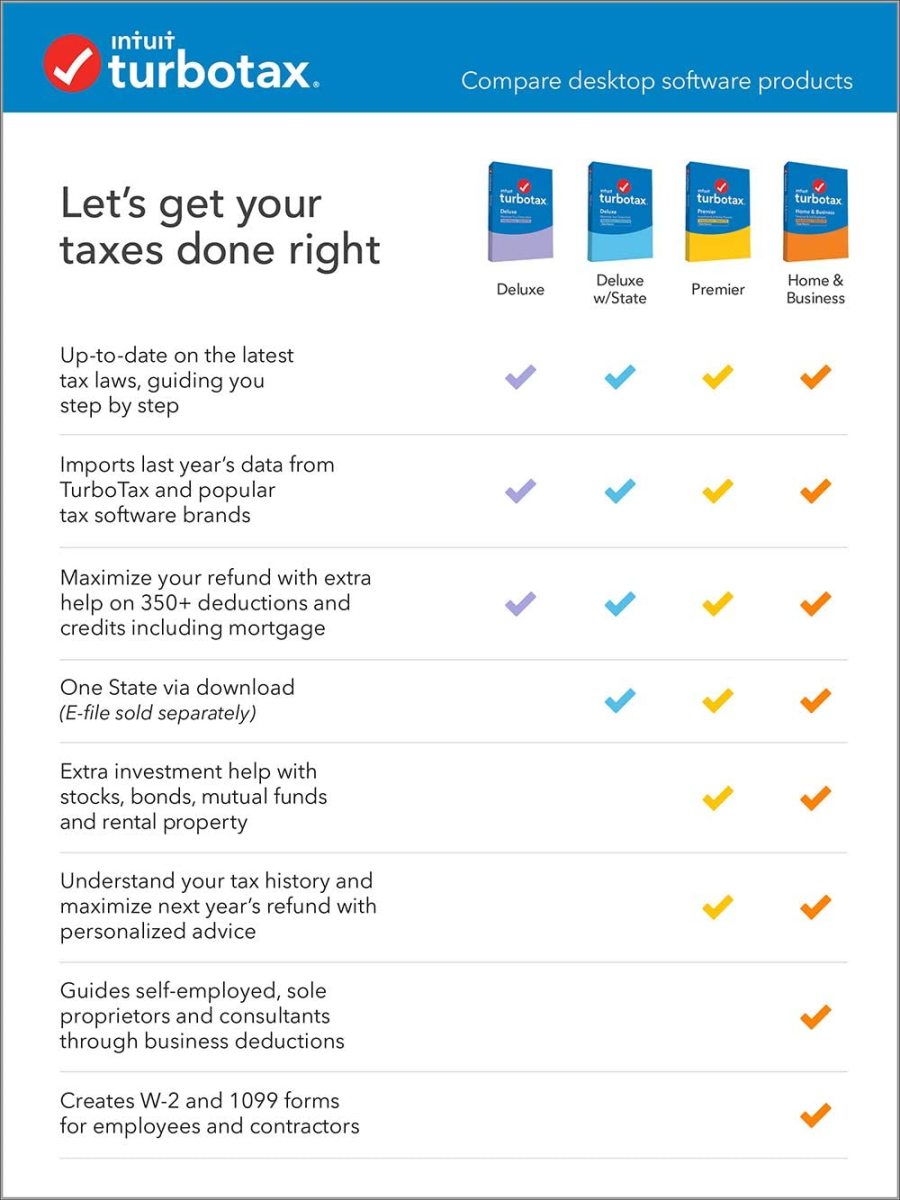

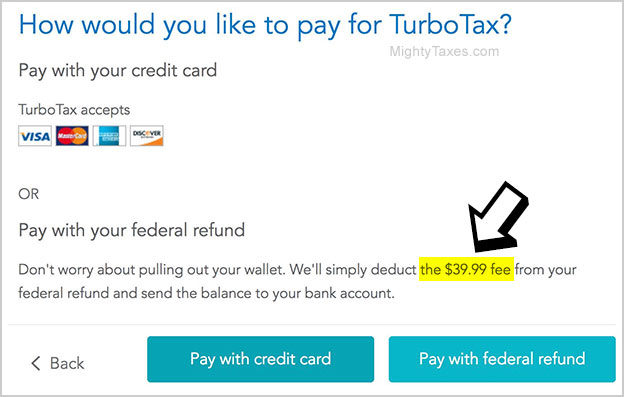

I have used TurboTax Deluxe for many consecutive years now and while the instructions online and here always say if you have stock sales you need the Premier Edition I have had stock sales virtually every year and the Deluxe version has been quite adequate. If you use TurboTax Online or Mobile. Selecting to pay the TurboTax account fees using the optional pay with refund - Service Charge 3999 If you have not paid for the online edition you are using have not filed your tax return or registered the Free edition then you can clear your return and start over with a lower priced edition.

Satisfaction Guaranteed or you dont pay. If you need or prefer more prep assistance than TurboTaxs DIY resources can provide TurboTax Live is right for you. You also may make payments using the CRAs My Payment service.

Remember you do not have to make them unless your net tax exceeds 3000. If you opt for a paid plan you dont have to pay until you file. In fact Intuits community boards are filled with customer.

It puts many people on track to pay. You can make instalment payments through direct debit from your bank account. That shows you each form completely filled out with all of the correct information.

How mush does TurboTax really cost. The tax expert appears by video on a split. To do so you need to set up a pre-authorized debit through the CRAs My Account service.

However there was only one review on the site as if this writing. If you have expenses in your self-employment work like your mobile phone mileage use of a home office and others thats where TurboTax Self-Employed comes in. Printing or electronically filing your return reflects your satisfaction with TurboTax Online at which time you will be required to pay or register for the product.

Offer may change or end at any time without notice. If you want to use a free version of TurboTax or HR Block at Home or Credit Karma Tax or TaxAct go wild. TurboTax Live is a hybrid package that pairs filers with credentialed CPAs or EAs for on-demand assistance during the prep and filing process.

