Featured

- Get link

- X

- Other Apps

Federal Identification Number Fein

Then enter the interest how I show before. An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity.

Ein Comprehensive Guide Freshbooks

Ein Comprehensive Guide Freshbooks

10-K filing includes an Exhibit 21 subsidiary information.

Federal identification number fein. What Is an EIN or FEIN. FEIN Federal Employer Identification Number - This is exactly the same as an EIN except the name clarifies that it is a federally assigned IRS tax ID number. The tax ID number is issued by the Internal Revenue Service IRS.

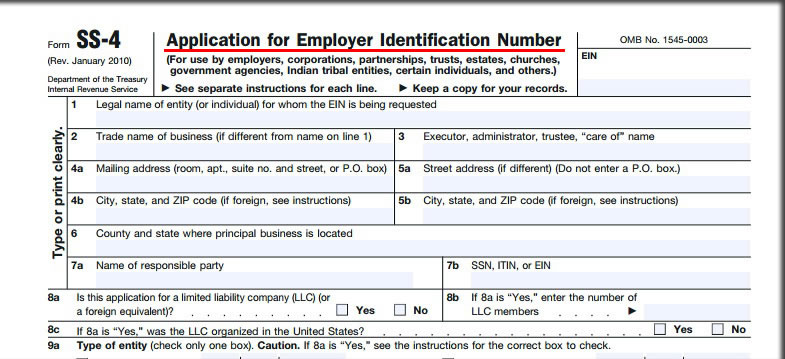

An EIN or FEIN is a specific type of tax ID number. You may apply for an EIN in various ways and now you may apply online. What is a federal tax identification number FEIN.

The employer identification number EIN for Walmart Inc. An EIN or employer identification number is a nine-digit number used by the IRS to identify your companys tax accounts. You may apply for an EIN in various ways and now you may apply online.

An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity. EIN for organizations is sometimes also referred to as taxpayer identification number or TIN or simply IRS Number. TIN Taxpayer Identification Number - This is a generic acronym which includes all types of tax ID numbers.

The FEIN is issued to individuals and to entities such as states government agencies corporations for tax administration. How do I find the Federal Identification Number for a foreign financial institution. It works in the same way as a Social Security number does for individuals and almost every business needs one.

The person applying online must have a valid Taxpayer Identification Number SSN ITIN EIN. It is one of the corporates which submit 10-K filings with the SEC. A FEIN is the Federal Employee Identification Number while an EIN is the Employee Identification Number.

The most important reason for an EIN is to identify your business for federal income tax purposes but its also used to apply for business bank accounts loans or credit cards and for state and local taxes. It is used to identify the business or entity as well as file various IRS tax returns. You may apply for an EIN in various ways and now you may apply online.

The Employer Identification Number EIN also known as the Federal Employer Identification Number FEIN or the Federal Tax Identification Number is a unique nine-digit number assigned by the Internal Revenue Service IRS to business entities operating in the United States for the purposes of identification. Generally businesses need an EIN. There is a free service offered by the Internal Revenue Service and you can get your EIN immediately.

There is no such thing as a FEIN in the eyes of the federal government and it is not used for federal filing purposes. You are limited to one EIN per responsible party per day. To report interest earned on a foreign account as if I had received a 1099INT.

A FEIN also known as a federal tax identification number or an employer identification number EIN is issued to entities that do business in. These two numbers can be used to identify a business. Get a EIN Employer Identification Number or Federal Employer Identification Number FEIN and have your new business up and running in minutes.

FEIN is an acronym for Federal Employer Identification Number. Wenn Sie unsere nicht-englische Version besuchen und die englische Version von Federal Employer Identification Number sehen möchten scrollen Sie bitte nach unten und Sie werden die Bedeutung von Federal Employer Identification Number in englischer Sprache sehen. Using that method you are not asked for the FEIN on the financial institution.

Like with a federal tax ID number the IRS utilizes this identification number to identify taxpayers who must file various business tax returns. It is a 9-digit number issued in the following format. Generally businesses need an EIN.

An Federal Employer Identification Number FEIN applicable to the United States is the corporate equivalent to a Social Security number. An Employer ID Number EIN is an important tax identifier for your business. An Employer Identification Number EIN is a federal tax ID number for a business or entity.

This is a nine-digit unique number assigned by the Internal Revenue Service IRS to businesses operating in the United States. It is also known as EIN Employer Identification Number. An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity.

Generally businesses need an EIN. You need to delete Form 1099-INT from your return. The responsible party is the person who ultimately owns or controls the entity or who exercises ultimate effective control over the entity.

Unless the applicant is a government entity the responsible party must be an individual ie a natural person not an entity. FEIN steht für Federal Employer Identification Number.

Ein Number What Is An Ein Truic

Ein Number What Is An Ein Truic

:max_bytes(150000):strip_icc()/tax-id-employer-id-397572v24-8e7a9cdb60a144cebc57e59288feeff8.jpg) How To Find Your Employer Identification Number Ein

