Featured

- Get link

- X

- Other Apps

W2 Form Vs W4

As mentioned earlier employers need to file Form W-2 each year. Therefore you should only receive a W-2 if you are an employee.

W2 Vs W4 What Is The Difference Between In Both

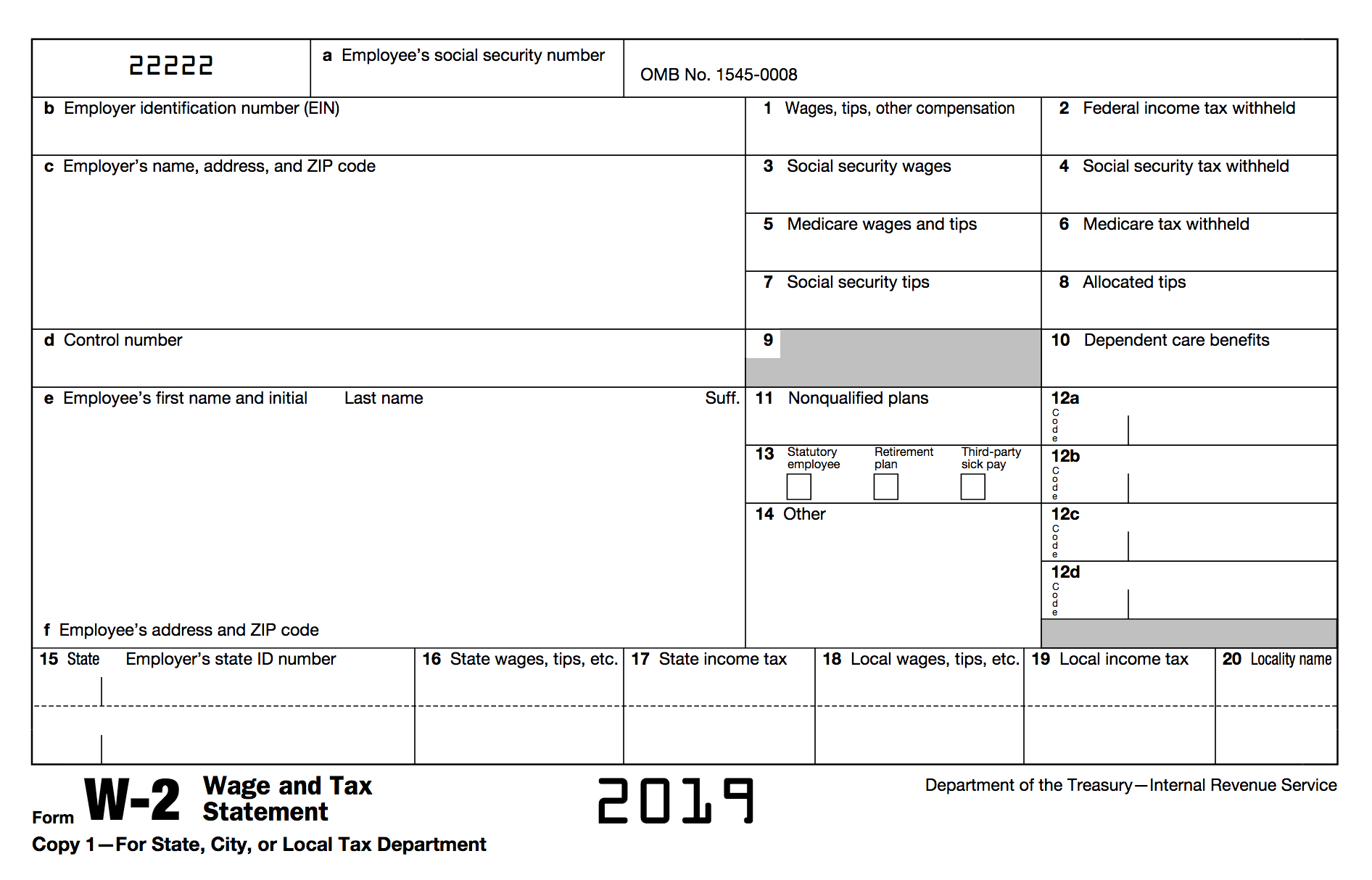

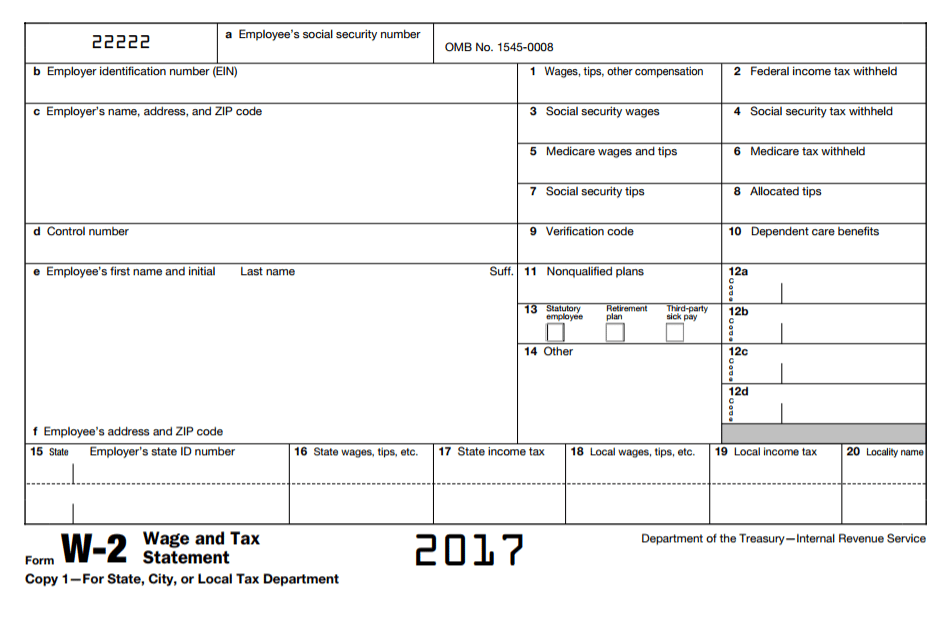

The W2 form contains.

