Featured

Ebay Tax Documents

Im eligible tor EITC credit and my effective tax rat is something like -30. The percentage that you are taxed depends on your total income.

Set Of 2 Thailand Official Documents Covers Revenue Tax Stamps Early 1900s Ebay

Set Of 2 Thailand Official Documents Covers Revenue Tax Stamps Early 1900s Ebay

Learn more about the changes - opens in new window or tab.

Ebay tax documents. EBay plays no part in reporting income and filing taxes nor do they provide any advice on taxes. Otherwise there is a 2 floor for expenses. Theyre supplying an online marketplace and sellers provide no services or work for eBay so the company has no obligation to assist sellers with their tax filings.

Therefore you will see applicable sales tax collected by eBay and included in your order total at checkout. Form 1099-K is an IRS information return that includes the gross amount of all payment transactions you received within a calendar year. If you and the IRS classify your eBay sales as a hobby youll have to report the income on Form 1040.

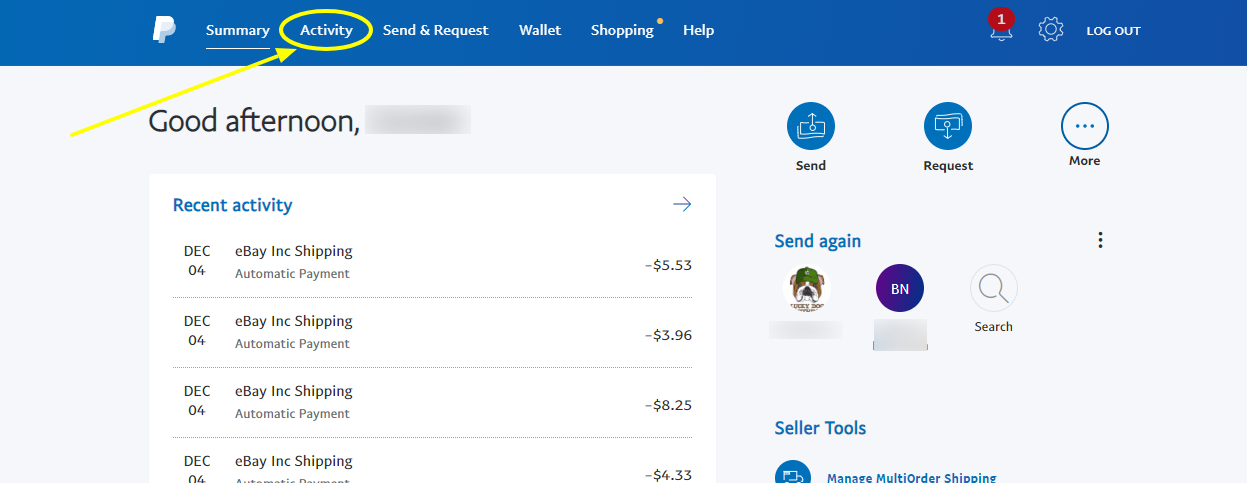

Ebay Tax Reporting. Its one of the top road blocks that actually keeps people from getting started in this flipping business. This will include the eBay income from your 1099 form and the expenses that your business had in the last tax year.

Benefits of Reporting eBay as a Business. However you should consult a tax advisor or contact the Department of Revenue for. When Do I File My eBay 1099 Taxes.

To report these tax deductions you will need to fill out a 1040 Schedule C Profit or Loss From Business Form. Lastly complete the electronic signature process. Hobby sales must be reported.

