Featured

Are Taxes Included In Mortgage

You can learn more about Escrow accounts here. Were paid in 2016.

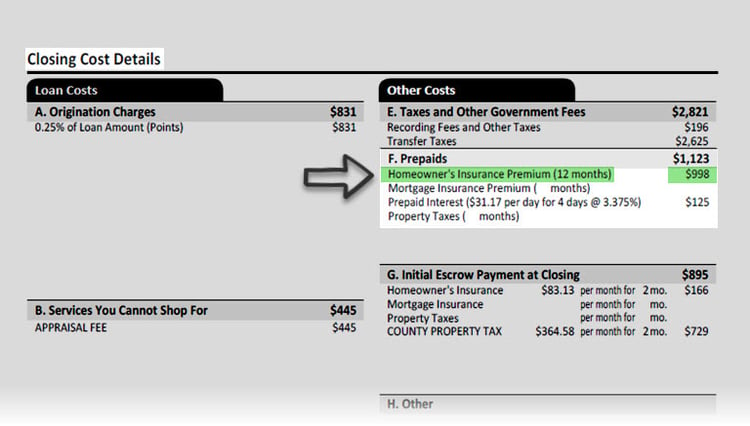

Prepaid Items Mortgage Escrow Account How Much Do They Cost

Prepaid Items Mortgage Escrow Account How Much Do They Cost

Are property taxes listed on 1098.

/property-tax-deduction-3192847_final-ca30dd2f9dcc4ce5b97d8a9e5615b3c7.png)

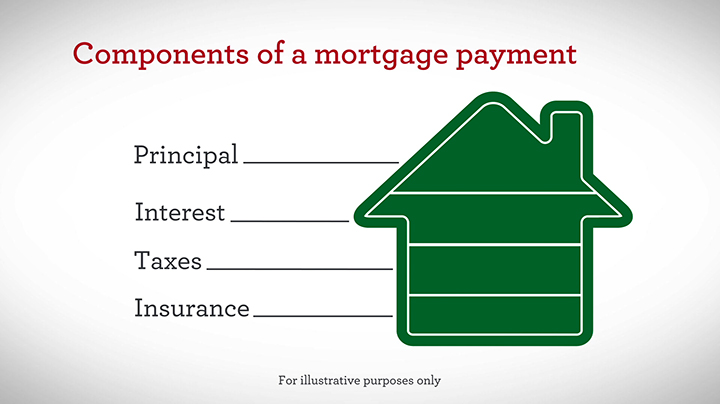

Are taxes included in mortgage. The typical mortgage payment includes principal interest homeowners insurance and property taxes. Lets go back to Jim and Pam. Government user fees are also included in the CPI.

Your monthly payment includes your mortgage payment consisting of principal and interest as well as property taxes and homeowners insurance. The typical mortgage payment includes principal interest homeowners insurance and property taxes. Those monies are often kept in an escrow account which is further defined below.

Fun fact- in Multnomah county tax bills and I think also Clackamas county property tax bills if your taxes are included in your mortgage bill that tax bill document will be printed on YELLOW COLORED PAPER. Taxes that are directly associated with the purchase of specific goods and services such as sales and excise taxes. Yes real estate taxes can be deducted as long as they have been paid.

Here we are talking about property taxes which are owed by you the homeowner. Your mortgage payment is likely to stay the same but your monthly payments can vary. Property taxes vary from state to state and county to county and sometimes city to city.

After thinking carefully they choose the home in the town with the lower tax rate and their mortgage lender estimates theyll owe 1600 in property taxes each year. By incorporating tax payments right into your monthly mortgage payment you wont have to worry about saving to cover your school and property taxes. But HOA fees are NOT included in the mortgage.

Each monthly mortgage payment will include 112 of your annual property tax bill. This is often referred to as PITI Principal Interest Taxes and Insurance and is an important aspect of the breakdown of your monthly mortgage payment. They dont have to be listed on 1098.

Since property taxes and homeowners insurance are included in your mortgage payment theyre counted on your debt-to-income ratio too. If you own your house free and clear you get a tax bill from local officials periodically throughout the year. While your local government charges property taxes every year you can pay them as part of your monthly mortgage payment.

A homeowners monthly mortgage payment commonly includes a twelfth of the years property taxes as well. Paying your property taxes through your mortgage is an investment in your propertys future. Your lender knows this which is why they will often insist that you go this route.