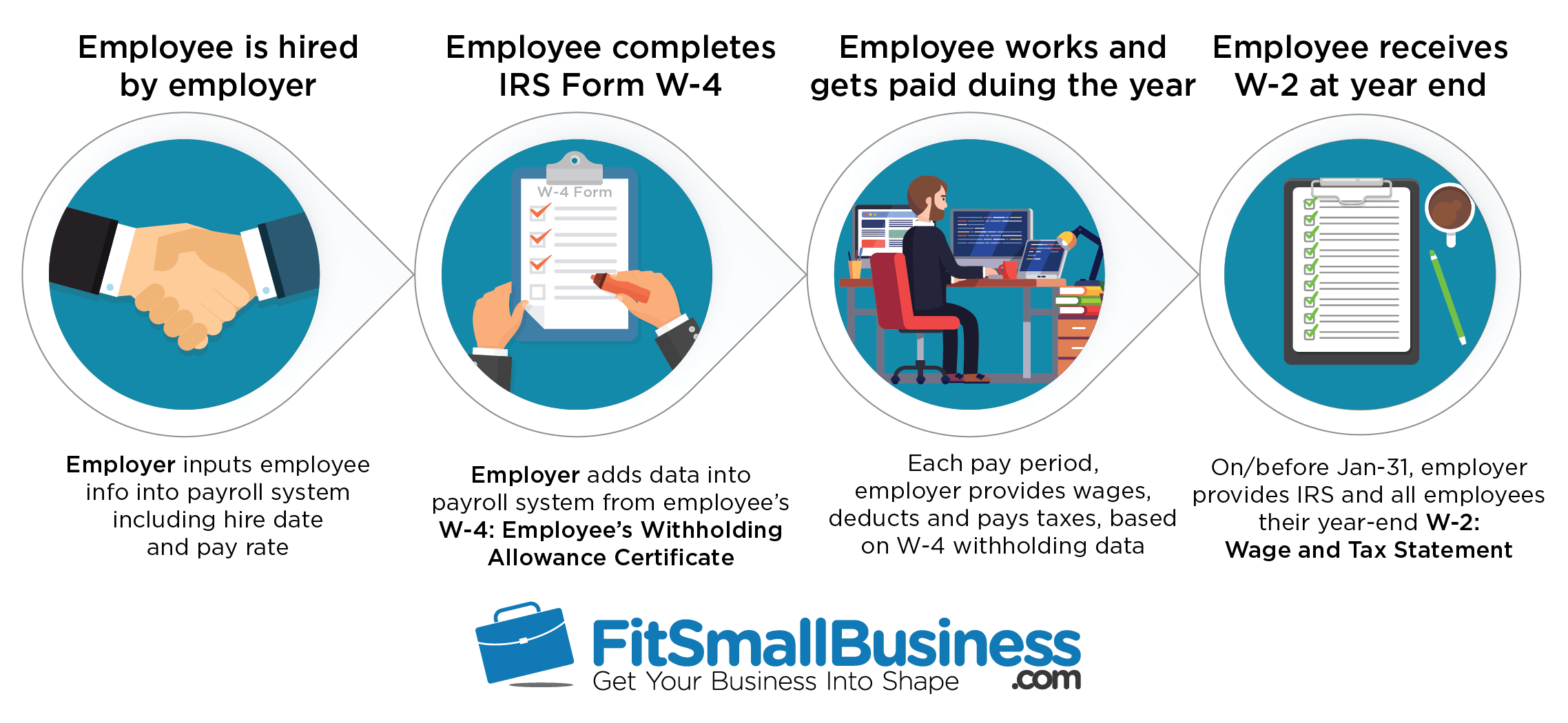

W2 form vs w4. Your employer has until February 1 to send your W-2 summarizing the prior year and youll reference this to file your taxes. EIN or the Employer Identification Number which is how the IRS knows the company. Employers would need to submit a copy to their employees and.

The W2 form is needed to file taxes for tax returns each year. The last thing that you want is to be left unprepared for tax season. Personal contact information from the employee.

