Featured

Check Irs Tax Filing Status

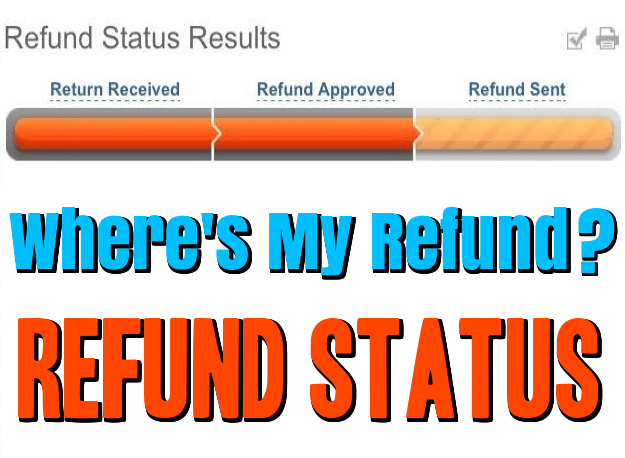

Using the IRS Wheres My Refund tool Calling the IRS at 1-800-829-1040 Wait times to speak to a representative may be long Viewing your IRS account information Looking for. The IRS receives the tax return then approves the refund and sends the refund.

Faqs On Tax Returns And The Coronavirus

Faqs On Tax Returns And The Coronavirus

Wheres My Refund is updated no more than once every 24 hours usually overnight so theres no need to check the status more often.

Check irs tax filing status. This app allows you to track the status of your refund using a smartphone or tablet. This status can last anywhere from a few hours to a few days. If more than one filing status applies to you this interview will choose the one that will result in the lowest amount of tax.

It has been 21 days or more since the tax return was e-filed. Your filing status is used to determine your filing requirements standard deduction eligibility for certain credits and your correct tax. Your tax return acceptance notice will be on the first page on the right.

21 days or more since you e-filed Wheres My Refund tells you to contact the IRS. You may check the status of your expected tax refund by calling the IRS Refund Hotline at 800-829-1954. Report and Verify Your Taxes.

You should only call if it has been. Log into myTax Portal. Enter your tax ID number filing status and expected refund amount.

The IRS offers two ways to check the status of your refund. Do not file a second tax return. If you file in early January before the IRS begins accepting returns your e-file status can remain pending for a few weeks.

Legally separated from their spouse under a divorce or separate maintenance decree. If no errors are found the IRS will Approve the federal tax refund and then Issue the federal tax refund. 1-800-829-1040 Monday through Friday from 700 am.

Taxpayers can start checking on the status of their return within 24 hours after the IRS received their e-filed return or four weeks after they mail a paper return. IRS Free File or e-file get your tax record and view your account. Expect delays if you mailed a paper return or had to respond to an IRS inquiry about your e-filed return.

Can I check the filing status on httpssawww4irsgovirfoflangenirfofgetstatusjsp. This means its on its way to the IRS but they havent acknowledged receiving it yet. Visit the Wheres My Refund page at IRSgov to track your refund online.

To check the status of your refund online. Enter your Social Security number or ITIN select your filing status and then type your exact refund amount as shown on your tax return. How do I check the status of my tax refund.

I tried but the Refund Amount box only. If you have further questions about the status of your return you can also call the IRS Tax Assistance Hotline. You can use the IRS Wheres My Refund tool to check the status of your tax refund.

Taxpayers should only call the IRS tax help hotline on the status of their tax refund if. This automated system will provide your refund status if you supply your Social Security number filing status and refund amount due. Browse to the IRS Website then click Check My Refund Status.

Download IRS2Go a free mobile app from IRSgov. Find filing information for you and your family. Only after your tax return is accepted by.

Select View Filing Status. The IRS checks its database and displays your returns current status and tells when to anticipate a. Marital status and spouses year of death if applicable.

It has been six weeks or more since the return was mailed. I file the federal tax return and owe some money to IRS. Once you prepare and submit your return your e-file status is pending.

Check whether IRAS has received your tax return. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. 4-2 Filing Status Generally taxpayers are considered to be unmarried for the entire year if on the last day of the tax year they were.