Special discount offers may not be valid for. Let me be blunt. If you have an amount owing after using a prepayment code you can pay the balance using any of the available payment options.

Deduct Expenses Using TurboTax Self-Employed or TurboTax Live Self-Employed. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return.

Try for FreePay When You File. Or you have the option to pay electronically using your financial institutions. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return.

In fact in addition to the cost of the software you also have to pay a State filing fee. TurboTax Free Edition 0 Federal 0 State 0 To File is available for simple tax returns only. But for the love of.

Printing or electronically filing your return reflects your satisfaction with TurboTax Online at which time you will be required to pay or register for the product. If you use TurboTax Online or Mobile. If you use TurboTax Online or Mobile.

Its just a convenient way to pay for TurboTax if you dont have or dont want to use your credit or debit card the company states. However filling out your forms with TurboTax is always free. You should not pay for TurboTax.

Just compete the full process and on the VERY LAST PAGE theres a link to click to review all the documents just before you submit. If you make under 34000 and qualify for TurboTax Free File you can also prepare and file your state return for. If you dont have a credit card you can use prepayment codes as the alternative by purchasing TurboTax Online from one of our retail partners.

If youre filing your taxes with turbo tax and it says you have to pay to file dont do it. TurboTax online and mobile pricing is based on your tax situation and varies by product. Printing or electronically filing your return reflects your satisfaction with TurboTax Online at which time you will be required to pay or register for the product.

Paper checks 3-4 weeks. We help you organize and quickly enter your expenses and help you get every last dollar you deserve. TurboTax is rated a 32 out of 5 on Trustpilot as of this writing.

In other words you dont pay until you choose to complete and send the information to the appropriate tax authority. Satisfaction Guaranteed or you dont pay. The Better Business Bureau gives TurboTax an A rating.