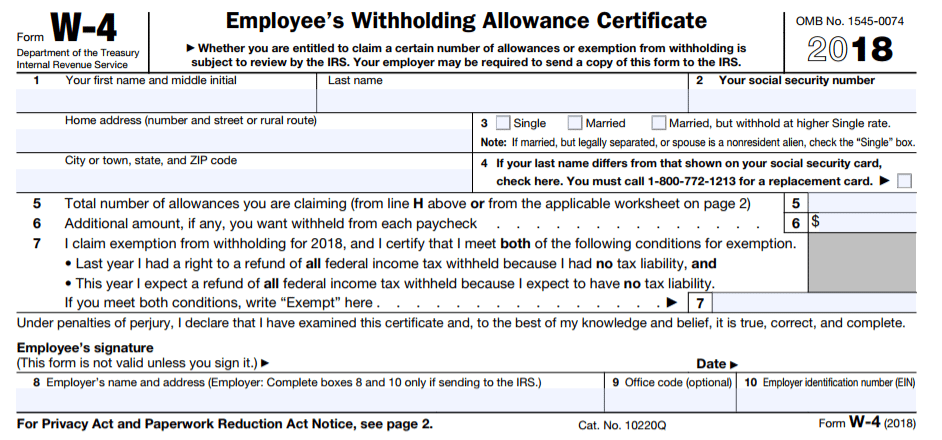

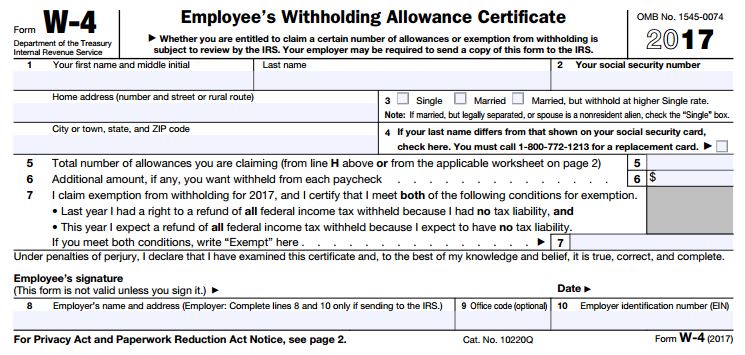

However they would need to fill out the form again any time their personal financial situation changes and they need more or less withheld from each paycheck. IRS forms W-2 and W-4 are highly different in function but are often confused simply because their names are so similar. Employer name and information.