How To Find Your Employer Identification Number Ein

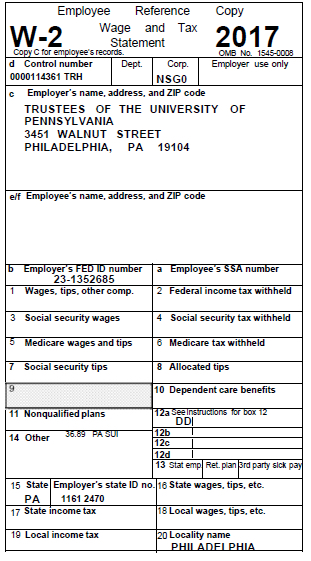

Tax Forms For 2017 University Of Pennsylvania Almanac

Tax Forms For 2017 University Of Pennsylvania Almanac

Do I Need An Employer Identification Number Ein And How To Get One

Do I Need An Employer Identification Number Ein And How To Get One

How To Access My Employer S Ein Number Online Quora

How To Access My Employer S Ein Number Online Quora

4 Ways To Find A Federal Tax Id Number Wikihow

4 Ways To Find A Federal Tax Id Number Wikihow

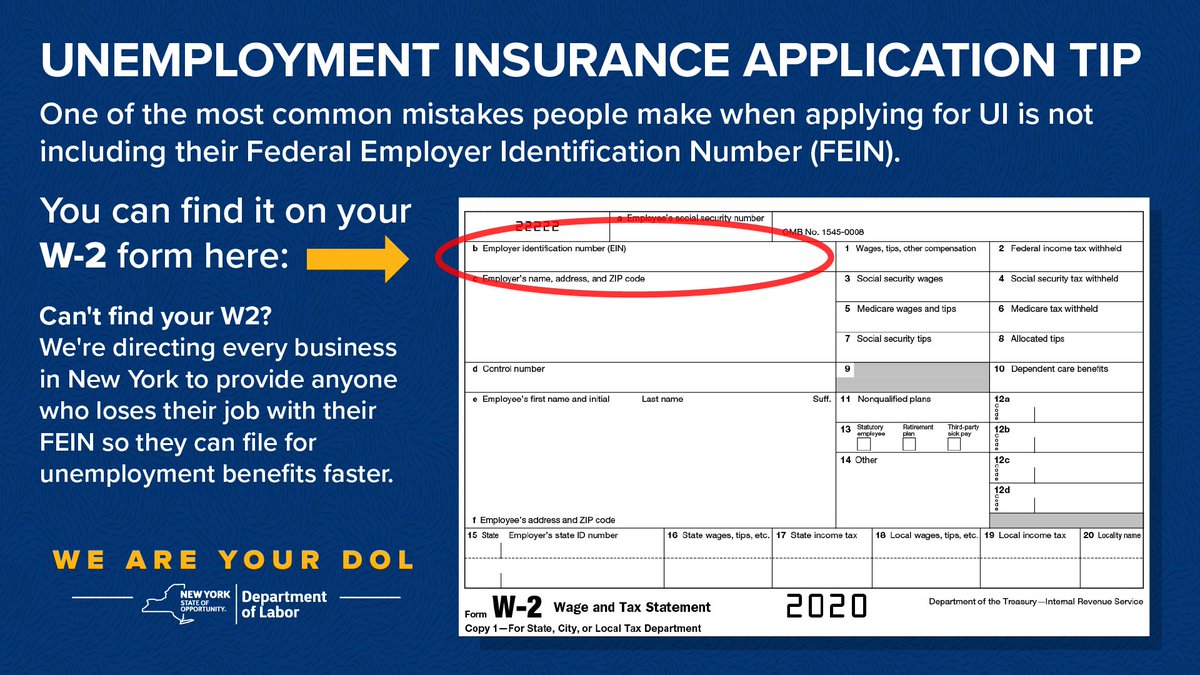

Nys Department Of Labor On Twitter It S Not Your Employee Id It S Your Employer S Nys Employer Registration Number Federal Employer Identification Number Fein And Full Employer Name And Address Https T Co Zxj1zevylq

Nys Department Of Labor On Twitter It S Not Your Employee Id It S Your Employer S Nys Employer Registration Number Federal Employer Identification Number Fein And Full Employer Name And Address Https T Co Zxj1zevylq

/tax-id-employer-id-397572v24-8e7a9cdb60a144cebc57e59288feeff8.jpg) Differences Among A Tax Id Employer Id And Itin

Differences Among A Tax Id Employer Id And Itin

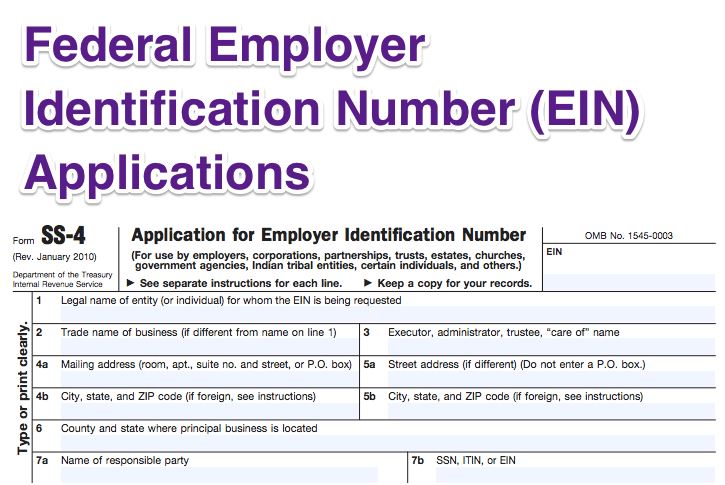

Employer Identification Number Ein Fein

How To Get A Tax Id Number Stumpblog

How To Get A Tax Id Number Stumpblog

4 Ways To Find A Federal Tax Id Number Wikihow

4 Ways To Find A Federal Tax Id Number Wikihow

What Is An Fein Federal Ein Fein Number Guide Business Help Center

What Is An Fein Federal Ein Fein Number Guide Business Help Center

Where Do I Find My Employer Id Number Ein Turbotax Support Video Youtube

Where Do I Find My Employer Id Number Ein Turbotax Support Video Youtube

Fein Number Ein Number Federal Tax Id Number Central Fl Nbs

Fein Number Ein Number Federal Tax Id Number Central Fl Nbs

Comments

Post a Comment