Featured

What Is The Nyc Income Tax Rate

New York State Tax. There are no city-specific deductions but some tax credits specifically offset the New York City income tax.

Nyc S High Income Tax Habit Empire Center For Public Policy

Nyc S High Income Tax Habit Empire Center For Public Policy

The total bill would be about 6800 about 14 of your taxable income even though youre in the 22 bracket.

What is the nyc income tax rate. New Yorks income tax rates were last changed one year ago for tax year 2019 and the tax brackets were previously changed in 2016. Single or married filing separately. TurboTax Has Simple Step-By-Step Instructions To Help Along The Way.

9 Zeilen New York State Tax Quick Facts. New Yorks income tax rate for annual earnings above 1 million will rise to 965 from its current 882 under the latest deal. AND NYS taxable income is 65000 or MORE.

The tax rate youll pay depends on your income level and filing status and its based on your New York State taxable income. New York City income tax rates. What are the personal income tax rates for New York City.

OR Total Capital base 15 of business and investment capital allocated to New York City for. NYS adjusted gross income is MORE than 107650. What are the personal income tax rates for New York City.

Part-year NYC resident tax. Married filing jointly or qualified widower 3078. Use the NYS tax computation.

General Corporation Tax Rates General Corporation Tax is computed by four different methods and is imposed at whichever method produces the largest amount of tax. From Simple To Complex Taxes Filing With TurboTax Is Easy. The city income tax rates vary from year to year.

New York has eight marginal tax brackets ranging from 4 the lowest New York tax bracket to 882 the highest New York tax bracket. That 14 is called your effective tax rate. The top tax rate is one of the highest in the country though only individual taxpayers whose taxable income exceeds 1077550 pay that rate.

New Yorks income tax rates range from 4 to 882. TurboTax Has Simple Step-By-Step Instructions To Help Along The Way. Prior to the Tax Cuts and Jobs Act of 2017 the tax rate was 35.

For heads of household the threshold is 1616450 and for married people filing jointly it is 2155350. 9 Zeilen The New York income tax has eight tax brackets with a maximum marginal income tax of. New York City or Yonkers Tax.

AND NYS taxable income is LESS than 65000. 8 Zeilen New York state income tax rate table for the 2020 - 2021 filing season has eight income. Anzeige You Can Do It.

Entire net income base 885 of net income allocated to New York City. NYS adjusted gross income is 107650 or LESS. Anzeige You Can Do It.

From Simple To Complex Taxes Filing With TurboTax Is Easy. It will also create new tax brackets for income above 5 million. NYS tax rate schedule.

Federal corporate tax rate Currently the federal corporate tax rate is set at 21. On the other hand state tax rates vary by state.