Here we look at what influences taxes and insurance and explain how these factors can change your monthly payment. The mortgage is money you borrow to buy the house not fees to live in it. Home Buyers especially first time home buyers property taxes in mortgage qualification is one of the most important aspects to consider when buying a home.

Every month you pay a portion of your property taxes on top of your monthly mortgage payment and your lender usually saves up those payments in a separate account called an escrow. With Escrow a portion of your monthly mortgage payment is set aside to be used for covering the taxes on your new home. Please be sure to keep your escrow statement for your records as a proof that taxes.

Many lenders prefer to manage the property taxes themselves setting up an escrow account. For example my property taxes where I live is 12000 per year. For example toll charges and parking fees are included in the transportation category and an entry fee to a national park would be included as part of the admissions index.

Sure its not strictly the best way to earn interest or rewards on that money but its one less thing for you to worry about when you take your first steps into homeownership. If you have an existing mortgage your assessed property taxes are split into monthly increments and added to your mortgage payment. As with many things that can be paid through an impound account like property taxes HOA fees can as well.

The amount on your payment letter includes principal and interest but it may also include several other items such as homeowners insurance mortgage insurance and property taxes.

Mortgage Payments Explained Principal Escrow Taxes More

Mortgage Payments Explained Principal Escrow Taxes More

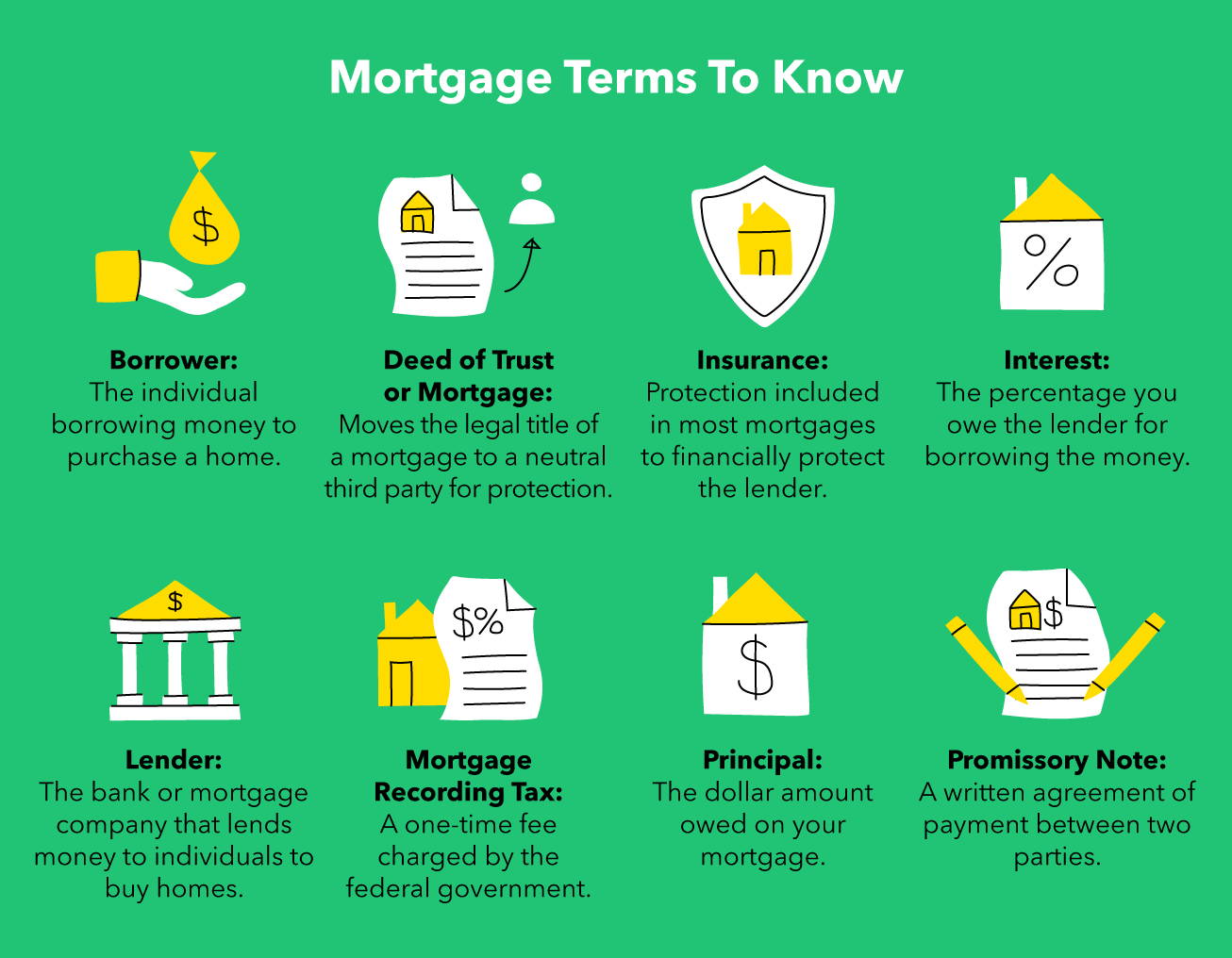

Questions And Answers About Mortgages

Questions And Answers About Mortgages

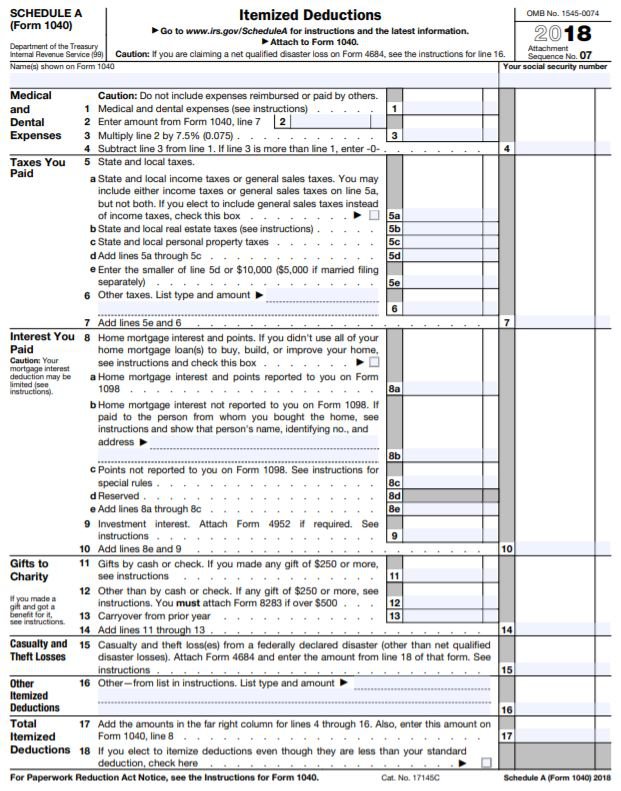

Are Property Taxes Deductible Guide Millionacres

Are Property Taxes Deductible Guide Millionacres

Questions And Answers About Mortgages

Questions And Answers About Mortgages

What Is A Mortgage Mintlife Blog

What Is A Mortgage Mintlife Blog

7 Questions Answered About Getting A Dutch Mortgage In 2021 Dutchreview

7 Questions Answered About Getting A Dutch Mortgage In 2021 Dutchreview

Mortgage The Components Of A Mortgage Payment Wells Fargo

Mortgage The Components Of A Mortgage Payment Wells Fargo

Understanding Mortgage Closing Costs Lendingtree

Understanding Mortgage Closing Costs Lendingtree

/property-tax-deduction-3192847_final-ca30dd2f9dcc4ce5b97d8a9e5615b3c7.png) The Rules For Claiming A Property Tax Deduction

The Rules For Claiming A Property Tax Deduction

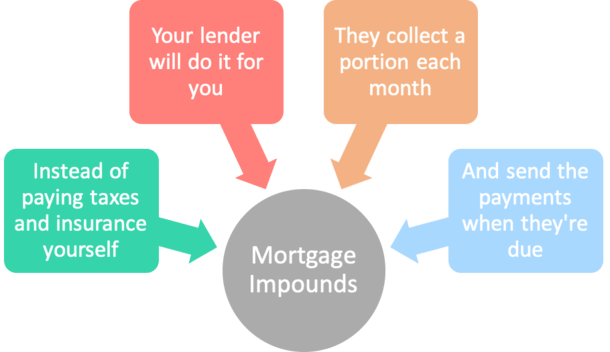

Mortgage Impounds Vs Paying Taxes And Insurance Yourself The Truth About Mortgage

Mortgage Impounds Vs Paying Taxes And Insurance Yourself The Truth About Mortgage

What S In A Mortgage Breaking Down The Components Of A Mortgage Payment Red Rhino Realty

Comments

Post a Comment