Featured

Colorado Marijuana Tax

At the Colorado Department of Revenue the Marijuana Enforcement Division MED oversees regulation and licensing of marijuana businesses for both the medical and retail marijuana while the Taxation Division administers the retail marijuana sales tax and retail marijuana excise tax. Fee revenue comes from marijuana.

Which States Made The Most Tax Revenue From Marijuana In 2018 Infographic

Which States Made The Most Tax Revenue From Marijuana In 2018 Infographic

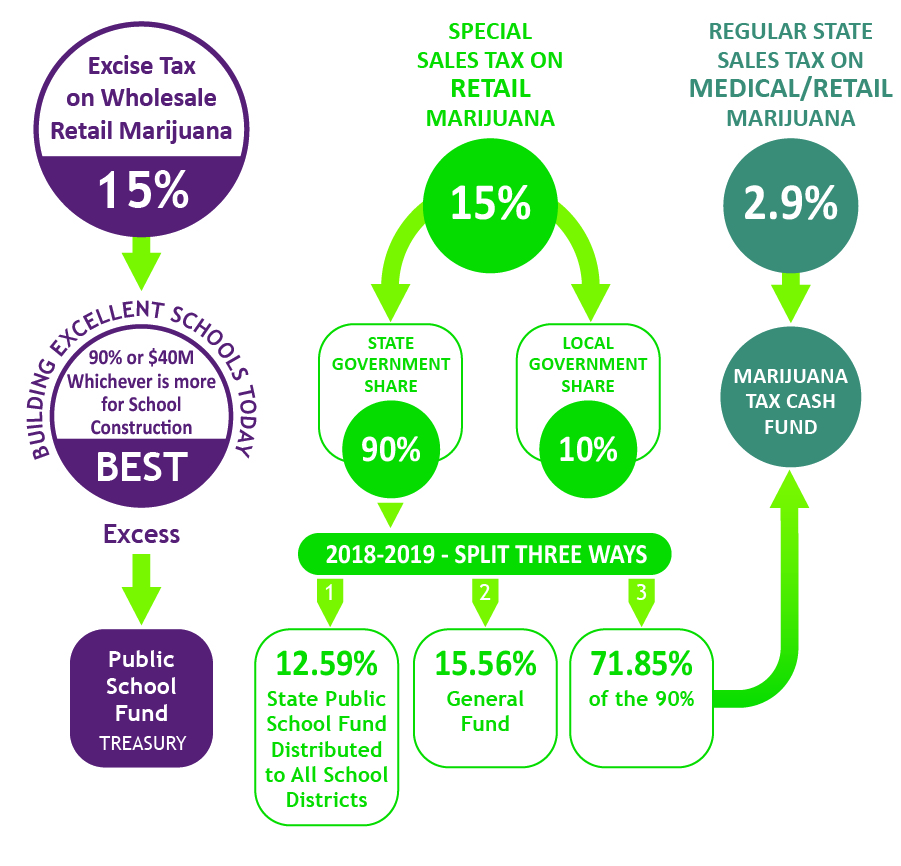

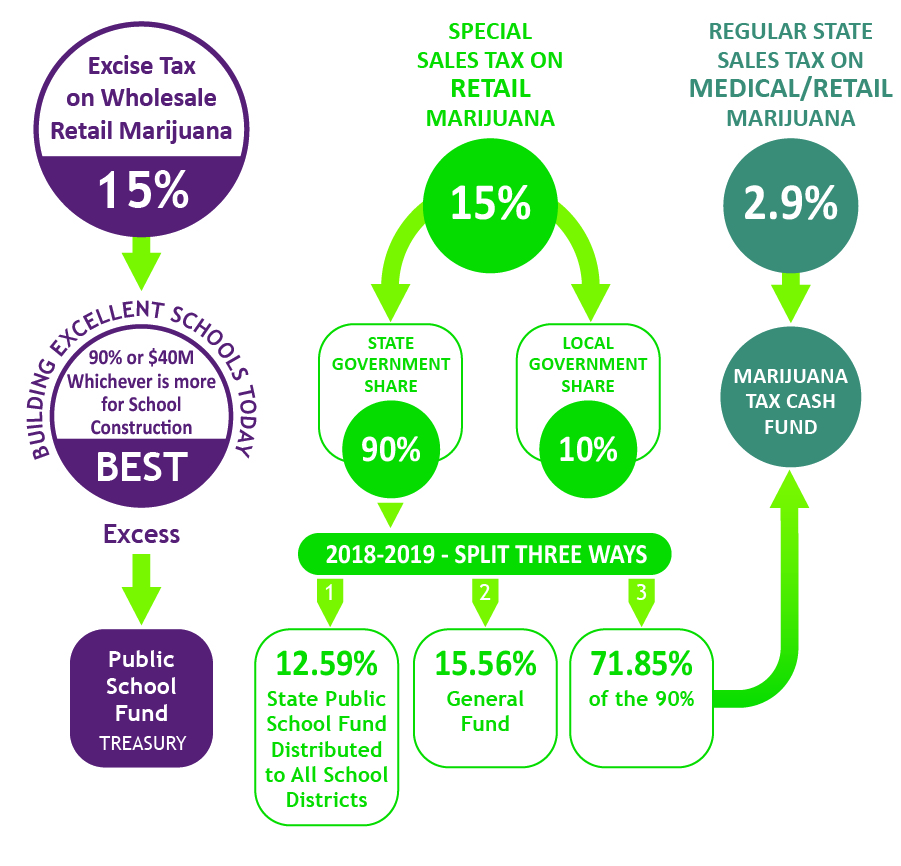

Currently Colorado taxes marijuana in two ways.

Colorado marijuana tax. Retail marijuana sales in Colorado began on January 1 2014 after voters approved Amendment 64 legalizing marijuana in November 2012 55 percent to 45 percent and Proposition AA establishing marijuana taxes in November 2013 65 percent to 35 percent. A complete list of state city county and special district tax rates is available through Revenue Online The rates are also available in the publication Colorado SalesUse Tax Rates DR 1002. Its one of the most frequently asked questions we are asked said Shannon Gray a spokeswoman for the Colorado Department of Revenue.

The excise tax is applied when distributors sell or transfer cannabis to a retail store or manufacturer and costs 15. Fines Suspension and Revocations. Market Size and Demand Studies.