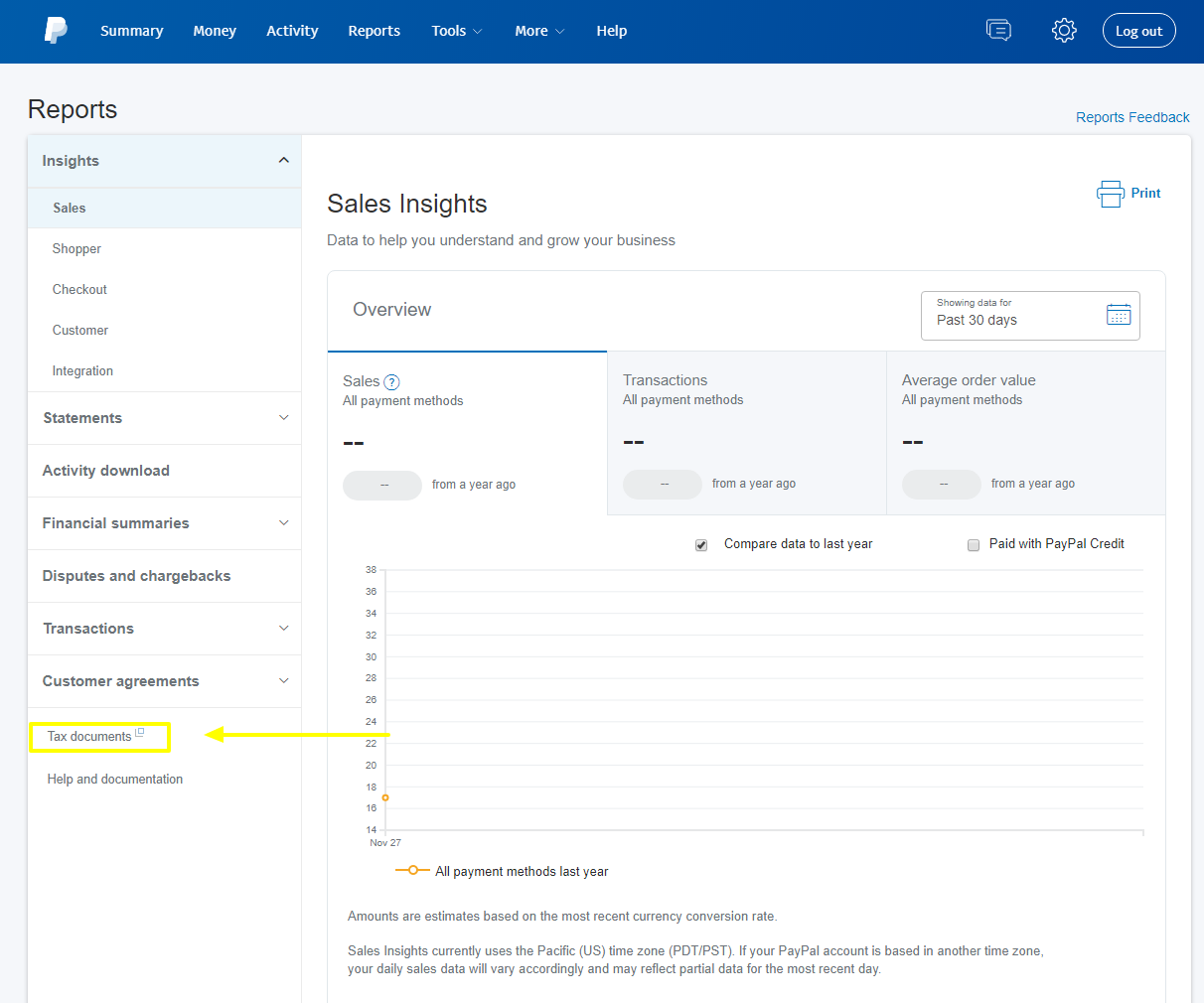

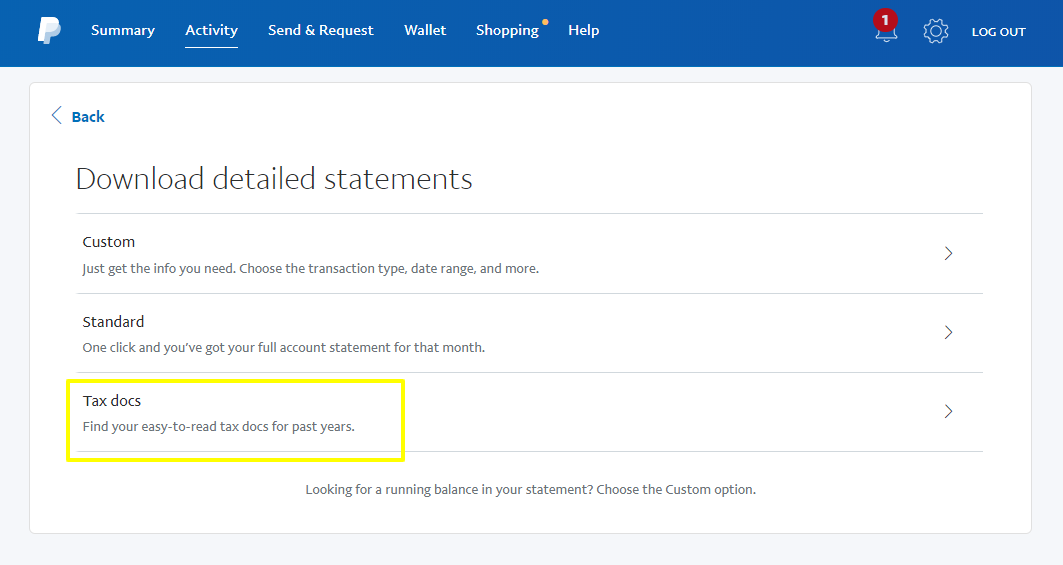

Doing taxes as a small business can be a very daunting task when starting out. Then select Tax Documents and the document that applies to you a W9 W8-BEN or W8-BEN-E. EBay does provide a nice new accounting spreadsheet in the seller hub.

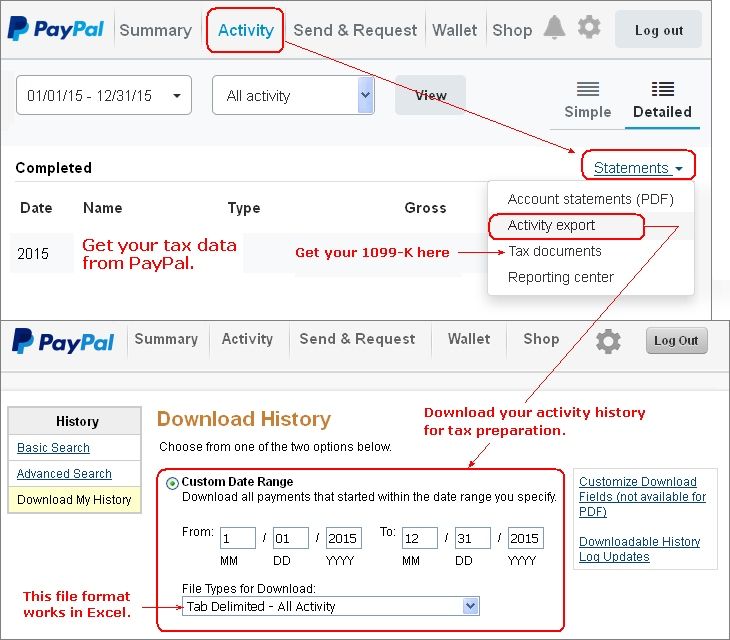

Refunds to a Buyer. If you are to receive a 1099 from your Ebay sales you will find it in your Paypal account. While you report your income to the IRS they do not pass this information onto your state the State filing is based on your gross income after expenses which is why it is important to document your expenses concerning your business as it greatly impact what you pay to in Federal Income Tax and what you pay as State Income Tax.

EBay and Form 1099-K If youre a managed payments seller you may receive a Form 1099-K from eBay depending on the totals of your sales and transactions. If you are buying items and reselling for profit you are essentially running an eBay business rather than being considered a hobby seller. If youve sold at least 20000 in gross merchandise value and exceeded 200 transactions for goods and services on eBay this year you will be receiving a tax Form 1099-K for all your 2019 sales transactions including relevant internet sales tax.

