Featured

How To Get Copies Of Old Tax Returns

If you would like a paper copy of your tax return and any attachment to that return from the Department you must complete Form IL-4506 Request for Copy of Tax Return. The fee per copy is 50.

How To Access Old Tax Returns 9 Steps With Pictures Wikihow

How To Access Old Tax Returns 9 Steps With Pictures Wikihow

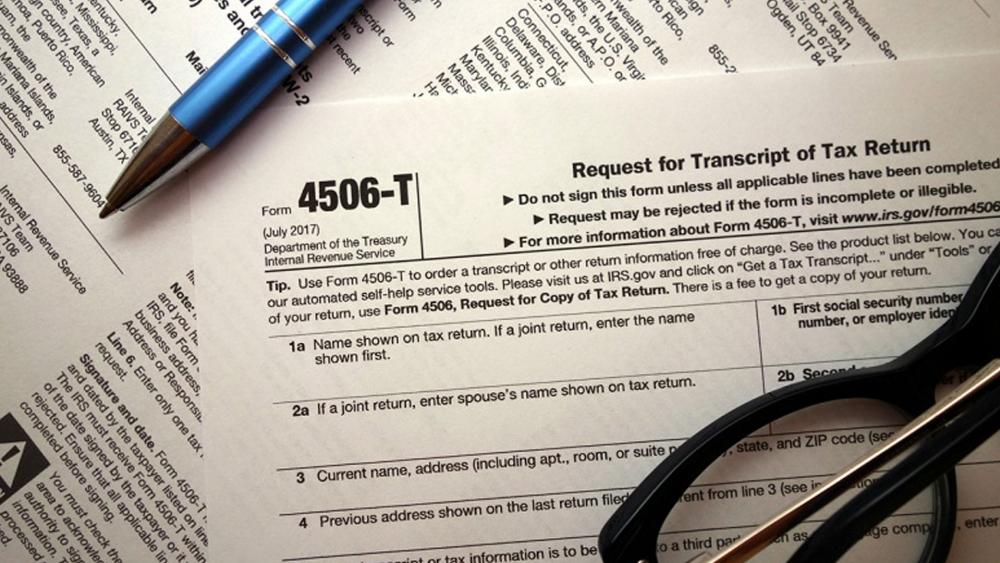

IRS Form 4506 - httpswwwirsgovpubirs-pdff4506pdf.

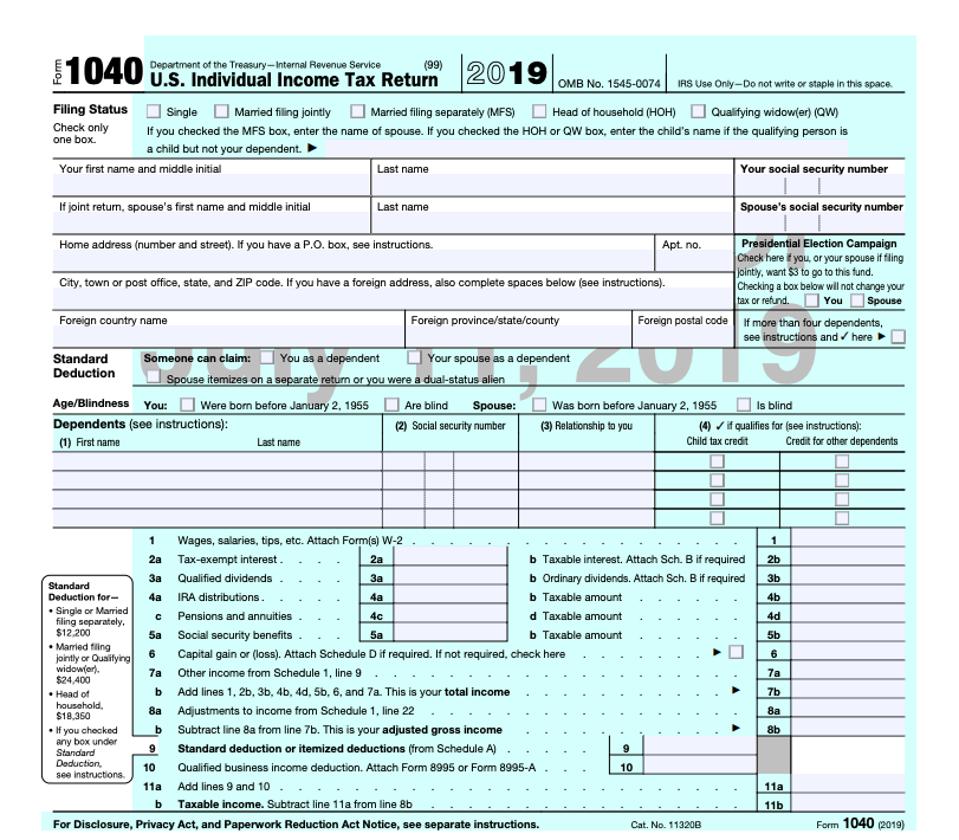

How to get copies of old tax returns. You can order a copy of a federal tax return using Form 4506. An authorized representative must provide a Form M-5008-R that covers the return s being requested. The fastest way to get a Tax Return or Account transcript is through the Get Transcript tool available.