Its imposed like this for retail marijuana. Our assessment of effectiveness looked at how well the audit unit is achieving its objectives and meeting its goals while our assessment of efficiency looked at the extent of resources required by the audit unit to produce marijuana tax audits. Marijuana tax license and fee revenue has reached 102 billion and marijuana sales over 65 billion the Colorado Department of Revenue announced in a news release.

This is no different with legal marijuana in Colorado. An excise tax and a retail sales tax. Marijuana Sales Tax Retail Marijuana Tax Return.

The excise tax is based on the average market rate for Bud Trim Immature Plant Wet Whole Plant Seed Bud Allocated for Extraction and Trim Allocated for Extraction. Retail marijuana business are required to file the Retail Marijuana Sales Tax Return. Additionally all marijuana businesses must file the Colorado Sales Tax Return DR.

Marijuana tax rates in Colorado. The Contract Price is defined as the invoice price charged by a retail marijuana cultivation facility to each unaffiliated retail marijuana businesslicensed purchaser for each sale or transfer of unprocessed retail marijuana exclusive of any tax that is included in the written invoice price and exclusive of any discount or other reduction 3. Colorado Sales Tax Return DR 0100.

When purchasing retail marijuana the purchase is subject to the 29 state sales tax plus any local sales taxes and an additional 15 state marijuana sales tax. This website includes information on how to file state administered sales and excise tax including the state sales. With the excise tax the first 40 million in retail marijuana excise tax revenue collected annually will go to public school.

