Featured

Venmo Card Benefits

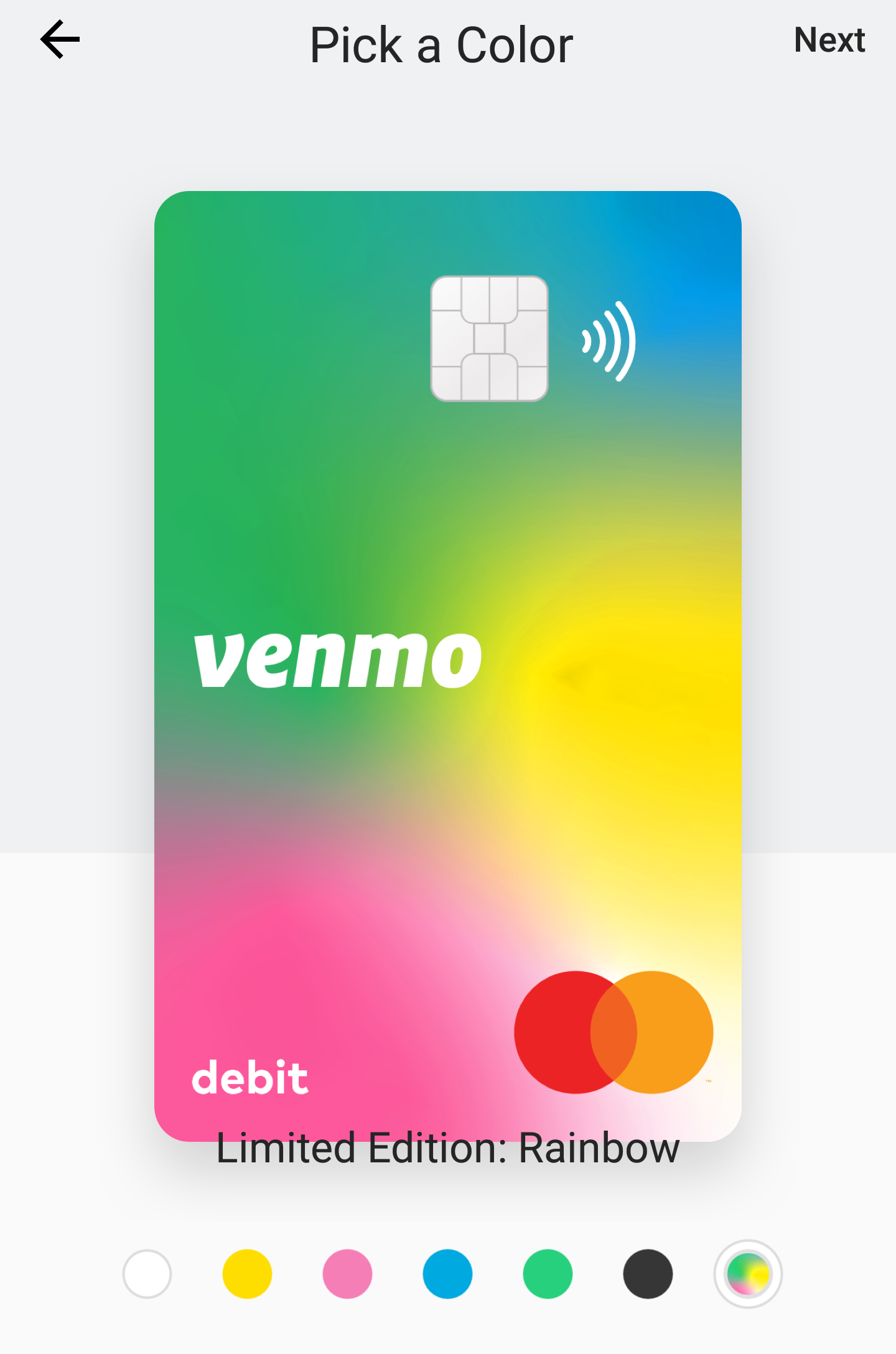

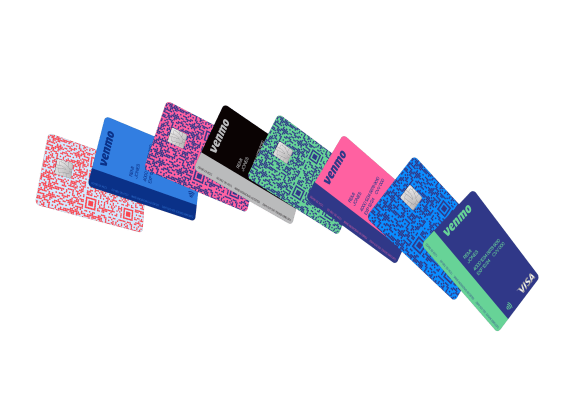

The Venmo Mastercard Debit Card is a debit card that operates on the Mastercard network. Cash-Back Rewards Get Personal and Automated The card offers 3 and 2 bonus categories that can change automatically each month depending on where you spend the most.