Includes a tracker that displays progress through three stages. Check your Tax REFUND Status.

How To File Federal Income Taxes For A Deceased Taxpayer

How To File Federal Income Taxes For A Deceased Taxpayer

/Balance_Tax_Refund_Status_Online_1290006_V1-a947aed0306642faac9f0e1029d9ef6c.png) Trace Your Tax Refund Status Online With Irs Gov

Trace Your Tax Refund Status Online With Irs Gov

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

Irs Kicks Off 2020 Tax Filing Season With Returns Due April 15 Help Available On Irs Gov For Fastest Service Eagle Pass Business Journal

Irs Kicks Off 2020 Tax Filing Season With Returns Due April 15 Help Available On Irs Gov For Fastest Service Eagle Pass Business Journal

How To Check The Status Of Your Tax Return Get Transcripts Tfx User Guide

How To Check The Status Of Your Tax Return Get Transcripts Tfx User Guide

Check Status Of Your Federal And State Tax Refund

Check Status Of Your Federal And State Tax Refund

Will Ordering An Irs Tax Transcript Help Me Find Out When I Ll Get My Refund Or Stimulus Check Aving To Invest

Will Ordering An Irs Tax Transcript Help Me Find Out When I Ll Get My Refund Or Stimulus Check Aving To Invest

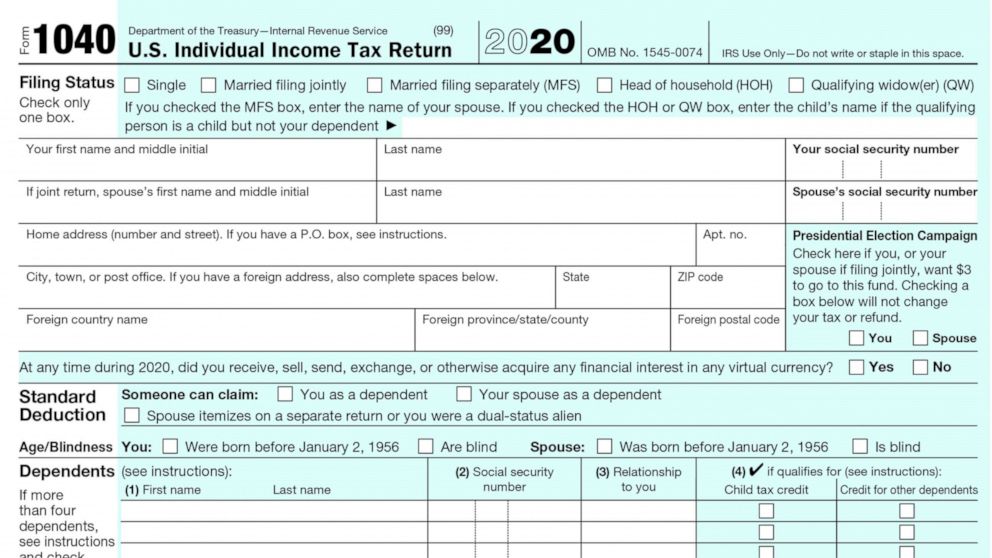

Irs Delays Tax Filing Deadline To May 17 Because Of Covid Related Changes Abc News

Irs Delays Tax Filing Deadline To May 17 Because Of Covid Related Changes Abc News

2021 Irs Tax Refund Schedule Direct Deposit Dates 2020 Tax Year

2021 Irs Tax Refund Schedule Direct Deposit Dates 2020 Tax Year

Your Irs Tax Return Filing Status Important For Your Taxes

Your Irs Tax Return Filing Status Important For Your Taxes

Where Is My Tax Refund How To Check The Status After Filing Your Return Cnn

Where Is My Tax Refund How To Check The Status After Filing Your Return Cnn

Irs Tax Refund Schedule 2021 Direct Deposit Dates 2020 Tax Year

Irs Tax Refund Schedule 2021 Direct Deposit Dates 2020 Tax Year

Stimulus Check Update When Will Plus Up Covid Payments Arrive

Stimulus Check Update When Will Plus Up Covid Payments Arrive

Comments

Post a Comment