I can import my Ameritrade Consolidated Form 1099 easily and have never needed a higher version than the Deluxe one. Actual prices are determined at the time of print or e-file and are subject to change without notice. If you asked for direct deposit itll be about 2 weeks.

Does TurboTax Offer Free State Filing. Printing or electronically filing your return reflects your satisfaction with TurboTax Online at which time you will be required to pay or register for the product.

Turbotax Review 2021 Nerdwallet

Turbotax Review 2021 Nerdwallet

Here S How Turbotax Just Tricked You Into Paying To File Your Taxes Propublica

Here S How Turbotax Just Tricked You Into Paying To File Your Taxes Propublica

Which Version Of Turbotax Do I Need Toughnickel

Which Version Of Turbotax Do I Need Toughnickel

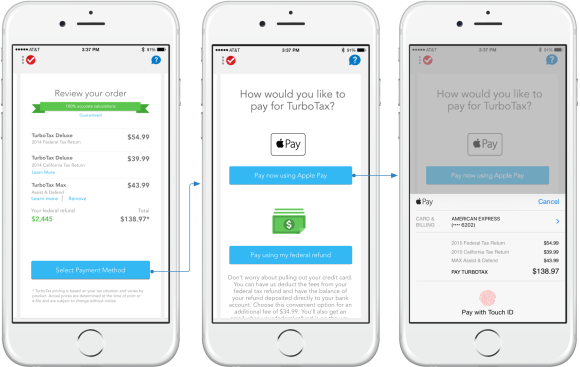

Taxes Made Even Simpler With Turbotax And Apple Pay The Turbotax Blog

Taxes Made Even Simpler With Turbotax And Apple Pay The Turbotax Blog

How Much Does Turbotax Cost Prices State Fee 2020

How Much Does Turbotax Cost Prices State Fee 2020

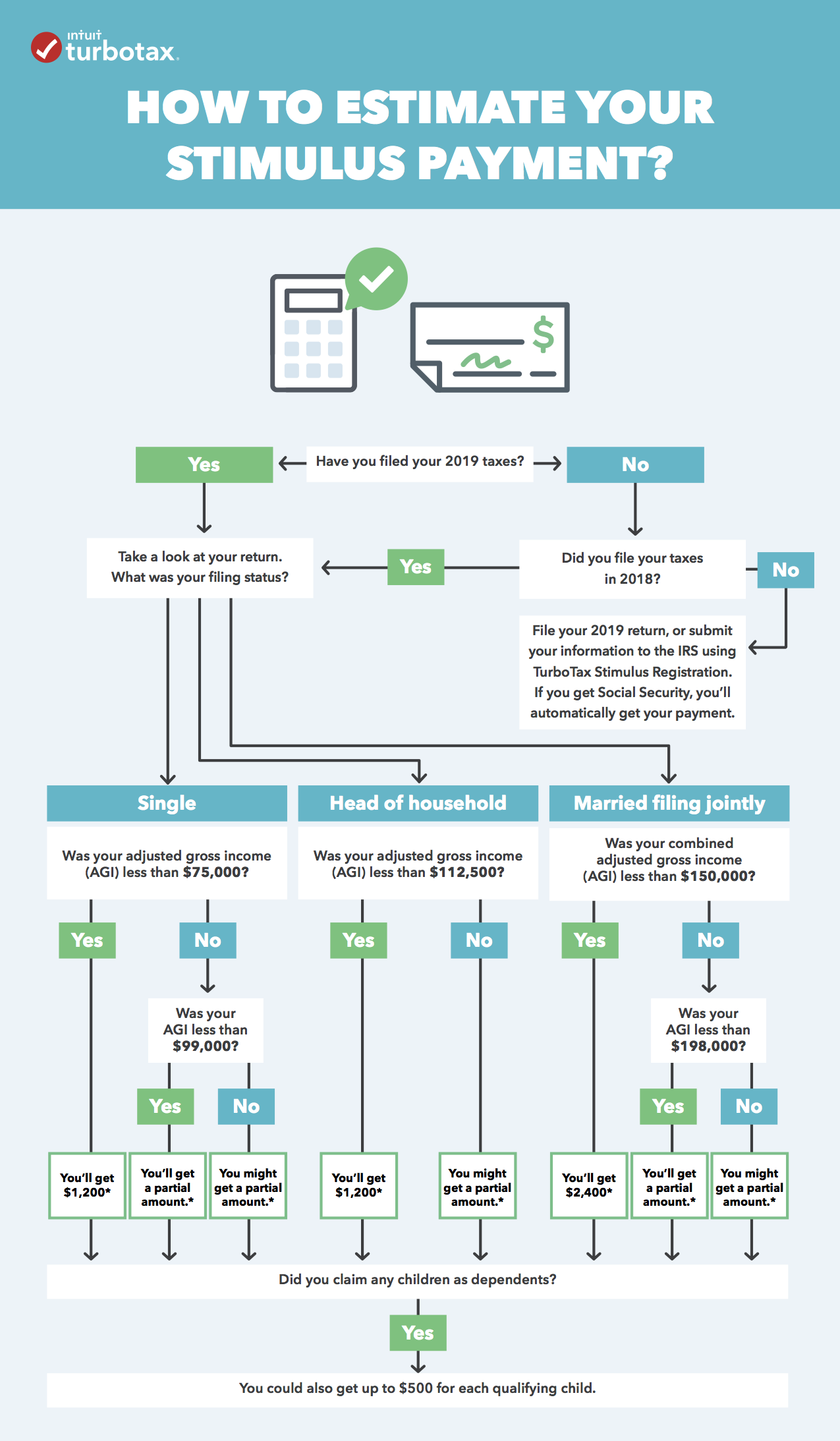