Venmo Mastercard Debit Card Venmo

Venmo Mastercard Debit Card Venmo

What do I do if I have unauthorized activity on my Venmo Credit Card.

Venmo card benefits. The Visa card provides 3 cash return on eligible acquisitions individualized benefits and tools to trace and manage funds. Today the company that is payPal-owned making good on those claims because of the first for the Venmo charge card initially rolling away to pick. The Venmo card does offer bonus cash back categories but after the first year the 3 and 2 categories are capped once you hit a combined 10000 in spending then the earning rate drops.

How can I get the Venmo Debit Card. For many existing Venmo customers there is the familiarity and intuitiveness of a platform that is already readily used. Nonetheless why is.

This happens to ensure that you have funds available for the purchase. The Venmo Credit Card is currently available only to select Venmo customers using the latest version of the Venmo app. Venmo Credit Card Review.

What are the benefits and rewards for the Venmo Credit Card. The category in which you spend the most each month will qualify for 3 cash back. 2 Social Media Like Interface.

For more information about using your Venmo balance click here. Venmo is a digital wallet that makes money easier for everyone from students to small businesses. With the Venmo Credit Card you can easily split purchases with friends on Venmo in the Venmo app earn cash back rewards on your eligible purchases and pay your bill using the money in your Venmo account.

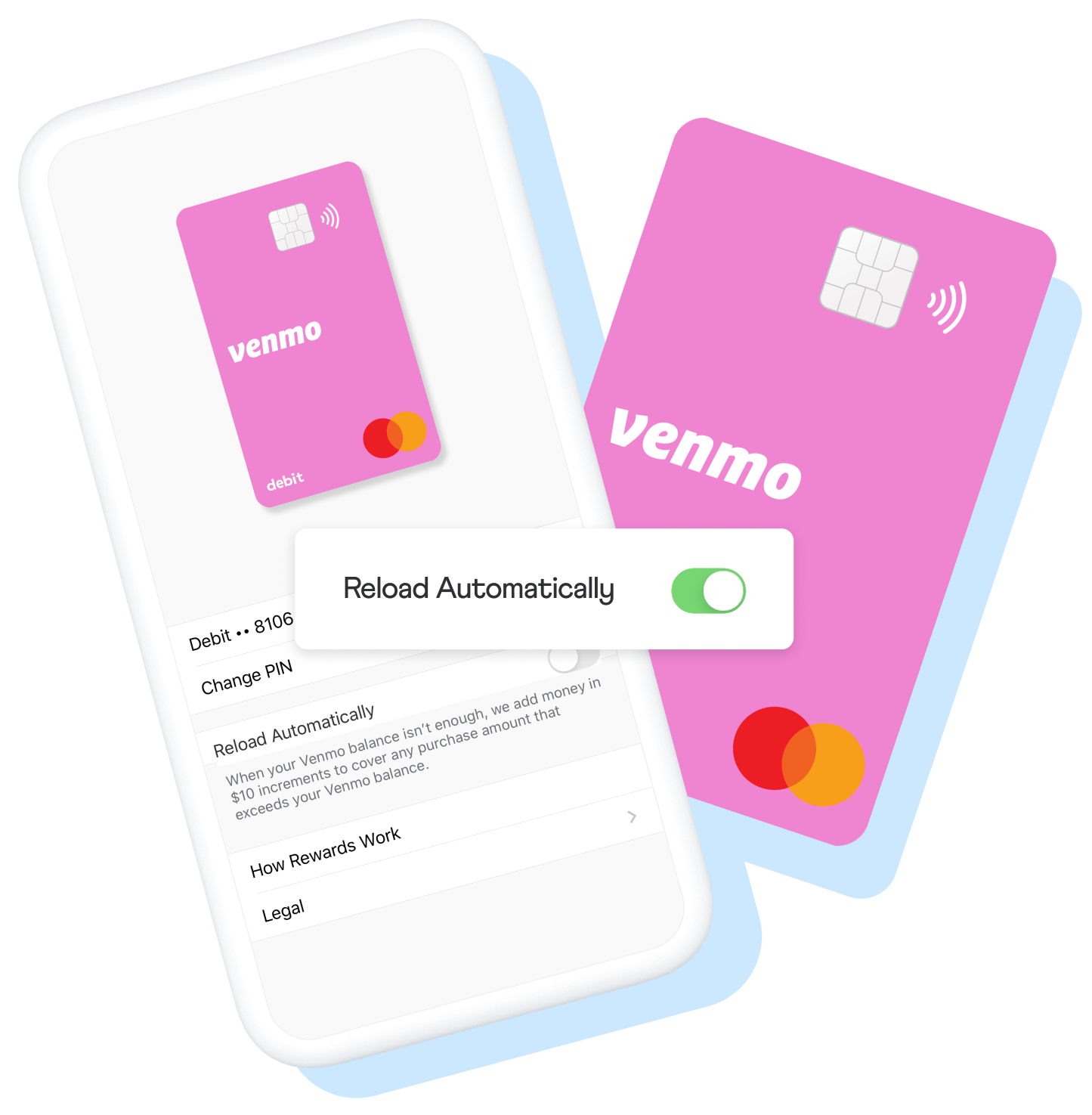

All you have to do is spend with the card and Venmo will automatically sort your purchases by product category. I used my Venmo Debit Card at a gas station and now I have a pending charge thats much larger than I expected. Venmo Debit Card goes where you go and brings your Venmo balance along.