Exploring Ny S Top Heavy Pit Base Empire Center For Public Policy

Exploring Ny S Top Heavy Pit Base Empire Center For Public Policy

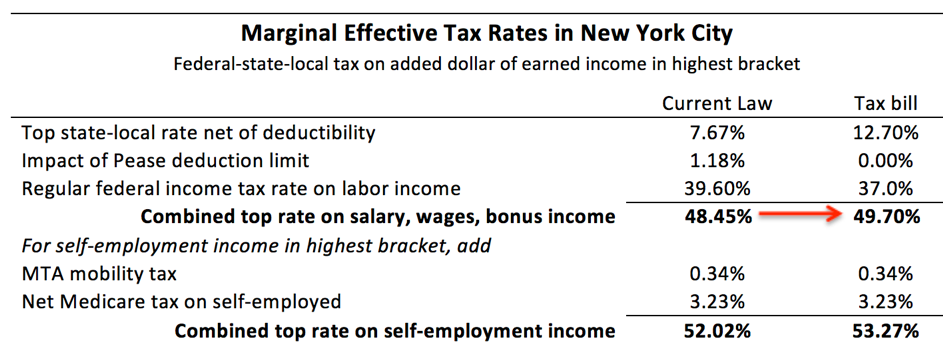

New York Taxes Layers Of Liability Cbcny

New York Taxes Layers Of Liability Cbcny

Do States Like New York And California Really Have High Taxes Quora

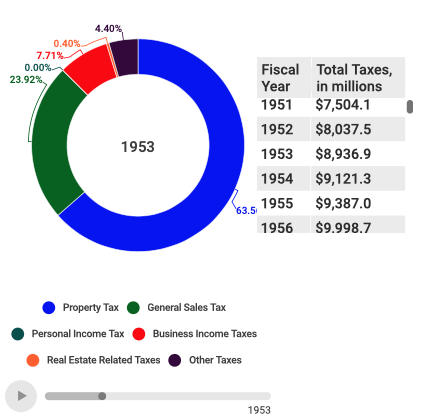

See The Evolution Of Local Tax Revenues In New York City Next City

See The Evolution Of Local Tax Revenues In New York City Next City

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

Covid 19 S Toll On The Local Economy A Preliminary Estimate Of Job Losses Tax Revenue Declines

Covid 19 S Toll On The Local Economy A Preliminary Estimate Of Job Losses Tax Revenue Declines

Albany Boosts Taxes On Wealthiest Wsj

Albany Boosts Taxes On Wealthiest Wsj

Immigrants In New York Their Legal Status Incomes And Taxes

Average Income In New York City What Salary Puts You In The Top 50 Top 10 And Top 1 Sportofmoney Com

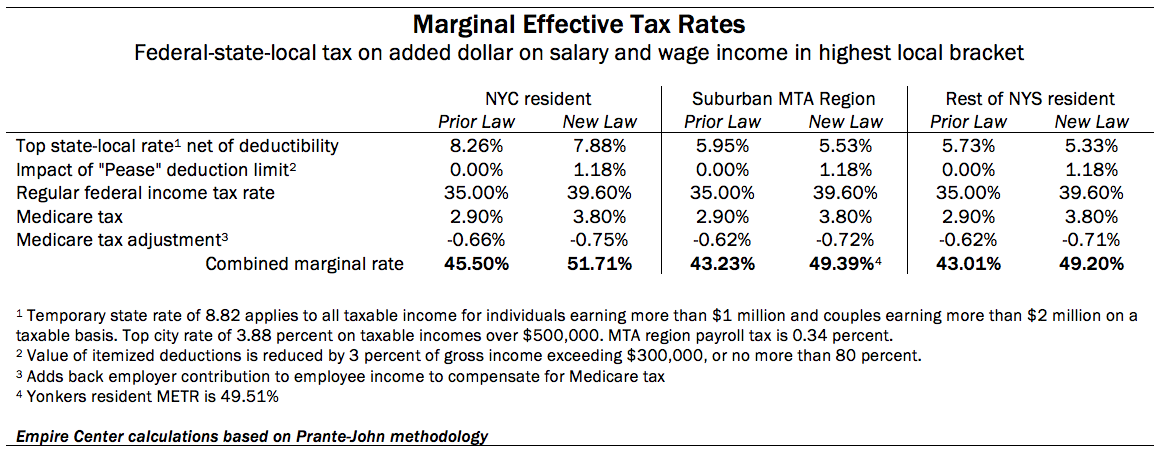

Feds Raise The Tax Bar Higher For Ny Empire Center For Public Policy

Feds Raise The Tax Bar Higher For Ny Empire Center For Public Policy

Average Income In New York City What Salary Puts You In The Top 50 Top 10 And Top 1 Sportofmoney Com

Testimony Fy2020 New York State Budget Taxes Empire Center For Public Policy

Testimony Fy2020 New York State Budget Taxes Empire Center For Public Policy

Https Www Empirecenter Org Wp Content Uploads 2018 04 Rdb Pit Ejm April 2018 Update Pdf

Effective Top Marginal Income Tax Rates For 2013

Effective Top Marginal Income Tax Rates For 2013

Comments

Post a Comment