Because shipping and payment are left to the individual users eBay is not accountable for activities outside its. What Resellers Need To Know Taxes. EBay Does Not Help You File Your Taxes.

According to eBays tax policy sellers are responsible for any taxes from the sales they make on eBay. As of January 1 2019 eBay is required to calculate collect and remit sales tax on behalf of sellers for items shipped to customers. Alternatively you may be able to get a credit for sales tax paid to eBay directly from your state.

I use my eBay sales to supplement my Social Security. While you dont need to register a business formally if youd like to be able to deduct your expenses to reduce your taxable obligation you should consider setting up an S-corporation a limited liability company or establishing a sole proprietorship. As an online platform that facilitates transactions eBay does not actively take part in the sales process and does not have the full record of a sale or shipment.

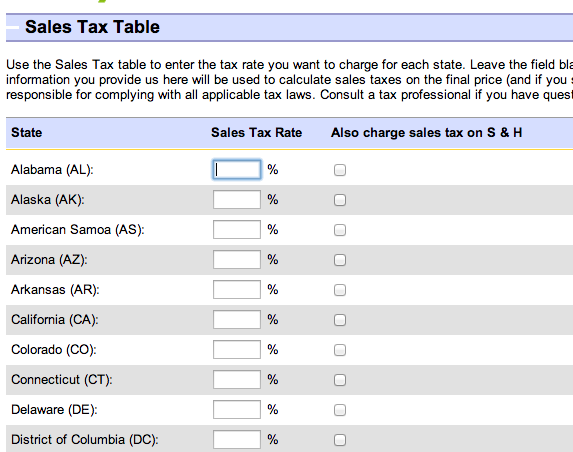

For tax years prior to 2018 you report your expenses are an itemize deduction on Schedule A. To find out if PayPal is issuing you a Form 1099-K you can log onto your PayPal account click History and then click Tax Documents. EBay and PayPal have changed the way taxes are collected and remitted.

EBays Buyer Exemption program for sales tax. You can open just half of them since each invoice includes the previous months total at the top. To get your total eBay fees you need to open your eBay invoices in My eBay Account tab Summary.

When you sell on eBay youre responsible for complying with all applicable tax laws. You can upload these documents by logging in to the portal and navigating to Balance in the upper right-hand corner. Here is a list of deductions for independent contractors.

This law is in effect now in your state as one of the marketplace responsibility states within the US. In fact you may find that if you have a full time job and sell part. Unlike some other third party processors like Amazon and Uber eBay does not provide its users with tax forms like the 1099-K.

Beginning in 2018 you are no longer eligible to take a deduction. Anyway youd file a Schedule C with your regular 1040. This is to help you comply with your tax obligations.

If you are a tax-exempt buyer we have a buyer exemption system that allows you to submit sales tax exemption certificates to eBay and make purchases without paying sales tax. Nobody loves the topic ok some people do - Im not one of those people but taxes are important to anyone who wants to earn an income. The report is a CSV download that contains all of the same selling details as have historically been available on PayPal although it appears to cover only 90 day.

EBay does not send out tax documents except to sellers in their Managed Payments program who exceed both 20000 gross and 200 transactions during the year. If youre selling to buyers outside the US you should inform them about the potential import charges theyll need to pay when they receive their item.

How To Collect Sales Tax On Ebay The Right Way Taxjar Blog

How To Collect Sales Tax On Ebay The Right Way Taxjar Blog

The Sales Tax Table Scam The Ebay Community

The Sales Tax Table Scam The Ebay Community

Collateral Inheritance Tax Document Goshen New York 1893 Original Document Ebay

Collateral Inheritance Tax Document Goshen New York 1893 Original Document Ebay

How To Collect Sales Tax On Ebay The Right Way Taxjar Blog

How To Collect Sales Tax On Ebay The Right Way Taxjar Blog

The Sales Tax Table Scam The Ebay Community

The Sales Tax Table Scam The Ebay Community

How Can Sellers Access Their Tax Forms Through Ebay Quora

Ebay Tax Filing 101 For Ebay Sellers

Comments

Post a Comment