Heres a look at what is in a W-2 form. What really is the difference between a form W2 vs W4. The W-2 tax form shows your wages earned Social Security contribution federal income tax withheld Medicare tax withheld and more.

Das W2 ist das Formular das ein Arbeitgeber dem Arbeitnehmer und dem Internal Revenue Service IRS am Ende jedes Jahres übermittelt. For your average individual its a reasonably simple doc that helps to calculate how much of ones money goes in to the United States government in taxes. The major difference between the W2 W4 and W4 2019 is that W4 is an input document whereas W2 is an output document.

W9 ist das Formular das von Drittfirmen wie unabhängigen Auftragnehmern die Dienstleistungen für Unternehmen erbringen auf. Filling out the W4 form correctly will ensure the right amount of taxes are taken out so take time to fill it out correctly so you dont face any avoidable questions from the IRS later on. If you want to be in control of your finances it is imperative that you understand W2 vs W4 and know the difference between the two.

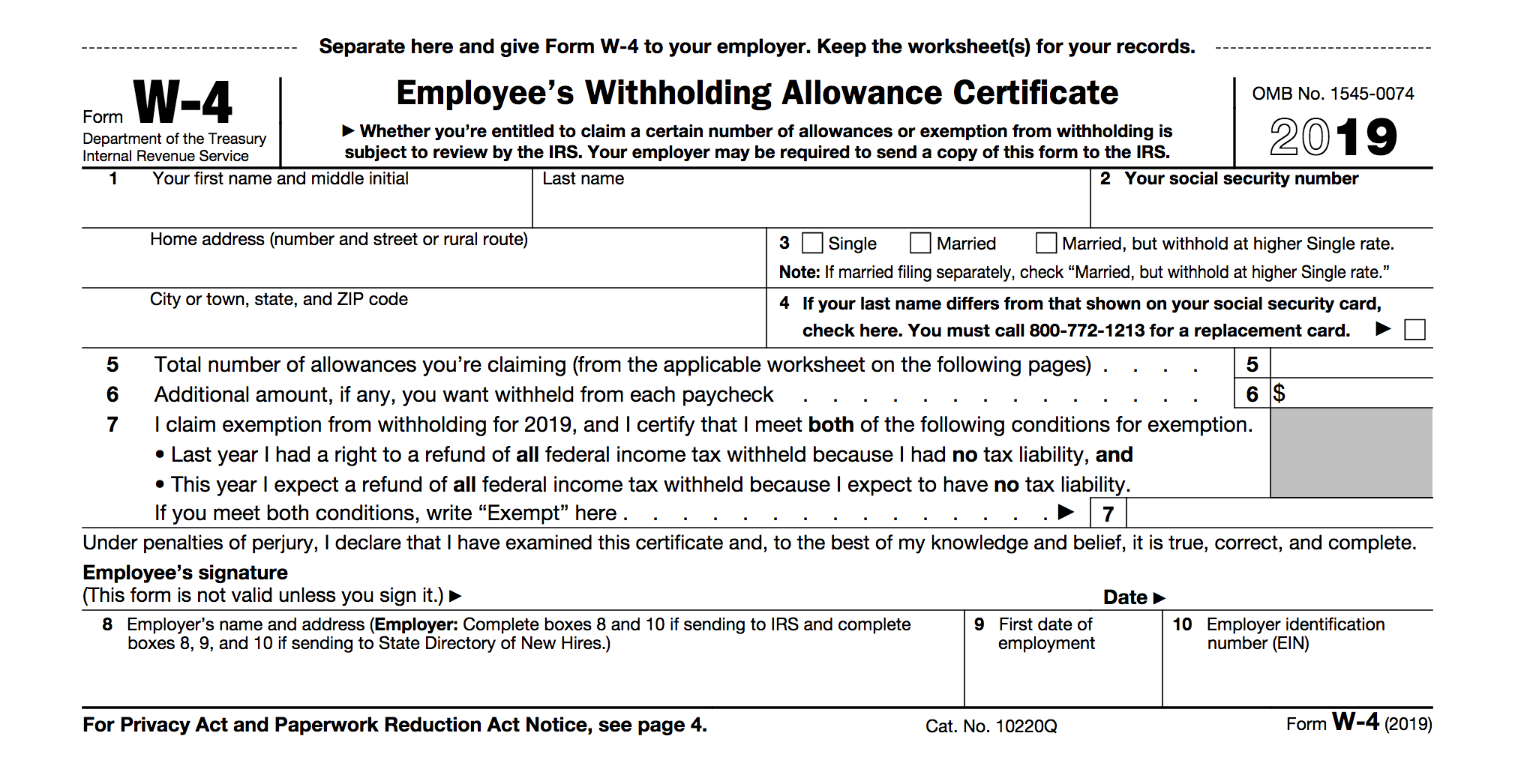

The amount of deductions is based on the W4 form the employee completes upon being hired. While both forms are related to employment and taxation they flow through your small business in opposite directions and serve distinct purposes for your operation. W4 wird vom Mitarbeiter ausgefüllt um seine Steuersituation dem Arbeitgeber anzuzeigen.

The Purpose Of The W4 Form. The W-2 is all about outputtelling the IRS whats been done in the previous year. W9 is different from a W4 because a W4 is telling the employer how many exemptions one may have and a W9 to find their.

The W-2 form is the form you receive at the beginning of the calendar year that you use to file your federal and state taxes for the prior tax year. End With Form W-2. One may have to create or request a taxpayer identification number in order to fill out the form.

Usually when youre starting a new job youre. Whats the Difference Between These IRS Forms. Form W-2 is one of the most common forms small business owners are required to submit while every employee needs to file a W-4.

Most people are acquainted with this form and what it is utilized for. Both the W2 and W4 are necessary for living and working legally in the United States. W2 Form Vs W4 For all those that have ever submitted a tax return you may have been presented having a W2 Form within the mail.