How To Estimate Your Stimulus Check Infographic The Turbotax Blog

How To Estimate Your Stimulus Check Infographic The Turbotax Blog

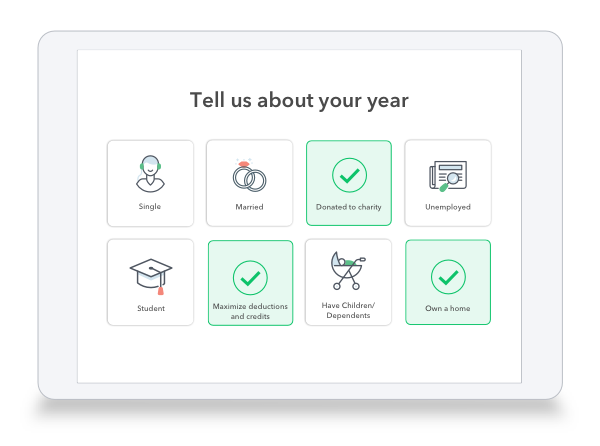

Turbotax Review 2021 The Easiest Tax Software To Use

Turbotax Review 2021 The Easiest Tax Software To Use

Turbotax Irs Launch Online Portal For Stimulus Check Direct Deposit

Intuit Turbotax 2021 Tax Year 2020 Review Pcmag

Intuit Turbotax 2021 Tax Year 2020 Review Pcmag

Turbotax Deluxe Online 2020 2021 Maximize Tax Deductions And Tax Credits

Turbotax Deluxe Online 2020 2021 Maximize Tax Deductions And Tax Credits

Turbotax Self Employed 2020 2021 Taxes Uncover Industry Specific Deductions

Turbotax Self Employed 2020 2021 Taxes Uncover Industry Specific Deductions

Best Tax Filing Software 2021 Reviews By Wirecutter

Best Tax Filing Software 2021 Reviews By Wirecutter

Turbotax Deluxe Online 2020 2021 Maximize Tax Deductions And Tax Credits

Turbotax Deluxe Online 2020 2021 Maximize Tax Deductions And Tax Credits

Intuit Turbotax 2021 Tax Year 2020 Review Pcmag

Intuit Turbotax 2021 Tax Year 2020 Review Pcmag

Comments

Post a Comment