Those who need an actual copy of a tax return can get one for the current tax year and as far back as six years. To get a copy of your HR Block online prior-year return sign in to your account with the same username and password used to originally create the account. People who live in a federally declared disaster area can get a free copy.

To request copies of e-filed or paper returns for tax years 1990 and forward complete and mail Form DTF-505 Authorization for Release of Photocopies of Tax Returns andor Tax Information. You can request an exact copy of a past tax return by using IRS Tax Form 4506 Request for Copy of Tax Return. There is a fee for each return requested.

If you are requesting more than eight years or periods you must attach another Form 599. To order your tax return transcript by mail. Taxpayers can call 800-908-9946 to request a transcript by phone.

Click here to submit a request for copies. Those who need an actual copy of a tax return can get one for the current tax year and as far back as six years. Request for Copy of Income Tax Return 10.

Get your tax transcript online or by mail. People can use Get Transcript Online to view print or download a copy of all transcript types. The simplest and fastest way to get a copy of your tax return transcript is online through the IRS Get Transcript application.

Mail the request to the appropriate IRS office listed on the form. Request copies of filed tax returns and Forms W-2 and 1099 by using our mobile friendly online application. Several transcript types available.

Copies of Forms 1040 1040A and 1040EZ are generally available for 7 years from filing before they are destroyed by law. Orders placed online and by phone are usually delivered within. We will send a photocopy of the return if available.

Transcripts requested by phone. We will only release the tax return to the person s who signed the return or to an authorized representative. Enter the tax year or the ending date of the year or period.

Then just access the Prior years link in the Taxes section. A copy of the Death Certificate The name of the surviving spouse will need to be matched to a Joint E-filed Return in our system A court order issuing Power of Attorney for the deceased and IRS form 56. If you are the taxpayer or a person with a Power of Attorney POA for a taxpayer then you may request taxpayer-specific records for example copies of tax returns or an audit file by emailing the request and if you are not the taxpayer then also a copy of the Power of Attorney to the email address below.

Here are the three ways to get transcripts. Heres how to get a transcript. Mail the request to the appropriate IRS office listed on the form.

Make sure your full payment of 50 per copy is included with your request. Complete and mail Form 4506 to request a copy of a tax return. Note that you can only order 1 type of tax return per request form which means you must submit separate Forms 4506 if you need different types of returns.

Please check the box that corresponds to the number of years or periods you are requesting. The fee per copy is 50. If you do not have access to a computer or are unable to use the online application you can request copies by calling Customer Service at.

There is a 50 fee for each tax return requested. They must verify their identity using the. Complete and mail Form 4506 to request a copy of a tax return.

Youll then see all the years of tax returns available in your account. You also can get a copy of your NJ-1040 NJ-1040NR or NJ-1041 at a Division of Taxation Regional Information Center. You can also order by phone at 800-908-9946 and follow the prompts.

Returns filed before 1990 are not available. If there is no View button on the period you need you must request a paper copy. Find line by line tax information including prior-year adjusted gross income AGI and IRA contributions tax account transactions or get a non-filing letter.

How To Access Old Tax Returns 9 Steps With Pictures Wikihow

How To Access Old Tax Returns 9 Steps With Pictures Wikihow

Irs Delays The Start Of The 2021 Tax Season To Feb 12 The Washington Post

Irs Delays The Start Of The 2021 Tax Season To Feb 12 The Washington Post

3 Ways To Get Copies Of Old W 2 Forms Wikihow

3 Ways To Get Copies Of Old W 2 Forms Wikihow

:max_bytes(150000):strip_icc()/tax_forms-56b810e45f9b5829f83d9167.jpg) How To Get Copies Of Your Past Income Tax Returns

How To Get Copies Of Your Past Income Tax Returns

Tax Return Transcripts How To Get Copies Of Your Old Tax Returns From The Internal Revenue Service Cbn News

Tax Return Transcripts How To Get Copies Of Your Old Tax Returns From The Internal Revenue Service Cbn News

Get Copy Of My 2015 Tax Return Tax Walls

Get Copy Of My 2015 Tax Return Tax Walls

How To Get A Copy Of Past Tax Returns For Free Online Irs Com

How To Get A Copy Of Past Tax Returns For Free Online Irs Com

How To Access Old Tax Returns 9 Steps With Pictures Wikihow

How To Access Old Tax Returns 9 Steps With Pictures Wikihow

How To Get An Irs Transcript Or Tax Return Copy Nerdwallet

How To Get An Irs Transcript Or Tax Return Copy Nerdwallet

Remember How The Irs 1040 Form Was Going To Be On A Postcard Here S Why It Didn T Happen

3 Ways To Get Copies Of Old W 2 Forms Wikihow

3 Ways To Get Copies Of Old W 2 Forms Wikihow

Everything Old Is New Again As Irs Releases Form 1040 Draft

Everything Old Is New Again As Irs Releases Form 1040 Draft

How Long To Keep Tax Records Plus How To Organize Old Tax Returns In Your Home Filing System

How Long To Keep Tax Records Plus How To Organize Old Tax Returns In Your Home Filing System

Comments

Post a Comment