Retail pot purchasers then must pay a 15 tax when they get to the counter. State Licensing Authority Annual Report. The Marijuana Tax Reports show state tax and fee revenue collected monthly as posted in the Colorado state accounting system.

A 15 percent excise tax is levied on recreational cannabis when it is sold from a cultivation facility to a store of manufacturer. This calculator is a resource for you to learn exactly where your money is going. Like everything you purchase there is a tax.

Retail marijuana is subject to a 15 excise tax on the Average Market Rate AMR or contract price 1 of retail marijuana. Tax revenue comes from the state sales tax 29 on marijuana sold in stores the state retail marijuana sales tax 15 on retail marijuana sold in stores and the state retail marijuana excise tax 15 on wholesale salestransfers of retail marijuana. Sales are subject to a 15 cannabis excise tax and any additional local taxes.

Colorado Department of Regulatory Agencies DORA Sunset Review. The 15 retail marijuana excise tax goes to Colorado public school construction. In 2013 Colorado voters approved Proposition AA which allows the state to levy up to a 15 percent excise tax on unprocessed retail marijuana as well as up to a 15 percent retail sales tax on retail marijuana.

Return and payment are due. The excise tax is remitted by the retail marijuana cultivation facility on the first sale or transfer of retail marijuana to any retail marijuana store or retail marijuana products manufacturer. Marijuana Enforcement Division Licensed Facilities.

The Treasury Divisions audit unit in conducting marijuana tax audits. 1 Medical marijuana is subject to the 29 percent state sales tax which applies to the retail sale of most goods and services. Updates from the Marijuana.

10 state marijuana tax 29 state sales tax and a 15 excise tax PLUS any local sales taxes are applicable. After that the retail tax takes another 15 when any recreational marijuana product is sold. It is a fact of life.

The government has to get its cut.

Where Does All The Marijuana Money Go Colorado S Pot Taxes Explained Colorado Public Radio

Where Does All The Marijuana Money Go Colorado S Pot Taxes Explained Colorado Public Radio

Colorado Made 1b In Marijuana Tax Revenue What Could This Mean For Federal Legalization Wjla

Colorado Made 1b In Marijuana Tax Revenue What Could This Mean For Federal Legalization Wjla

Here S Why It Might Be Time To Update Colorado S Cannabis Tax Colorado Fiscal Institute

Here S Why It Might Be Time To Update Colorado S Cannabis Tax Colorado Fiscal Institute

Marijuana Taxes Lessons From Colorado And Washington Tax Foundation

Marijuana Taxes Lessons From Colorado And Washington Tax Foundation

Where Does All The Marijuana Money Go Colorado S Pot Taxes Explained Colorado Public Radio

Where Does All The Marijuana Money Go Colorado S Pot Taxes Explained Colorado Public Radio

Don T Get Too High On Potential Marijuana Revenues Cbcny

Don T Get Too High On Potential Marijuana Revenues Cbcny

Marijuana Tax Revenue And Education Cde

Marijuana Tax Revenue And Education Cde

Record Marijuana Sales In Colorado Bring New High To Tax Revenue Westword

Record Marijuana Sales In Colorado Bring New High To Tax Revenue Westword

Which States Have The Highest Taxes On Marijuana

Which States Have The Highest Taxes On Marijuana

Colorado Weed Revenue Exceeds 1 Billion Huffpost

Colorado Weed Revenue Exceeds 1 Billion Huffpost

How High Are Recreational Marijuana Taxes In Your State 2019

How High Are Recreational Marijuana Taxes In Your State 2019

Off The Grid You Won T Believe How Much Marijuana Tax Revenue These States Are Getting

Colorado S Gained Over 500 Million In Marijuana Tax Revenue Since 2014 Westword

Colorado S Gained Over 500 Million In Marijuana Tax Revenue Since 2014 Westword

Chart Colorado Hits 1 Billion In Marijuana State Revenue Statista

Comments

Post a Comment