The W-4 is all about inputthe employee telling you what to do with their withholdings. The Form W-4 is the means to ensure adequate withholdings are taken from each paycheck. Simply put the W4 form serves as the input document.

Your job starts with a Form W-4 and ends each year with a Form W-2. If youre a freelancer independent contractor or self-employed you will receive an earnings statement on tax form 1099 instead of a W-2. Typically employees need to submit Form W-4 once when they begin a new job.

Comparison Between W2 W4 and W9 Form. The W2 form is the document that the employer uses to report the wages for their individual employees each year. W2 A W2 document on the other hand is a form which reports the wages an employee earned and taxes and deductions withheld in the course of the year.

W4 Tax Form 2020 - W2 Explained - Whats the difference between a W-2 and W4 Tax Form 2020This new How To video covers Tax Form W4 2020 and Form W2.

W 2 Vs W 4 What S The Difference When To Use Them

W 2 Vs W 4 What S The Difference When To Use Them

W 2 And W 4 A Simple Breakdown Bench Accounting

W 2 And W 4 A Simple Breakdown Bench Accounting

W 2 Vs W 4 What S The Difference When To Use Them

W 2 Vs W 4 What S The Difference When To Use Them

W 2 Vs W 4 What S The Difference Seek Business Capital

W 2 Vs W 4 What S The Difference Seek Business Capital

Form W 4 Vs Form W 2 Emptech Blog

Form W 4 Vs Form W 2 Emptech Blog

W 2 Vs W 4 What S The Difference When To Use Them

W 2 Vs W 4 What S The Difference When To Use Them

W 2 And W 4 A Simple Breakdown Bench Accounting

W 2 And W 4 A Simple Breakdown Bench Accounting

Difference Between W2 W4 And W9 Compare The Difference Between Similar Terms

Difference Between W2 W4 And W9 Compare The Difference Between Similar Terms

W 2 Vs W 4 What S The Difference Seek Business Capital

W 2 Vs W 4 What S The Difference Seek Business Capital

W2 Vs W4 What S The Difference Valuepenguin

W4 Vs W2 What Is The Real Difference Surveyswonk

W4 Vs W2 What Is The Real Difference Surveyswonk

W 2 Vs W 4 What S The Difference When To Use Them

W 2 Vs W 4 What S The Difference When To Use Them

W2 Vs W4 What S The Difference Camino Financial

W2 Vs W4 What S The Difference Camino Financial

Comments

Post a Comment