This is a delight for all of its users. More than 60 million people use the Venmo. Final October Venmo announced it could introduce its very first bank card sometime in 2020.

Youll be able to use this card to earn better rewards rates from categories that other cards might not offer. Better yet theres no annual fee for the Venmo Credit Card. Here we will look into some of the Pros and Cons of VENMO.

Though similar cards require users to activate cash back deals on their debit card Venmo automatically applies offers to your account. Pay and earn cashback from some of your favorite stores right to your Venmo account. What is the Venmo Debit Card.

You will earn cashback rewards when you pay with the Venmo card at select merchants including Sams Club. There are two sides to every product the benefits and the loop-holes. While credit cards reap massive benefits not everyone can use or likes using credit cards.

Additionally this card is great for earning rewards on your purchases as well. Just know that youll only earn 3 and 2 back on up to 10000 in purchases. Through Dosh youll earn rewards.

The latter is the case with the Venmo card. Get the Most Out of Your Venmo Credit Card. Youll automatically earn maximum benefits on the categories where you spend the most.

Whatever your opinion might be Venmo is a great option to maintain your funds while also redeeming some cash back along the way. With the Venmo Credit Card you can easily split purchases with friends on Venmo in the Venmo app earn cash back rewards on your purchases and pay your bill using the money in your Venmo account. With its ease of use and powerful safety features the Venmo card is a great option for anyone to keep in their wallet.

Venmo launches its very first bank card providing up to 3 money back customized benefits Final October Venmo announced it could introduce its very first bank card sometime in 2020. It offers 3 cash rewards in. When you sign up for a Venmo Credit Card youll be able to benefit from their app and their personalized rewards structure.

It is linked to your Venmo account and allows you to spend your Venmo balance funds everywhere Mastercard is accepted in the US. While the exact amount varies by gas. Venmo card holders earn Venmo Rewards in form of cash back through a partnership with Dosh a card-linked cash back app similar to Rakuten Ibotta and Swagbucks.

When you purchase fuel at the pump your card will be authorized when you first swipe it for an amount thats higher than the actual amount of gas you will likely purchase. Venmo Credit Card Benefits. The fee structure is free of almost all transactions through a bank account or debit card.

If youre in the market for a cash-back card the Venmo Credit Card is worth a closer look. A PROS 1 Low-cost Fee Structure. Today the company that is payPal-owned making good on those claims because of the first for the Venmo charge card initially rolling away to pick clients.

What are the benefits of a Venmo card.

Venmo Card What It Is How To Use It And Whether It S Worth It

Venmo Card What It Is How To Use It And Whether It S Worth It

Venmo Card Now Offers Cash Back Rewards Pymnts Com

Venmo Card Now Offers Cash Back Rewards Pymnts Com

The Venmo Card Is It Right For You Bankrate

The Venmo Card Is It Right For You Bankrate

Venmo Officially Launches Its Own Mastercard Branded Debit Card Techcrunch

Venmo Officially Launches Its Own Mastercard Branded Debit Card Techcrunch

Venmo Officially Launches Its Own Mastercard Branded Debit Card Techcrunch

Venmo Officially Launches Its Own Mastercard Branded Debit Card Techcrunch

The Easiest 15 Ever Should You Open The New Venmo Card Points With A Crew

The Easiest 15 Ever Should You Open The New Venmo Card Points With A Crew

Introducing The Venmo Credit Card The Venmo Blog

Introducing The Venmo Credit Card The Venmo Blog

Venmo Credit Card 2021 Review Forbes Advisor

Venmo Credit Card 2021 Review Forbes Advisor

Venmo Mastercard Debit Card Venmo

Venmo Mastercard Debit Card Venmo

Venmo Launches Its First Credit Card Offering Up To 3 Cash Back Personalized Rewards Techcrunch

Venmo Launches Its First Credit Card Offering Up To 3 Cash Back Personalized Rewards Techcrunch

Now You Can Earn Rewards With Venmo The Venmo Blog

Venmo Mastercard Debit Card Venmo

Venmo Mastercard Debit Card Venmo

Here S How To Get The Venmo Card So You Can Pay For Dinner Without Your Phone

Here S How To Get The Venmo Card So You Can Pay For Dinner Without Your Phone

Comments

Post a Comment